The Income Statement Line Item Most Likely Affected By An Investment In Enterprise Systems Would Be

An extraordinary item is an event that materially affected a company s finances and needs to be thoroughly explained in the annual report or form 10 k filing.

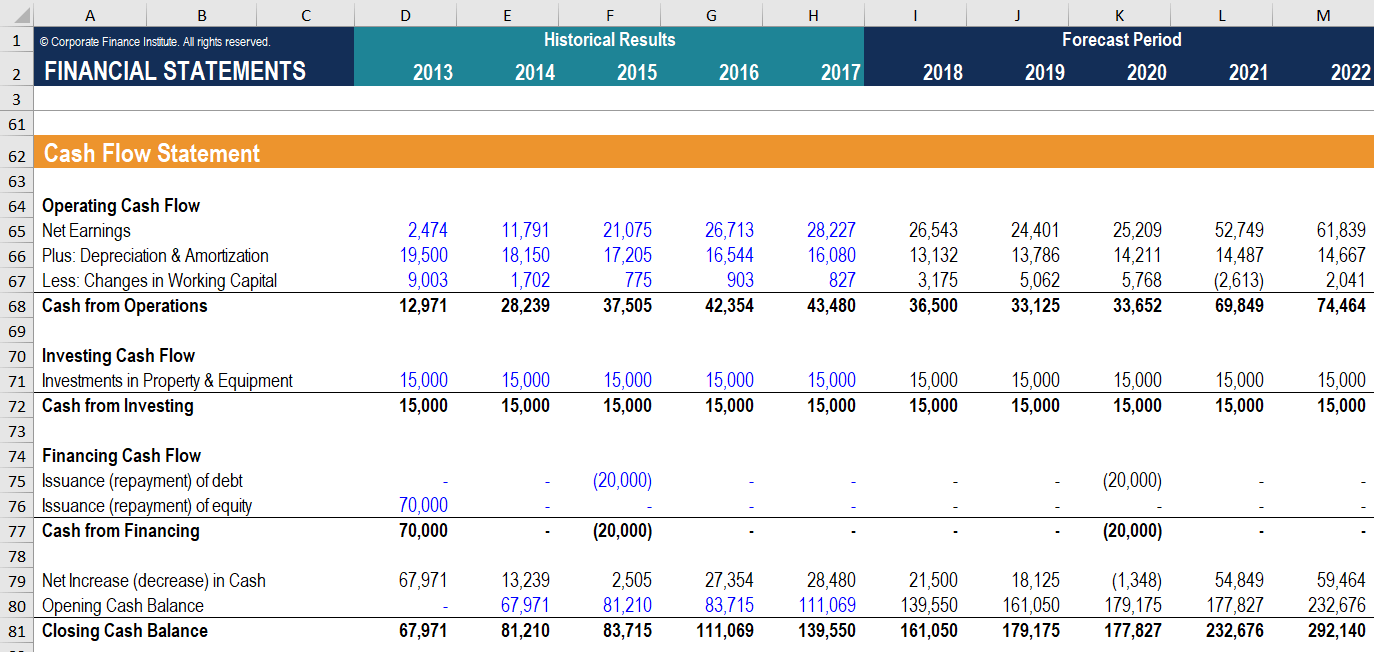

The income statement line item most likely affected by an investment in enterprise systems would be. A non recurring event is a one time charge the company doesn t expect to encounter again. Net income net income net income is a key line item not only in the income statement but in all three core financial statements. While it is arrived at through the income statement the net profit is also used in both the balance sheet and the cash flow statement. While it is arrived at through the income statement the net profit is also used in both the balance sheet and the cash flow statement.

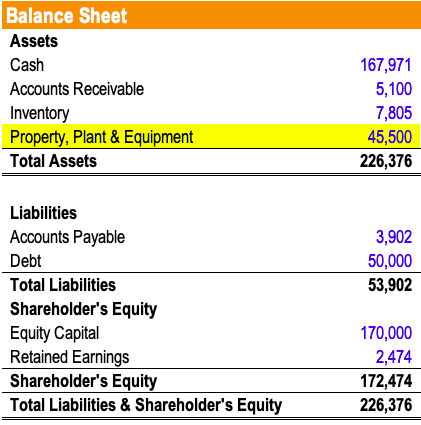

The income statement line item most likely affected by an ais investment in supply chain that would interface with suppliers would be. The bottom line of an income statement is the net income that is calculated after subtracting the expenses from revenue. The income statement line item most likely affected by an ais investment in enterprise systems would be. From the bottom of the income statement links to the balance sheet and cash.

Ias 1 sets out the overall requirements for financial statements including how they should be structured the minimum requirements for their content and overriding concepts such as going concern the accrual basis of accounting and the current non current distinction. Extraordinary events can include costs associated with a merger or the expense of implementing a new. Selling general and administrative expenses. Selling general and administrative expenses.

Cost of goods sold unearned revenue selling general and administrative expenses revenues 2 a systems analyst analyzes a business problem that might be addressed by an information system and recommends software or systems to address that problem. Net income net income net income is a key line item not only in the income statement but in all three core financial statements. The standard requires a complete set of financial statements to comprise a statement of financial position a statement of. Cost of goods sold.

Is calculated by deducting income taxes from pre tax income. Chapter 1 1 the income statement line item most likely affected by an ais investment in enterprise systems would be. Selling general and administrative expenses. The income statement line item most likely affected by an ais investment in enterprise systems would be.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)