The Income Statement Reports Chegg

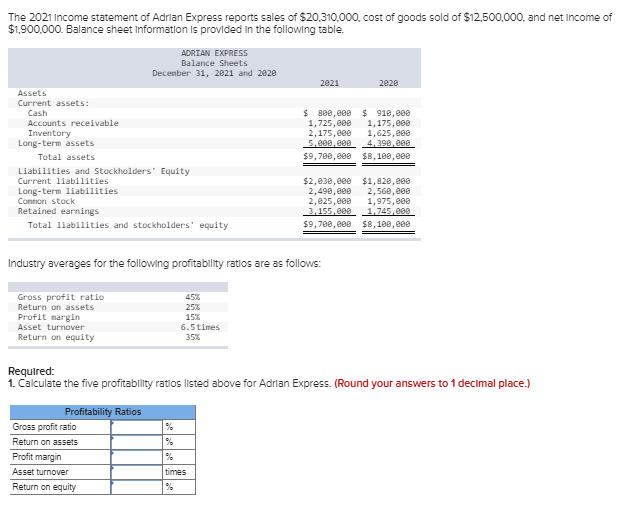

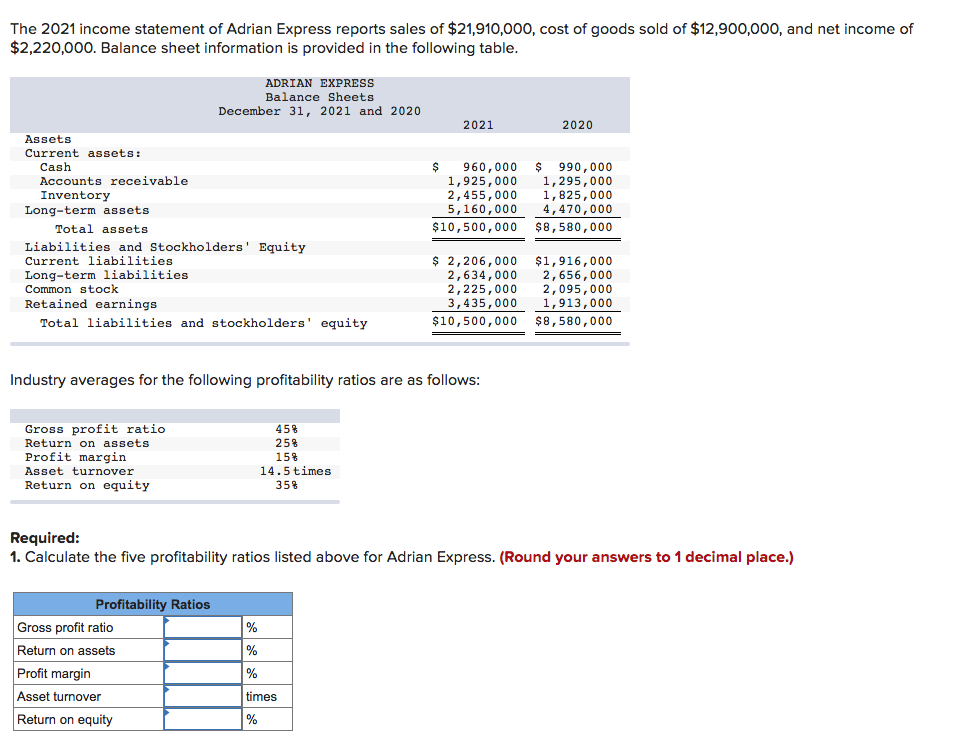

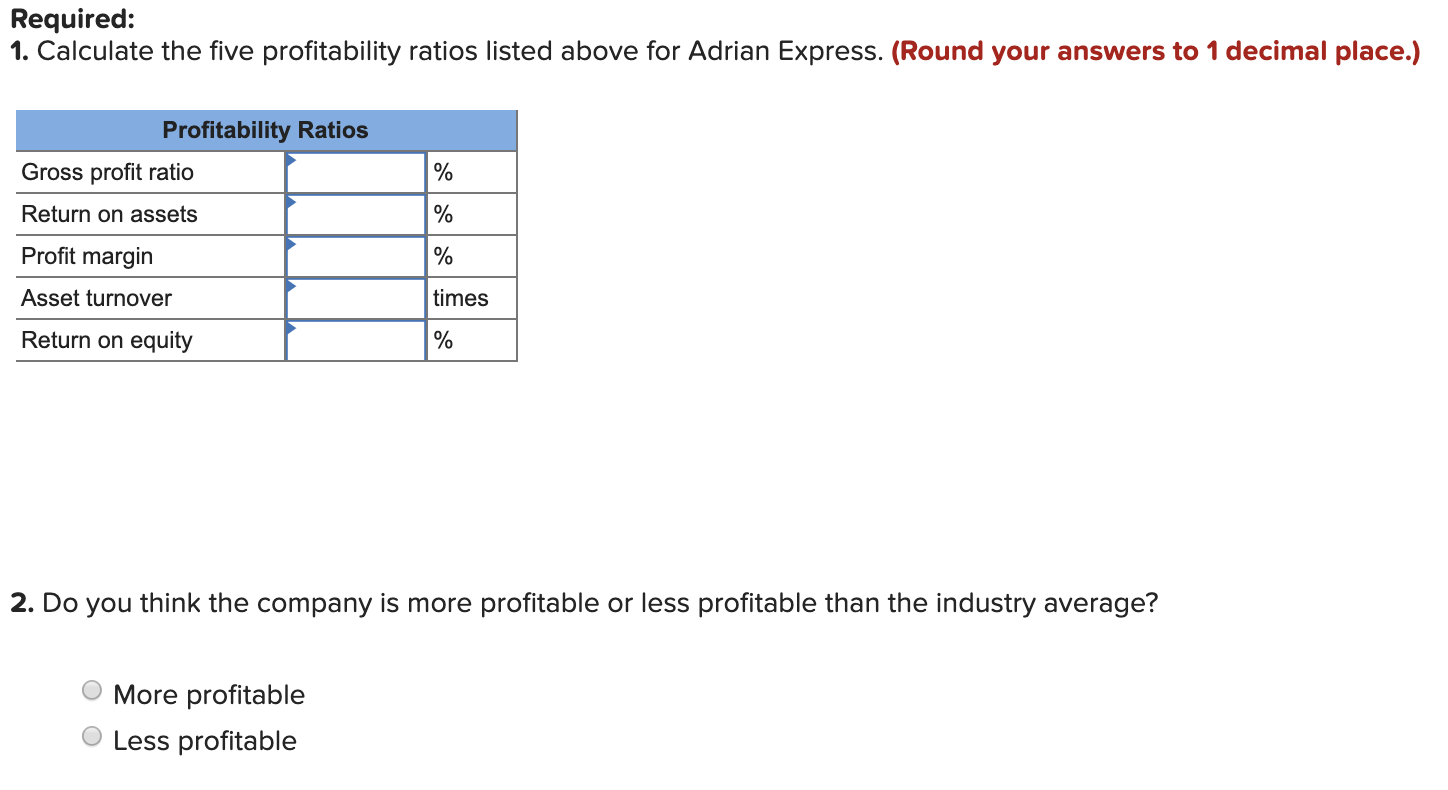

Round the percentage to one decimal place.

The income statement reports chegg. Automatic data processing inc. A how is the company doing. Consolidated statements of income year ended may 31 in millions 2011 2010 revenues 21 862 19 014 cost of sales 11 354 10 214 gross profit 10 508 8 800 demand creation expense 2 948 2 356 operating overhead. Number of chegg services subscribers an increase of 35 year over year.

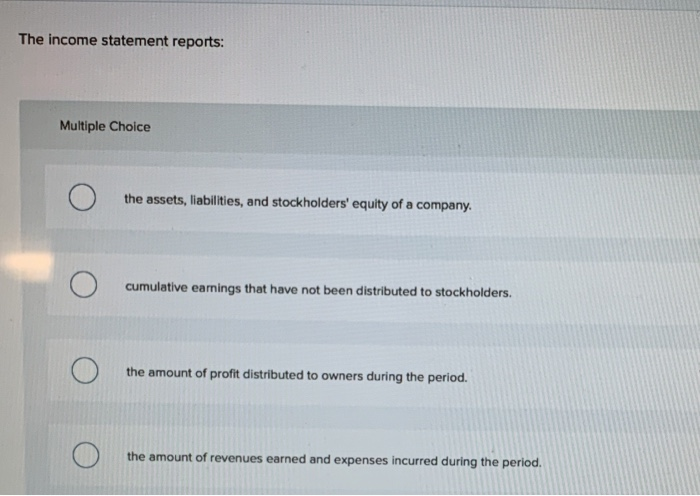

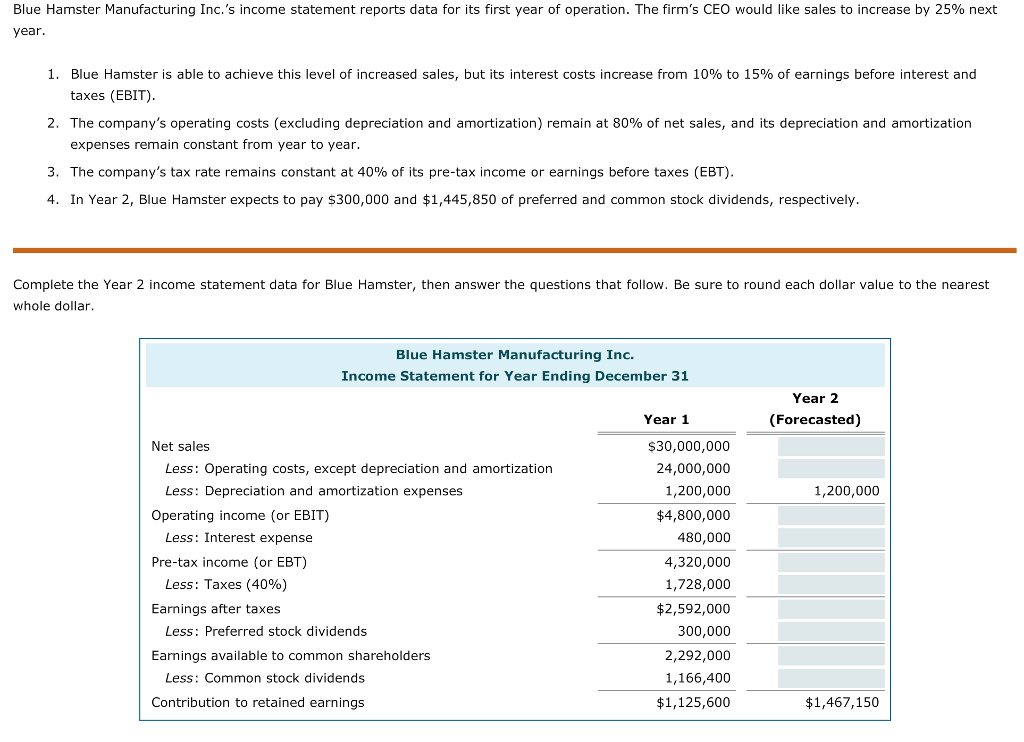

A reports the results of operations for a period b reports on the events causing a change in stockholders equity during a period c presents a firm s assets liabilities and stockholders equity on a given date d reports cash inflows and outflows during a period e none of the above 2. This left 160 bikes in ending inventory. Net income 149 430 interest expense 12 999 average total assets 1 867 000 determine the rate earned on total assets. Forecasting an income statement adp reports the following income statement.

Comparative analysis using vertical or horizontal method. Hayek bikes prepares the income statement under variable costing for its managerial reports and it prepares the income statement under absorption costing for external reporting. Chegg services revenues grew 33 year over year to 100 4 million or 76 of total net revenues compared to 77 in q1 2019 net loss was 5 7 million non gaap net income was 29 0 million adjusted ebitda was 31 8 million 2 9 million. Find out the revenue expenses and profit or loss over the last fiscal year.

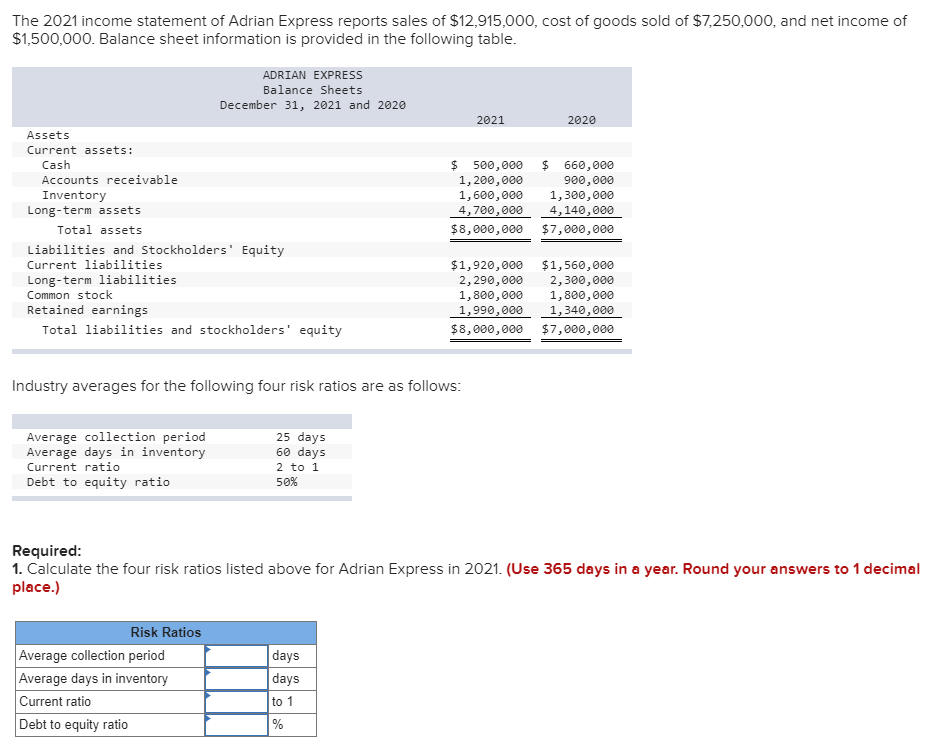

Get the detailed quarterly annual income statement for chegg inc. Must use four ratios to support the answer. Size of the company possible industry etc. 2021 2020 sales revenue 4 400 000 3 500 000 cost of goods sold 2 860 000 2 000 000 administrative expense 800 000 675 000 selling expense 360 000 302 000 interest.

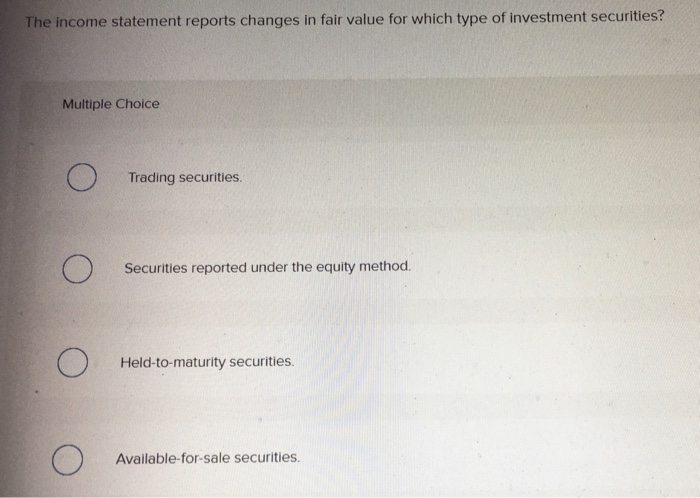

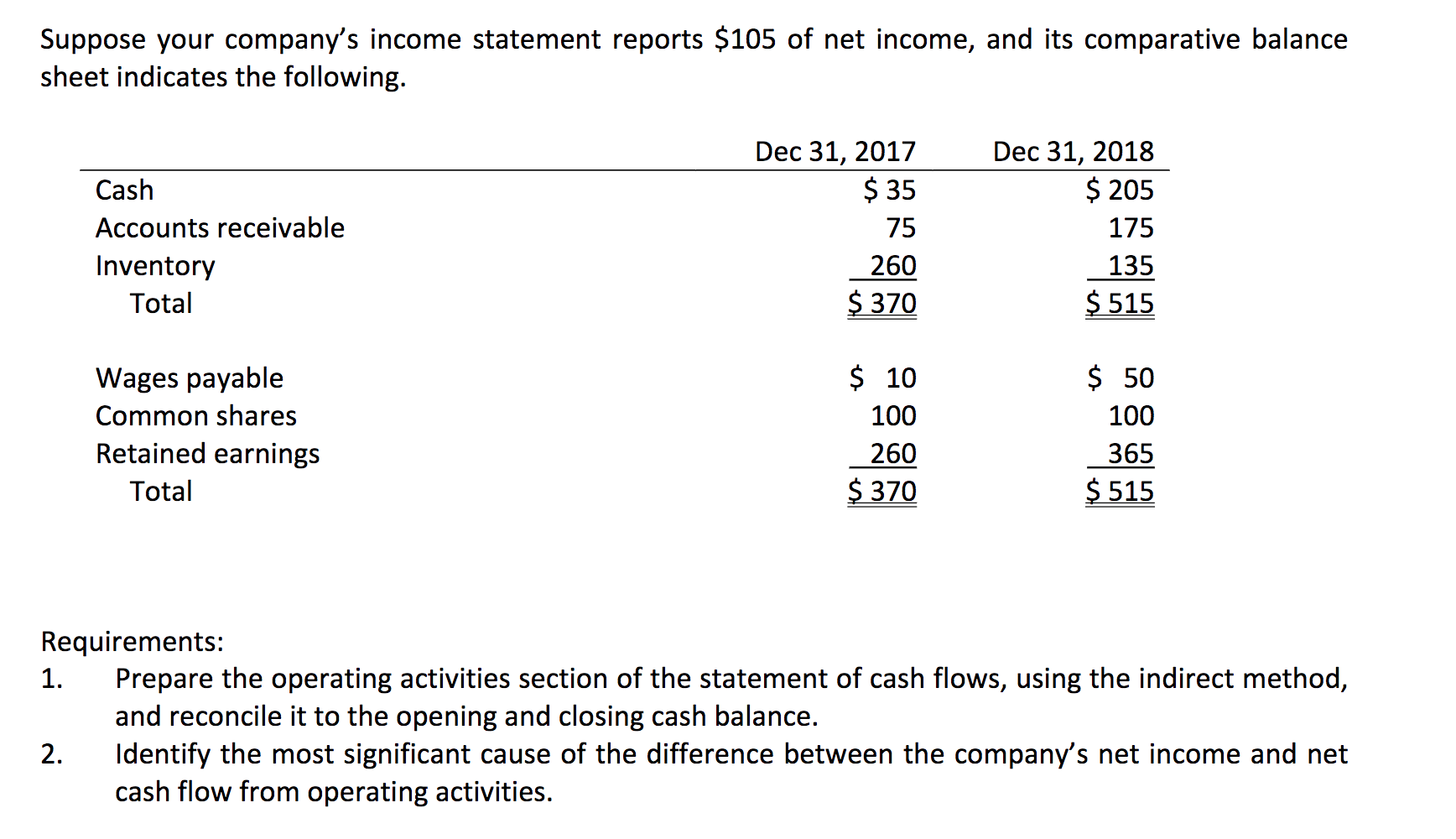

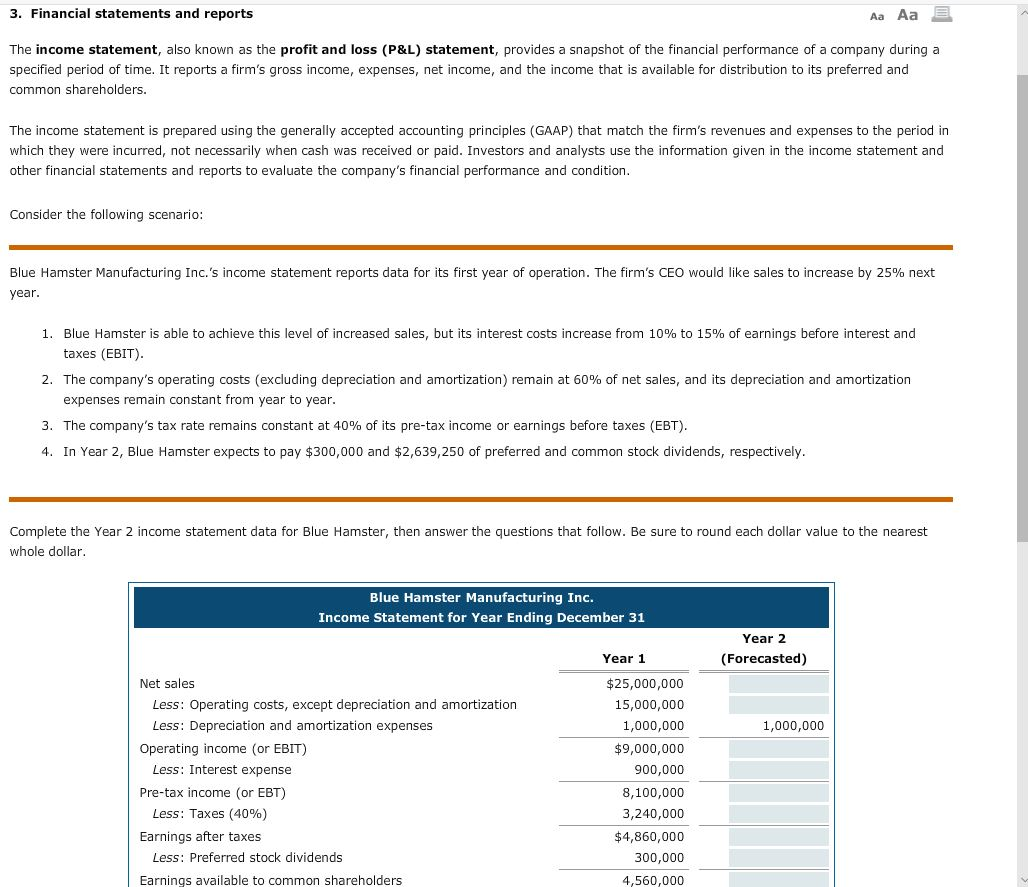

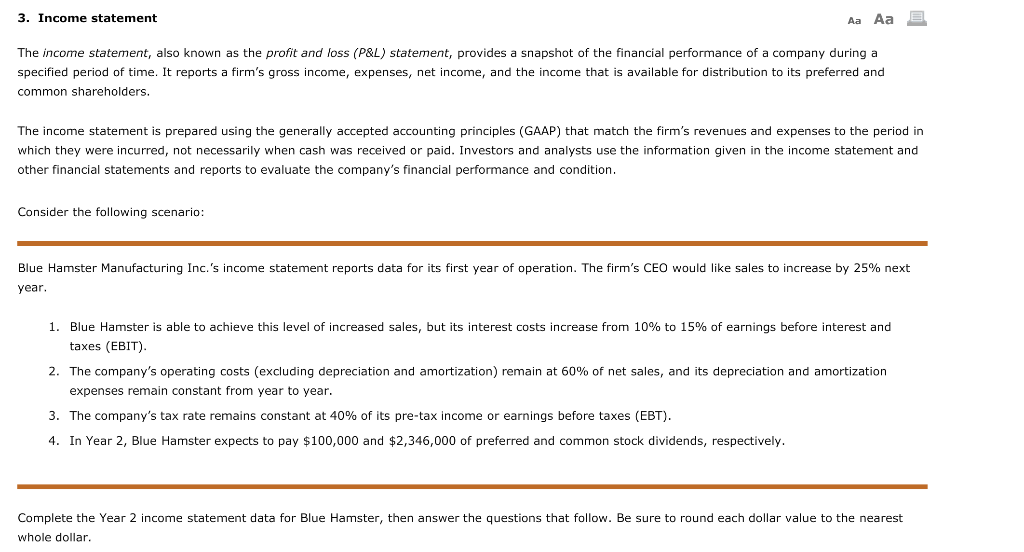

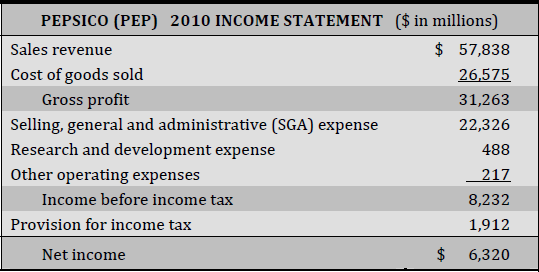

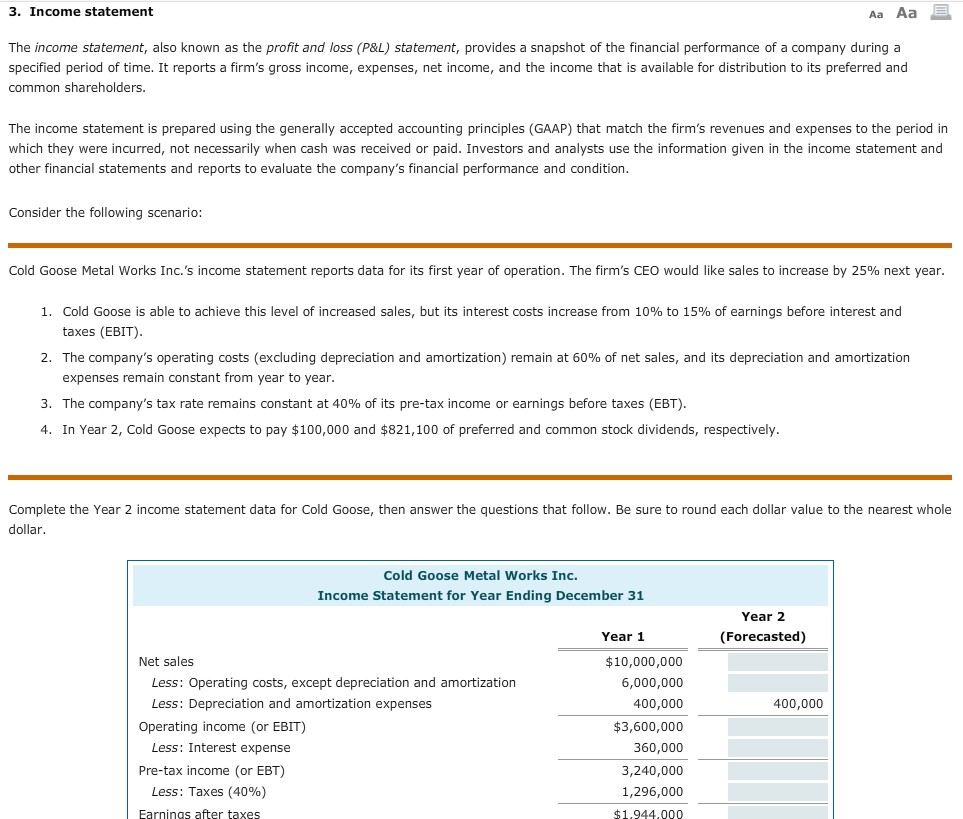

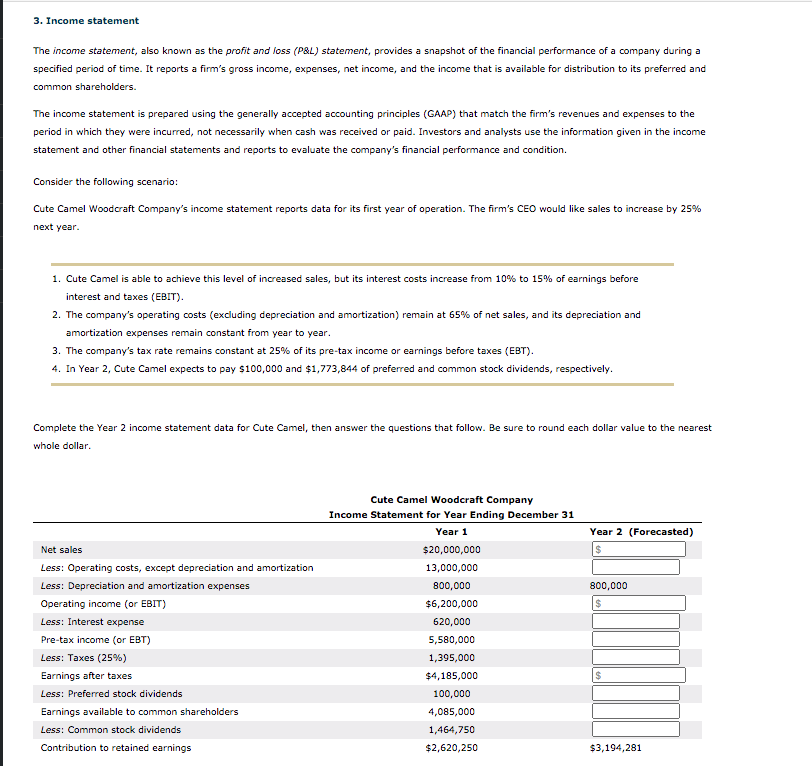

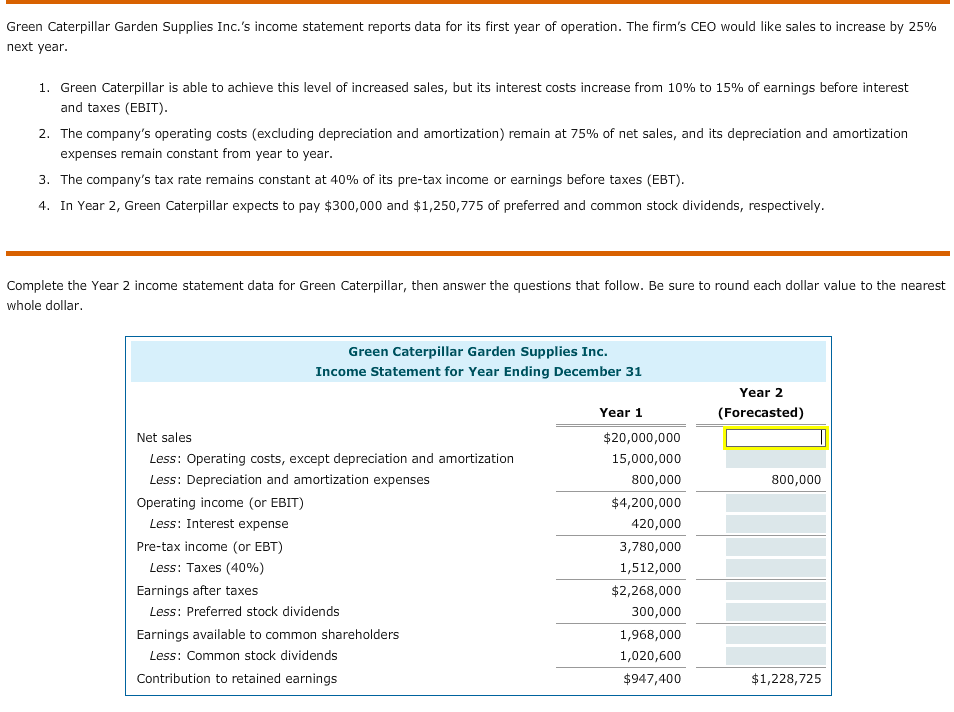

It reports a firm s gross income expenses net income and the income that is available for distribution to its preferred and common shareholders. 1 make financial statements income statement statement of retained earning balance sheet for both month. Forecasting the income statement balance sheet and statement of cash flows assume the following are the financial statements of nike inc. A company reports the following income statement and balance sheet information for the current year.

Statement of consolidated earnings for year ended june 30 2019 millions total revenues 14 175 2 operating expenses 7 145 9 systems development and programming costs 636 3 depreciation and amortization 304 4 total cost of revenues 8 086 6 selling. B where do you see the company in one year.