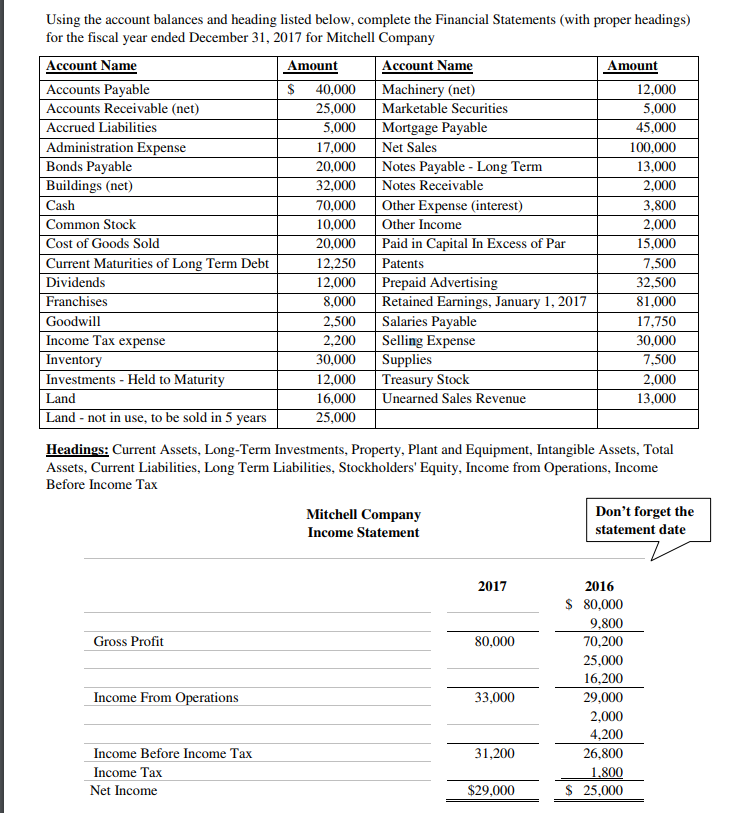

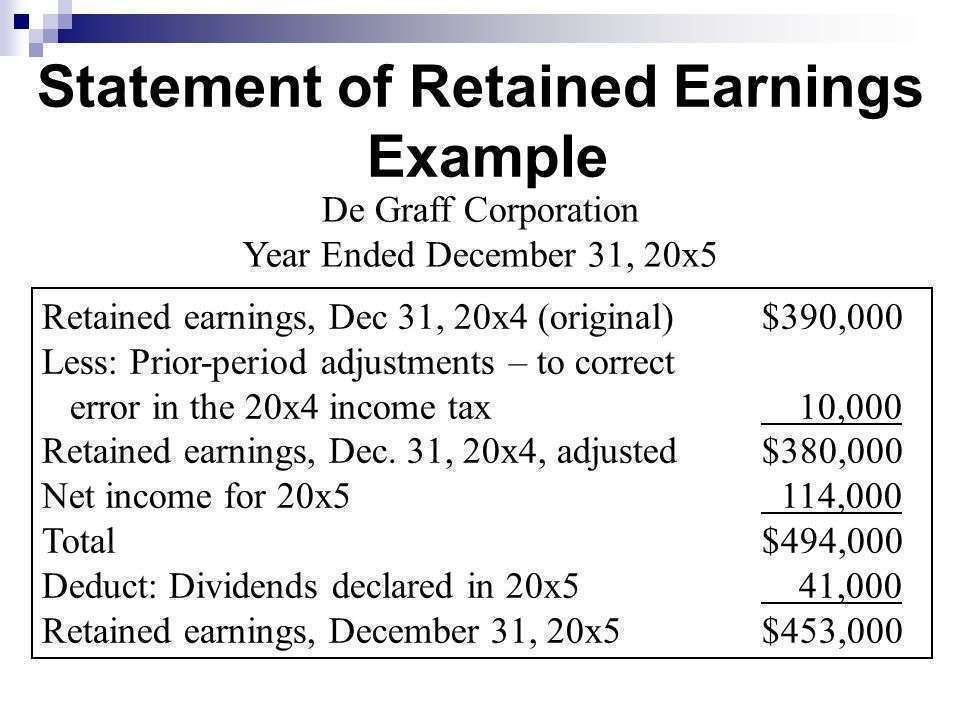

Proper Income Statement Heading

An income statement is a key financial document in business.

Proper income statement heading. This financial statement can also be used to track revenue and expenses to plan annual budgets and sales projections along with determining what areas of the business are over budget or under budget. The name of the company appears first followed by the title income statement the third line tells the reader the time interval reported on the profit and loss statement. Since income statements can be prepared for any period of time you must inform the reader of the precise. It shows the profitability of a company over a specific period of time.

The income statement above shows five full calendar years plus a last twelve months ltm period as of 9 30 13. A typical income statement starts with a heading which consists of three lines. Examples of service businesses are medical accounting or legal practices or a business that provides services such as plumbing cleaning consulting design etc. And the third states the period covered in.

Cash accounting means you calculate your profits or loss based on when the income and expenses hit your bank accounts. The heading of the income statement conveys critical information. An income statement shows the net income or net loss of a business. The second describes the title of the report.

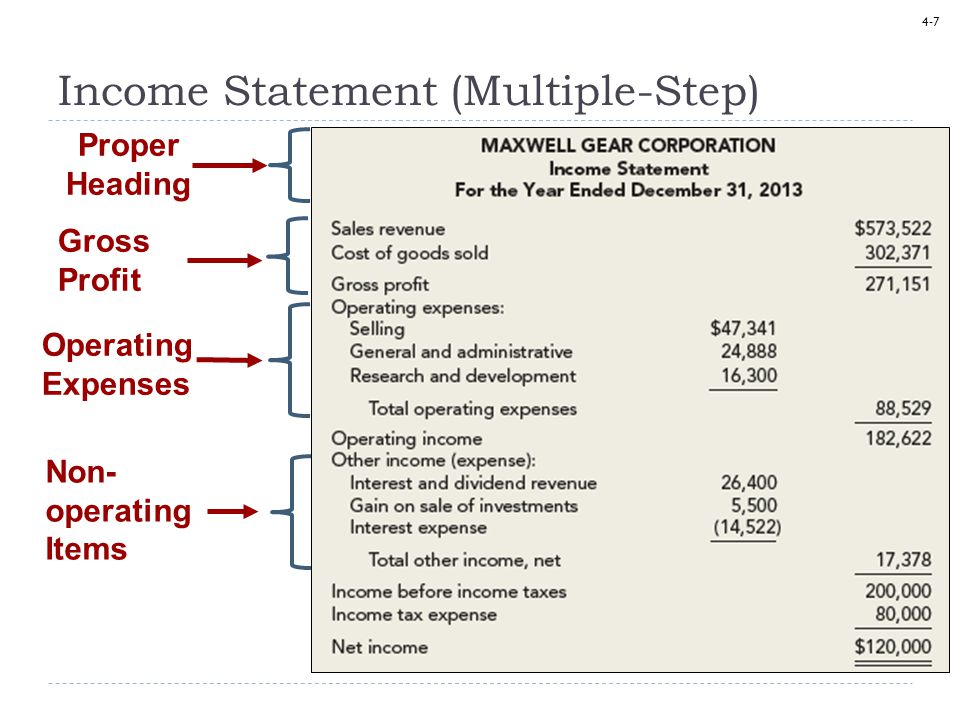

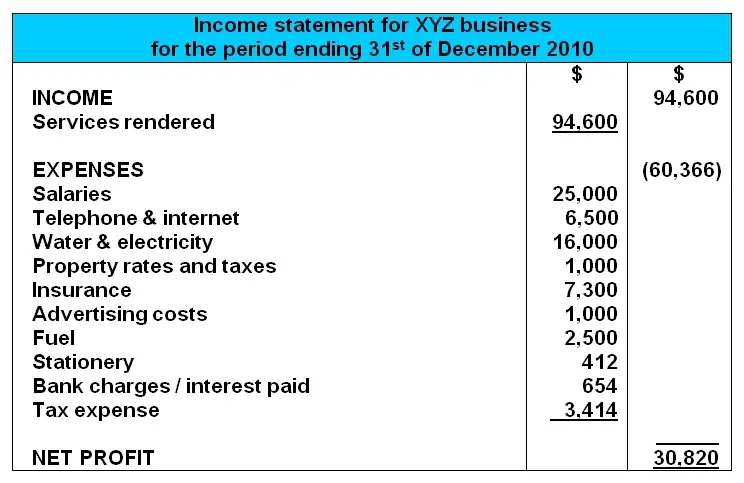

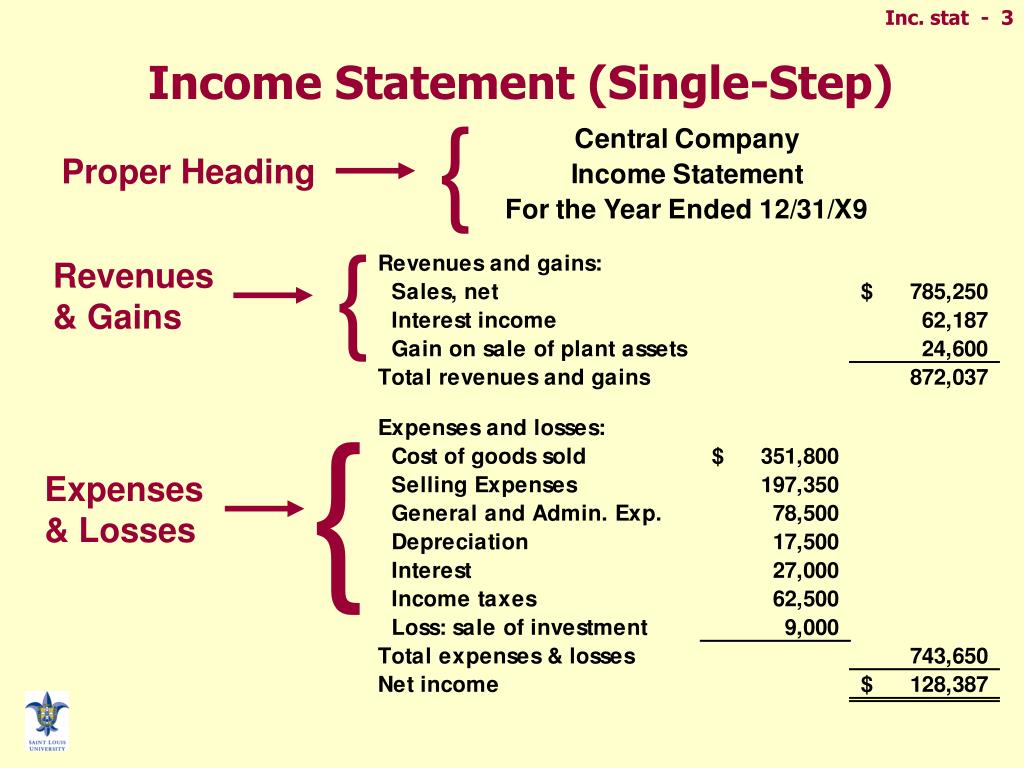

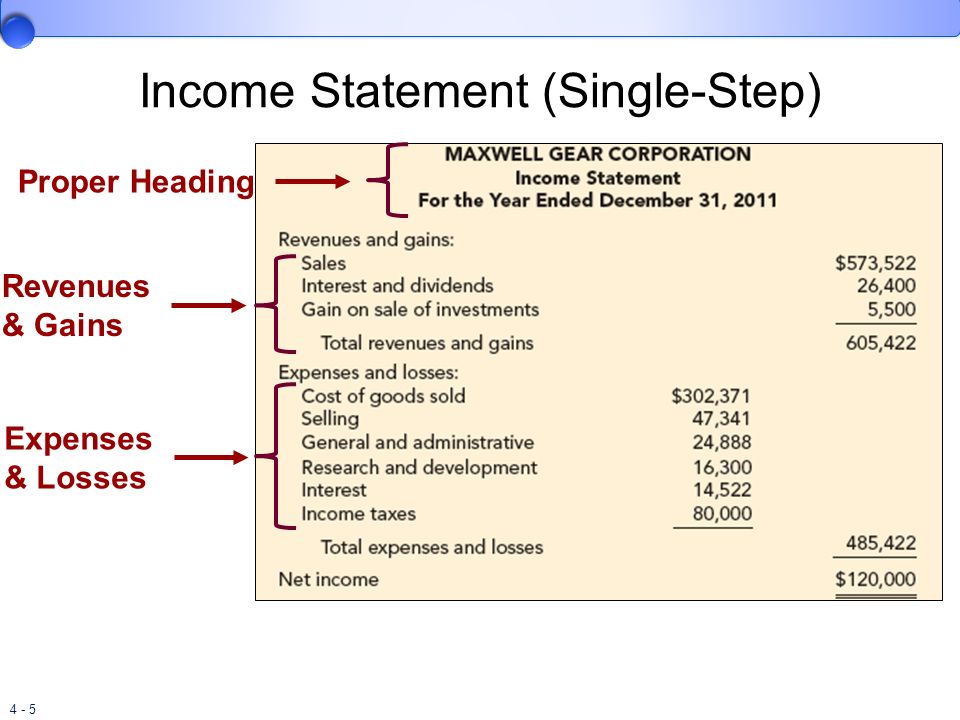

As you can see this example income statement is a single step statement because it only lists expenses in one main category. The income statement format above is a basic one what is known as a single step income statement meaning just one category of income and one category of expenses and prepared specifically for a service business. Here is an example of how to prepare an income statement from paul s adjusted trial balance in our earlier accounting cycle examples. A multi step income statement separates operating income and expenses from non.

Single step income statement. The following guide shows you how to prepare a simple multi step income statement. This is achieved by deducting all expenses from all income. Accrual accounting computes.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)