Pension Liabilities Income Statement

Have a significant portion of their balance sheet and income statement tied to and influenced by the volatility of pension liabilities and assets.

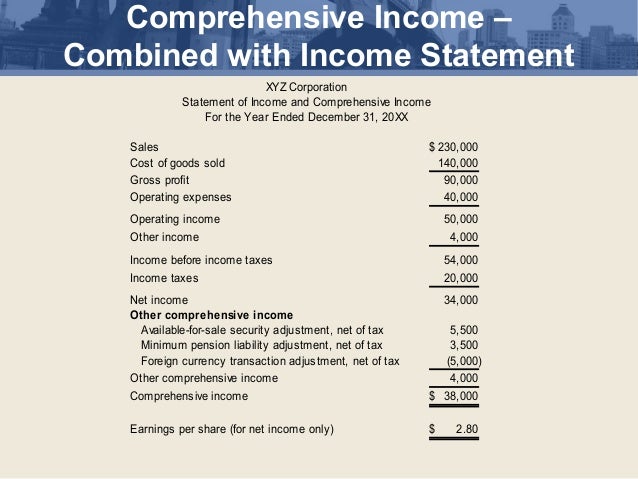

Pension liabilities income statement. Components of pension expense. With ifrs 1 pension liabilities have become a bigger topic as now pension liabilities are on balance sheet and changes are recorded in the comprehensive income statement. Obligation increases matching expense on the income statement. The current service cost is fully and immediately recognized for the accounting period.

The difference between assets in a pension fund and the amount of benefits the fund is required to pay out are considered unfunded pension liabilities. Value the net asset or liability position of the pension plan on a fair value basis. Cost of benefits earned during year called normal cost plus interest expense on pension liability minus expected return on plan assets plus minus amortization of deferred gains losses. Accounting for the long term nature of these liabilities has always been complex.

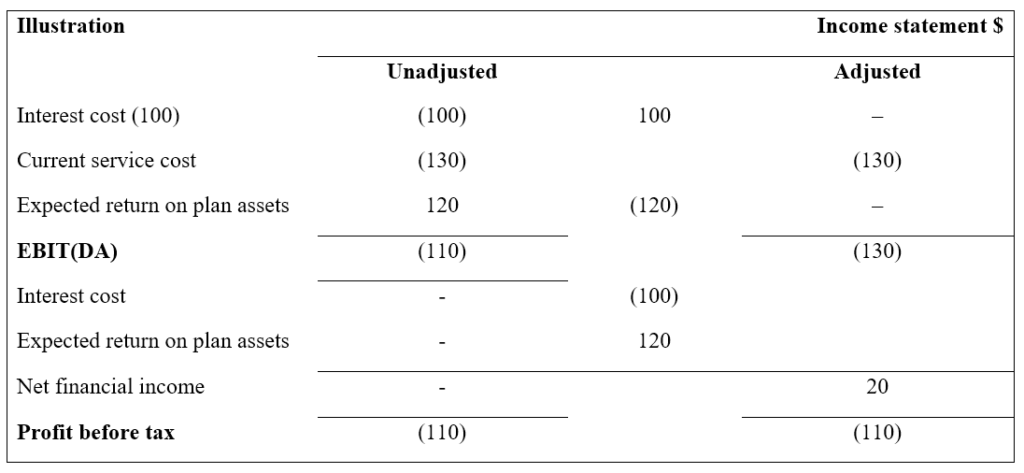

Users of financial statements often found it difficult to interpret operating results. Consolidated income statement and consolidated statement of comprehensive income. Fair value of plan assets 64 7 68 3 65 4. Treated as actuarial gain or loss.

For example if a pension fund has 1 million in funds and owes benefits of 1 5 million then the 500 000 of benefits that it cannot pay would be considered an unfunded pension liability. Pension expense income is booked on the income statement usually in cogs. Pension expense increase in the dbo pbo during the accounting period. A pension liability is the difference between the total amount due and the actual amount of money the company has on hand to make those payments.

Present value of funded obligation. Pension asset falls and pension liability falls by the same amount. What it s not is the total amount that gets paid. Consolidated statement of financial position.

Changes in actuarial assumptions. Defined benefit pension liabilities in the balance sheet. Obligation increases matching expense on the income statement. Pension expense is an expected value and when the actual value of the pension differs those deviations are recorded through other comprehensive income oci under ifrs.

Current service cost amount by which a company s defined benefit obligation increases as a result of employee service during the accounting period.

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)