Reorganization Items Income Statement

D as a debit directly to retained earnings.

Reorganization items income statement. Gains and losses resulting from adjusting existing book values of liabilities to the amounts likely to be allowed penalties from cancelation of purchase contracts interest income on investment of excess cash. In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing. B on the income statement as a separate reorganization item. A on the income statement but not classified as a reorganization item.

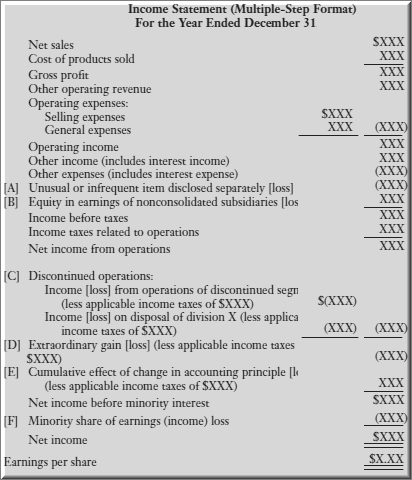

Question 1 reorganization items for a firm undergoing reorganization on the income statement are likely to include all of the following except. Amount of interest income on accumulated cash reported as a reorganization item. The income statement similarly combines operating profits with the costs of financing such as interest expense. Chapter 4 income statement and related information 4 3 illustration illustration 4 2 presents an income statement for boc hong company.

The income statement during reorganization. The most common income statement items include. A restructuring charge is a one time cost that a company pays when it reorganizes its business. Amount of reorganization items related to impairment loss.

As you can see this example income statement is a single step statement because it only lists expenses in one main category. Debtor reorganization items impairment loss duration. Sales revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services. During a reorganization how should interest expense be reported on the financial statements.

Here is an example of how to prepare an income statement from paul s adjusted trial balance in our earlier accounting cycle examples. Single step income statement. C on the balance sheet as a prepaid expense. To prepare the financial statements for analysis of economic performance you need to reorganize the items on the balance sheet income statement and statement of cash flows into three categories of components.

Such items are placed on the income statement before any income tax expense or benefits. It is a short term expense the company undertakes with an eye toward boosting long term profitability. Means non recurring expenses including professional fees incurred in connection with the chapter 11 cases. Boc hong s in come statement includes all of the major items in the list above except for discontin ued operations.

Debtor reorganization items revaluation of assets and.