The Income Statement Approach To Calculating

The alternative method for calculating gdp is.

The income statement approach to calculating. Gdp value added at basic prices taxes less subsidies on products. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. Assessing the economic contribution of the voluntary sector to gross domestic product can be considered methodologically as an under researched area in the uk since the majority of research work lacks detailed methodology. It s calculated by dividing the net operating income by the capitalization.

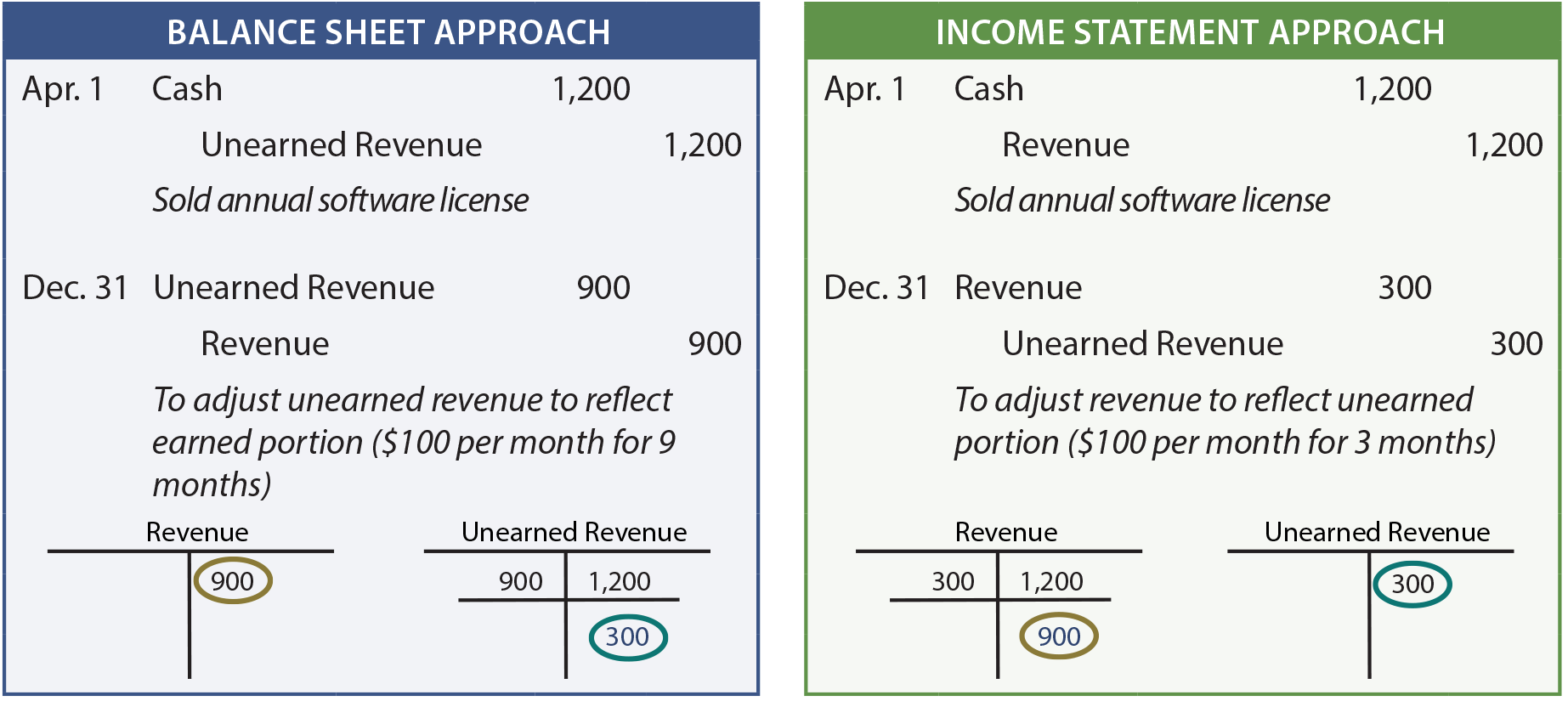

The income statement is one of three statements. The first is an income statement approach that measures bad debt as a percentage of sales. The income approach and the expenditure approach see also gross domestic product. This is a simple equation that shows the profitability of a company.

The income approach states that all economic expenditures should equal the total income generated by the production of all economic goods and services. There are two primary methods for estimating bad debt expense. This video shows the income statement approach to calculating breakeven points. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities.

If revenue is higher than expenses the company is profitable. There are two primary methods to calculate gdp. If given the option use one of the following shortcut methods instead. According to the income approach gdp can be computed by finding total national income tni and then adjusting it for sales taxes t depreciation d and net foreign factor income f.

The income approach is a real estate valuation method that uses the income the property generates to estimate fair value. The income statement is used to calculate the net income of a business. With the production approach value added is measured as the. The second is a balance sheet approach that measures uncollectibles as a percentage of ending accounts receivable.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)