Rental Income Yield Calculator

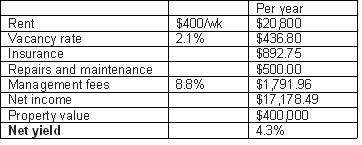

Net rental yield is usually a better metric to look at because expenses don t always scale linearly with income meaning that as you earn one dollar in income the expenses associated with that income are not always.

Rental income yield calculator. How to calculate gross rental yield. Working out the potential rental yield of a buy to let property will allow you to estimate the return on your property investment so you can ensure that your rental income is sufficient for your investment. The rental yield calculator allows you to work out the gross and net rental yields on any individual property or the entire portfolio of your lettings business. Working out the rental yield for your property is fairly easy.

You take the annual rental income and divide by the property value. Take the monthly rental income amount or expected rental income and multiply it by 12. Finally multiply the result by 100 to get the percentage. Divide it by the property s purchase price or current market value.

Gross rental yield is commonly used when looking at returns as it is simple to calculate and lets you easily compare properties with different values and rental returns. Annual rental income 12 000 property value 200 000 x 100 6. Then multiply this number by 100 to get a percentage value. Firstly find your annual rental income for the property and divide that by the property value.

Rental yield monthly rental income x 12 property value. This occurs when the weekly rent of the property is double the price of the property divided by 1 000. The rental yield calculator enables you to enter a range of costs associated with the acquisition of a buy to let property such as purchase price and legal fees. Other helpful property calculators.

Multiply this figure by 100 to get the. We ve broken down how you use this formula to calculate rental yield below. As an example equation consider the following.