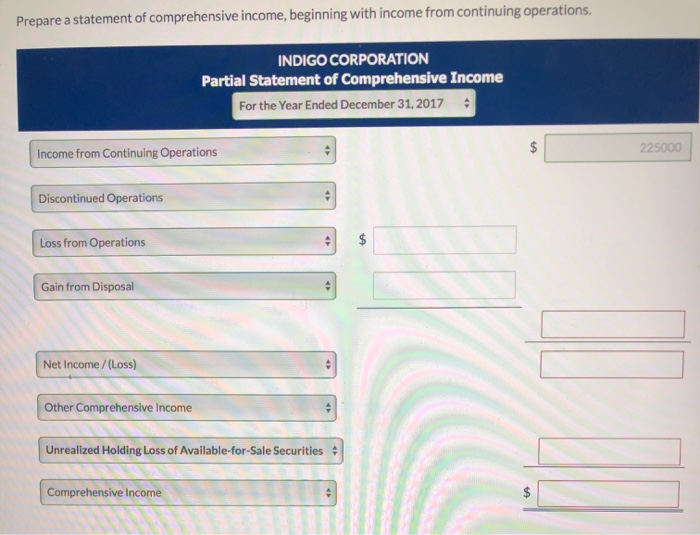

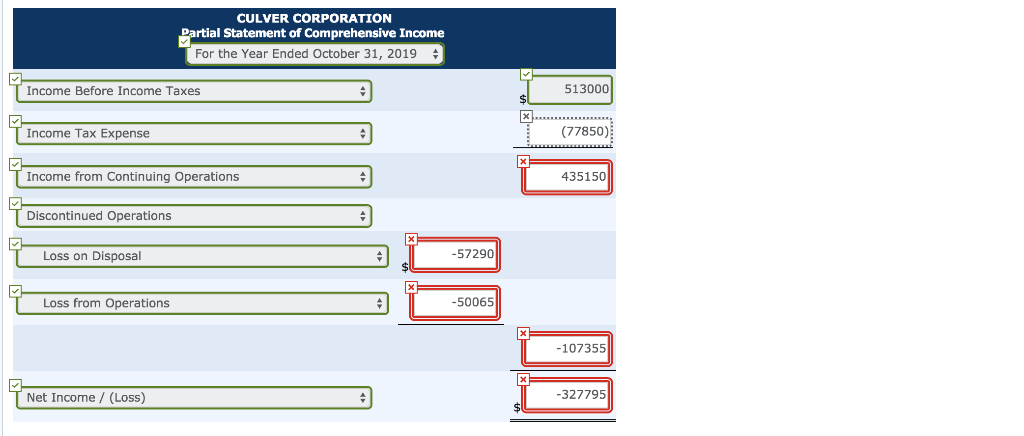

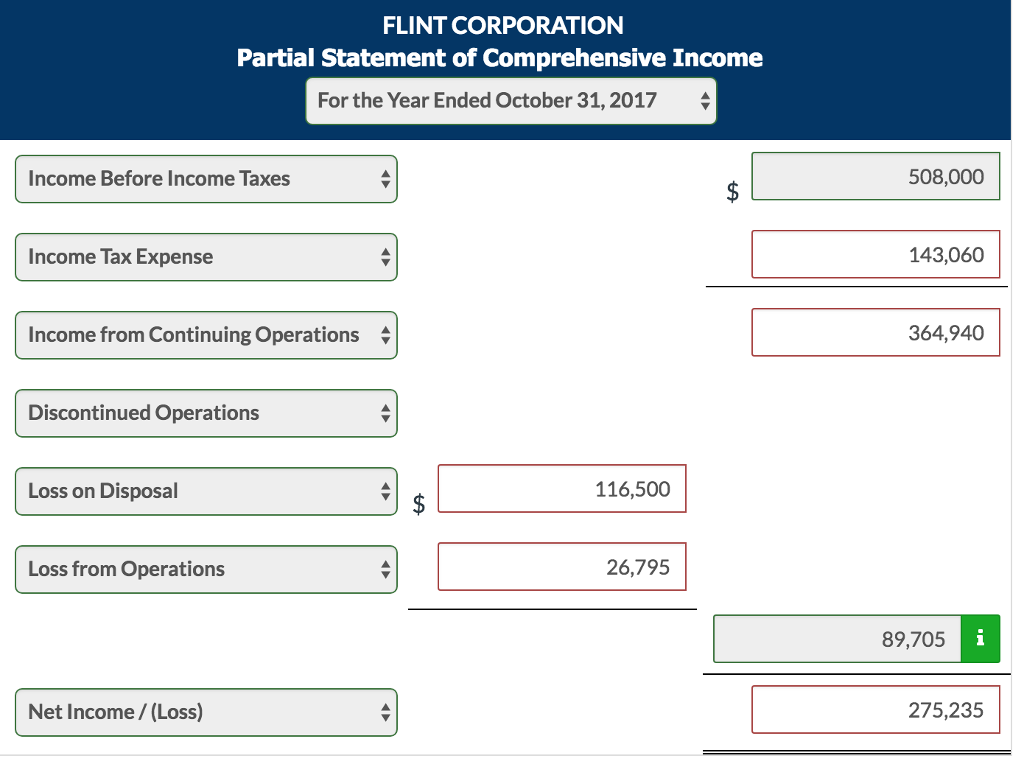

Partial Statement Of Comprehensive Income

But don t depend solely on it.

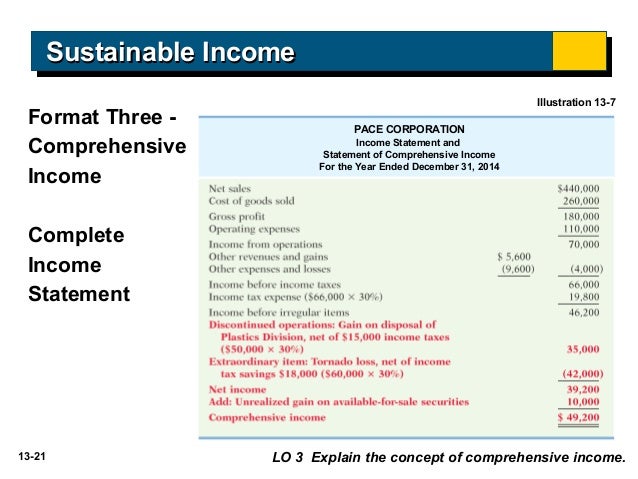

Partial statement of comprehensive income. Normally we prepare an income statement for a single month or for a year. However a partial income. A statement of comprehensive income that begins with profit or loss bottom line of the income statement and displays the items of other comprehensive income for the reporting period ias 1 p 81 so the statement of comprehensive income aggregates income statement profit and loss statement and other comprehensive income which isn t. Revenue 7600000 cost of goods sold 3700000 operating expenses 2100000 interest expense 1100000 income tax expense 700000 other comprehensive income fair value loss on fvtoci investments 30000 what is the times interest earned.

Although the income statement is a go to document for assessing the financial health of a company it falls short in a few aspects. Limitations of a statement of comprehensive income. The income statement encompasses both the current revenues resulting from sales and the accounts receivables which the firm is yet to be paid. A statement of comprehensive income is the overall income statement that consolidates standard income statement which gives details about the repetitive operations of the company and other comprehensive income which gives details about the non operational transactions such as the sale of assets patents etc.

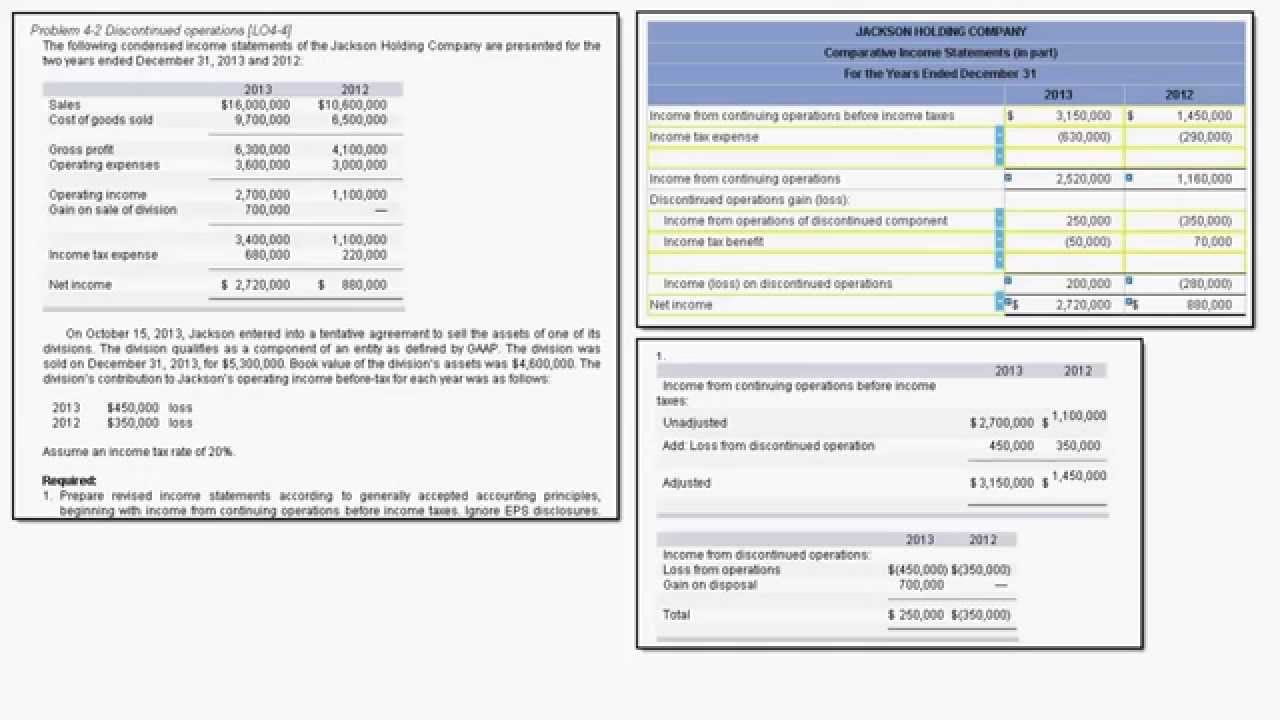

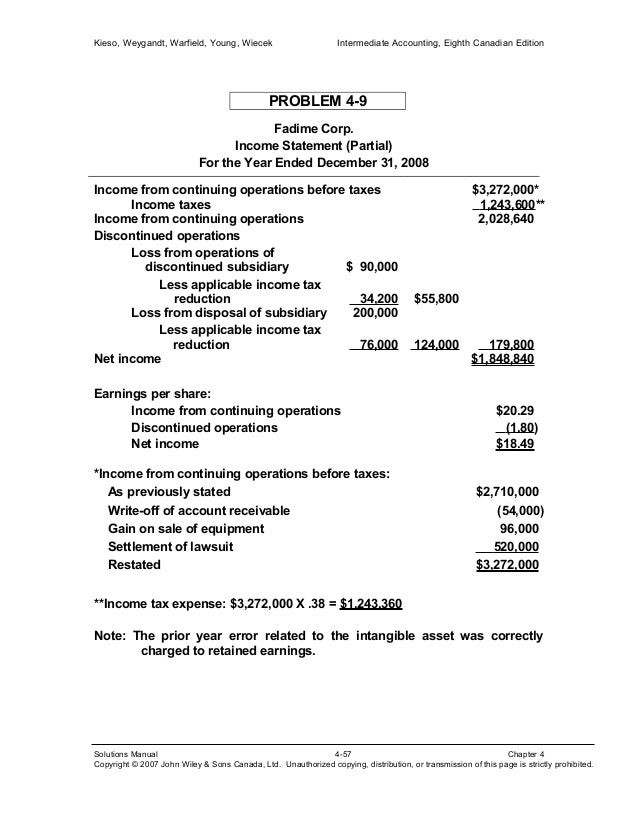

The partial statement of comprehensive income for an entity is as follows. Partial statement of comprehensive income for the year ended december 31 2014 income from continuing operations 12 600 000 discontinued operations loss from operation of discontinued restaurant division net of tax 315 000 loss from disposal of restaurant division net of tax 89 000 404 000 net income 12 196 000 other comprehensive income items that may be reclassified subsequently to net.