Per Capita Income Vs Revenue

The census takes the total income for.

Per capita income vs revenue. Investment uses of per capita income. Average household incomes need not map directly to measures of an individual s earnings such as per capita income as numbers. The method of charging tax on different types of receipt is different. To smooth the year by year fluctuations of the per countries.

It includes every form of income e g salaries and wages retirement income near cash government transfers like food stamps and investment gains. If per capita income is the same agencies that provide aid or financial assistance to those in country x because members of country x would be financially worse off. The average income per capita is the total income for the area divided by the number of people. The premium on letting out shops or houses.

A higher per capita income represents higher purchasing power as members of the community have more money to spend. The income arises from non recurring transactions by certain or a certain event is called capital income. The united states census bureau takes a survey of income per capita every ten years and revises its estimates every september. Income tax act 1961 provides a separate head capital gains for levying tax on capital receipts.

Dollars has as well as per capita income differ significantly from the. The following are the main differences between capital income and revenue income with examples. Capital losses vs revenue losses. Revenue is the total amount of income generated by the sale of goods or services while income is earnings or profit revenue minus expenses.

Household income is a measure of the combined incomes of all people sharing a particular household or place of residence. A few extremely wealthy people in one area can raise the average and that would make it seem like people have it better than they really do. Income tax is levied on income of assessee and not an every receipt which he receives. Top marginal income tax rates selected countries 1979 1990 2002 total tax revenue gdp vs government effectiveness total tax revenue gdp vs state effectiveness.

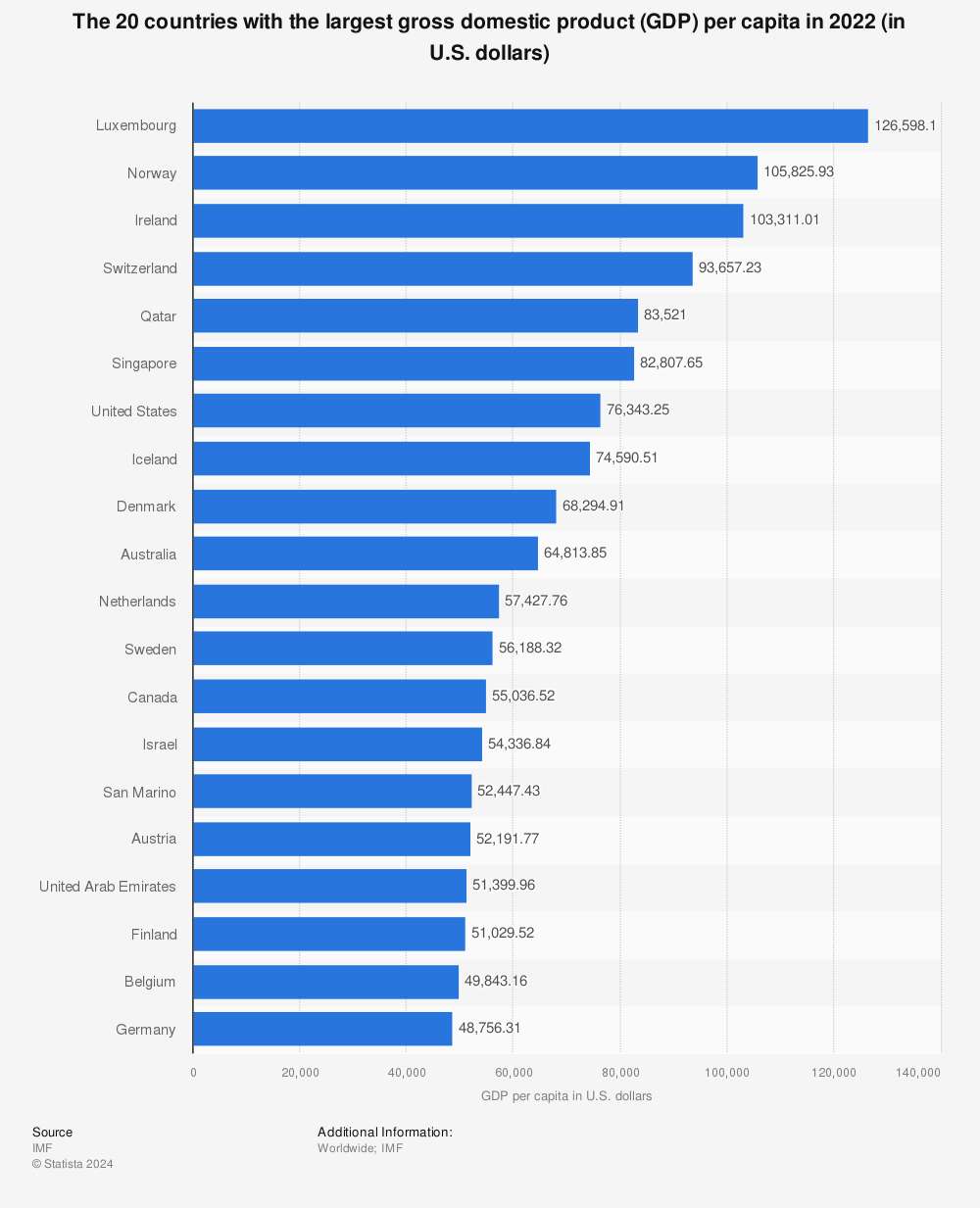

Per capita income in the u s. Price received on investments in small saving schemes.