Presentation Of Interest Expense In Income Statement

Income statement for the year ended december 31 2011 000s sales 11 892 cost of goods sold 9 905 gross profit 1 987 research development 225 selling expense 520 general administrative expense 490 total operating expense 1 235 operating profit 752 interest income 114 interest expense 10 other income 25 pretax income 881 income taxes 352.

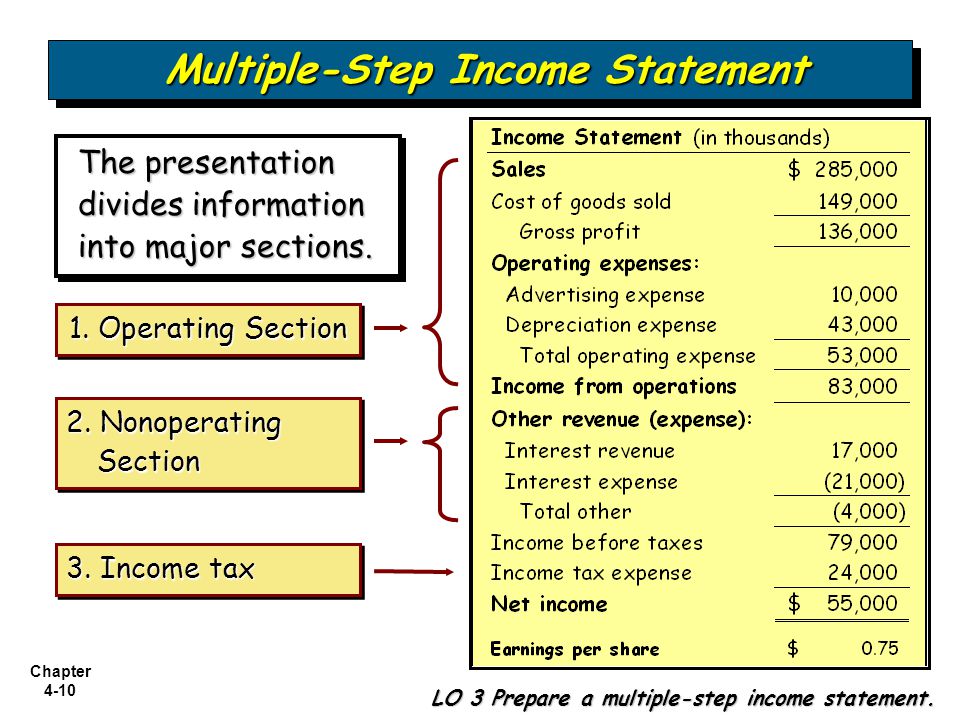

Presentation of interest expense in income statement. As a result of this analysis the staff recommended the following presentation in the statement of comprehensive income. Cost of goods sold 7 600. The expense paid on the loans and bonds is an expense out through the income statement. Net refers to the fact that management has simply subtracted interest income from interest expense to come up with one figure.

The standard requires a complete set of financial statements to comprise a statement of financial position a statement of profit or loss and other comprehensive income a statement of changes in equity and a statement of cash flows. Ias 1 was reissued in september 2007 and applies to annual periods beginning on or after 1 january 2009. Interest expense represents an amount of interest payable on any borrowings which includes loans bonds or other lines of credit and its associated costs are shown on the income statement. Interest expense 1 150.

The following income statement items appeared on the adjusted trial balance of schembri manufacturing corporation for the year ended december 31 2013 in 000s. General and administrative expenses 940. Interest expense is one of the core expenses found in the income statement income statement the income statement is one of a company s core financial statements that shows their profit and loss over a period of time. This applies accordingly to interest resulting from a negative interest rate on a financial liability which must not be presented as a negative part of interest expense i e a reduction.

Presented on the face of the income statement when such presentation is relevant to an understanding of the company s financial performance. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of. These expenses highlight interest accrued during the period and not the interest amount paid over the time period. Interest expense 126 060 income before income tax 231 423 income tax 66 934 net income for the year 164 489 attributable to.

Under the indirect method we take the profit or loss before tax and interest paid and then we subtract the amount of interest paid during the year.