The Contribution Income Statement Reports Gross Margin

Reports gross margin b.

The contribution income statement reports gross margin. A reports gross margin b is allowed for external reporting to shareholders c categorizes costs as either direct or indirect d can be used to predict future profits at different levels of activity 12 contribution margin equals. The basic difference between a traditional income statement and a contribution margin income statement lies in the treatment of variable and fixed expenses. The contribution income statement. 11 the contribution margin income statement.

Looking at this statement it can be easily understood as to which business activity is resulting in a revenue leak. A reports gross margin b is allowed for external reporting to shareholders c categorizes costs as either direct or indirect d can be used to predict future profits at different levels of activity answer. Reports the contribution margin income statement for 2017. 10 the contribution income statement.

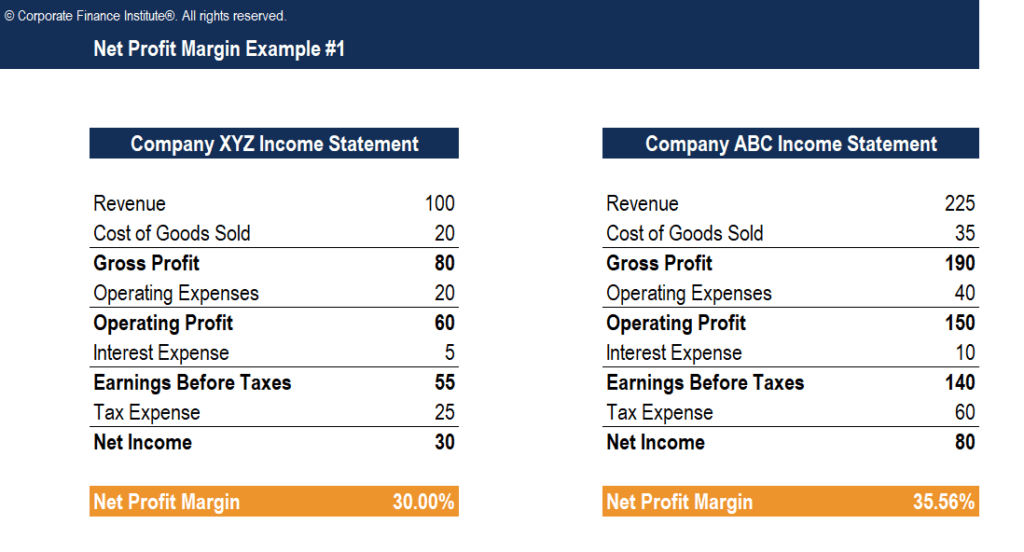

Contribution margin example. If a company has 2 million in revenue and its cogs is 1 5 million gross margin would equal revenue minus cogs which is 500 000 or 2 million. A reports gross margin b is allowed for external reporting to shareholders c categorizes costs as either direct or indirect d can be used to predict future profits at different levels of activity. In this article we shall discuss two main differences of two income statements the difference of format and the difference of usage.

Sherry s custom jewelry sells a single product. The contribution margin income statement is a special format of the income statement that focuses on expenses that are bifurcated for better understanding. The contribution margin income statement is a useful tool when analyzing the results of a previous period. Thus the arrangement of expenses in the income statement corresponds to the nature of the expenses.

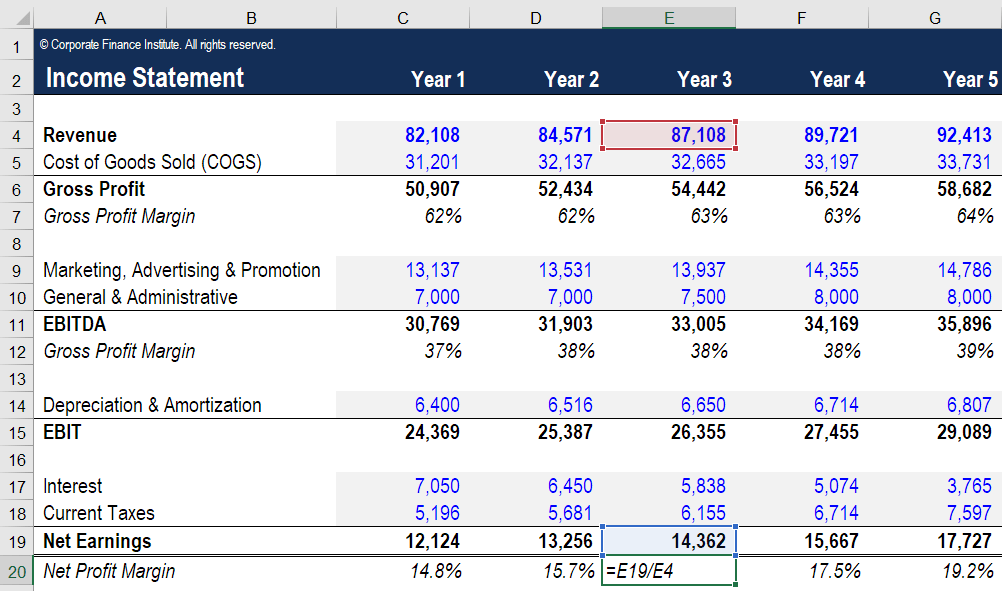

This statement tells you whether your efforts for the period have been profitable or not. The resulting value is sometimes referred to as operating income or net income. This difference of treatment of two types of costs affects the format and uses of two statements. Contribution margin income statement for year ended december 31 2017 sales 10 800 units at 375 each 4 050 000 variable costs 10 800 units at 3 240 000 300 each contribution margin 810 000 fixed costs 660 000 pretax income 150 000 1.

The contribution margin income statement. A revenues minus period costs. Categorizes costs as either direct or 14796497. D 11 contribution margin equals.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

:max_bytes(150000):strip_icc()/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

:max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg)

:max_bytes(150000):strip_icc()/Apple2Q2020IncomeStatement-810d3a73c6f64a8d931979faaec40067.jpeg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/Screenshot2019-08-21at10.58.51AM-049e1ab335434a16ab7ddc69664758a7.png)