Unearned Interest Income Income Statement Or Balance Sheet

Accrued interest receivable that is to be reported on the balance sheet.

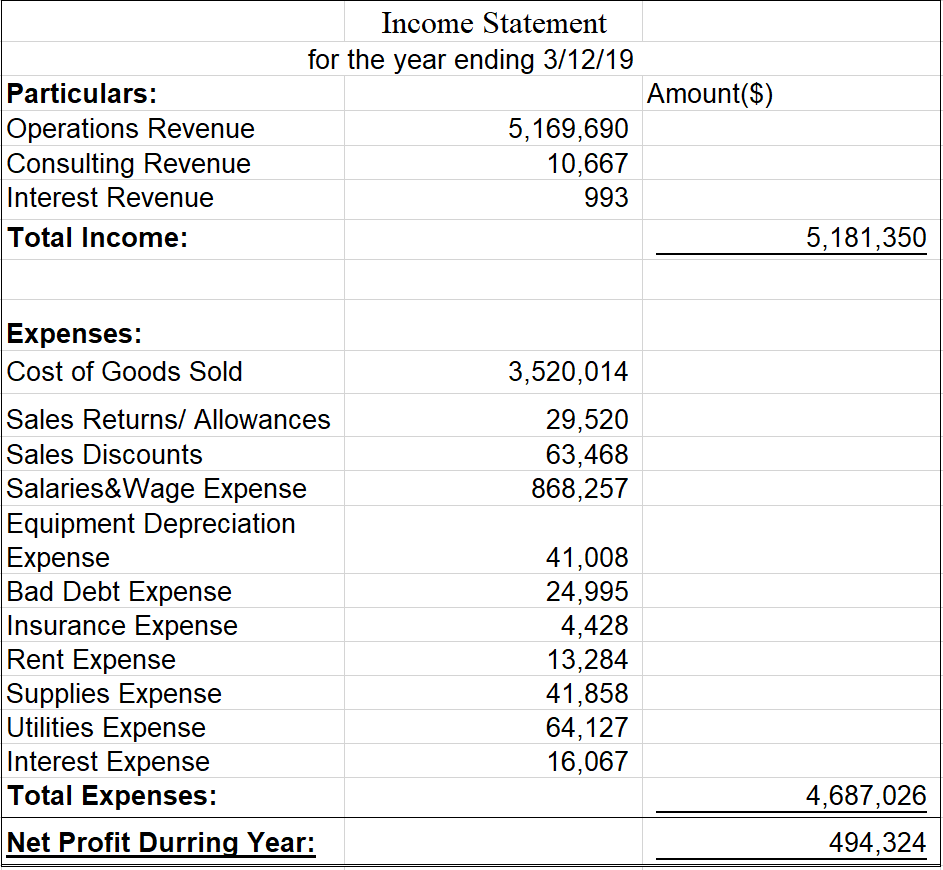

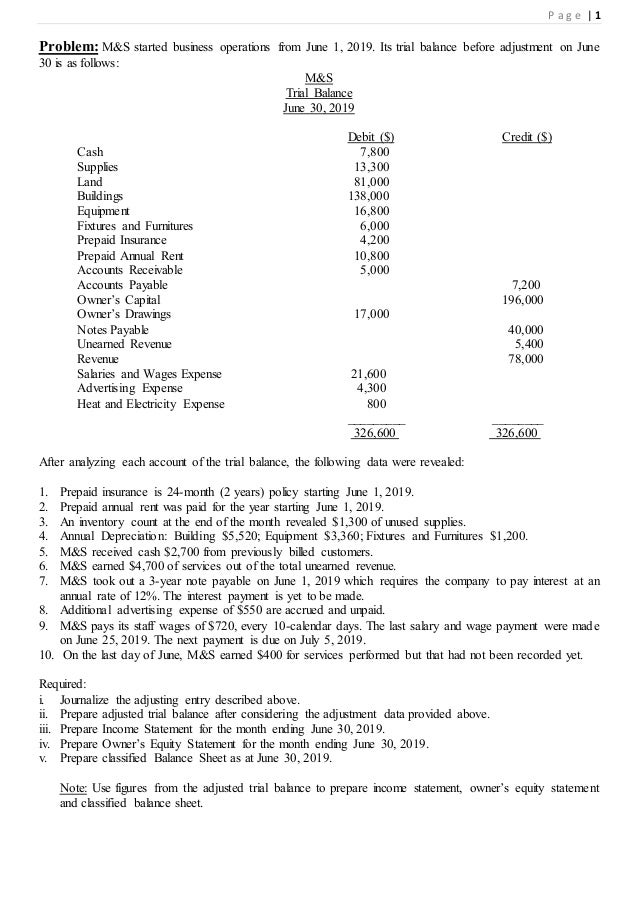

Unearned interest income income statement or balance sheet. The amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of. Net interest expense of 325 million represents the cost of debt servicing and put j c. In april when the first service is provided the company will debit the liability account unearned revenues for 60 and will credit the income statement account service revenues for 60. This balance is added in current year s depreciation and total is deducted from concerned asset in balance sheet.

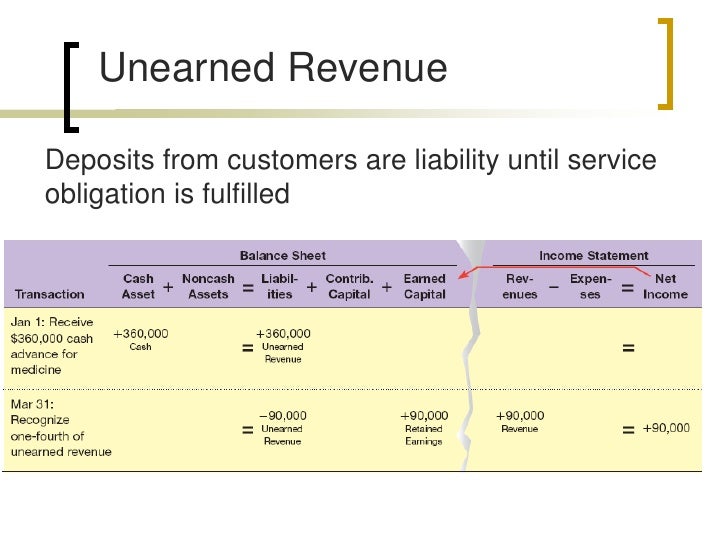

An income statement also called a profit and loss account or p l. Accrued interest income that is to be reported on the income statement. Penney in the red. Balance sheet as on 31 03 2018 will show an increase in cash balance by the amount of annual subscription of rs 12000 and unearned income a liability will be created.

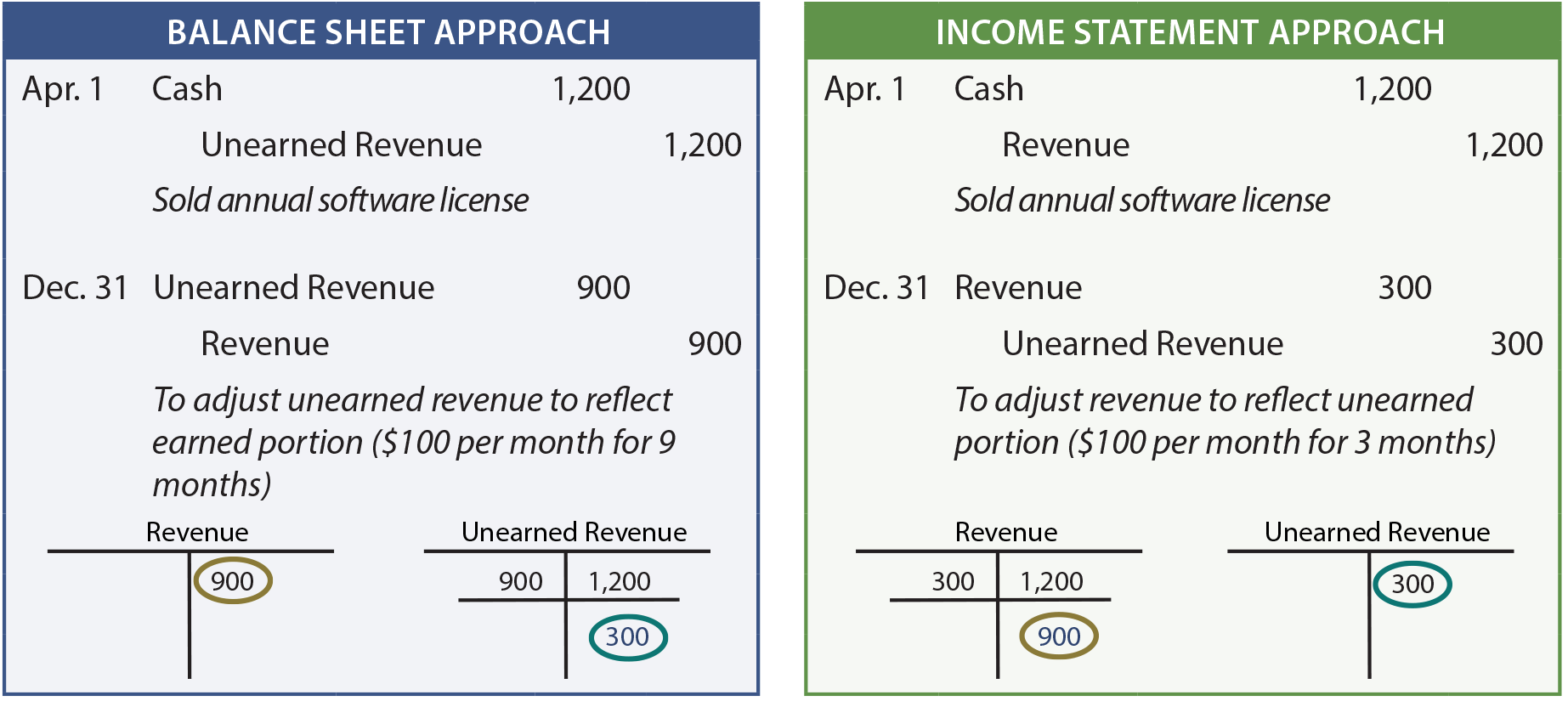

How adjustments effect income statement and balance sheet. The said liability will decrease by the proportional amount of rs 1000 on 30 04 2018 when abc delivers the first installment of business magazine to its client. At the end of april the balance sheet will report the company s remaining liability of 240. Instead it is initially recorded as a liability.

A balance sheet lists assets and liabilities of the organization as of a specific moment in time i e. Interest on capital. Unearned interest is interest that has been collected on a loan by a lending institution but has not yet been counted as income or earnings. As of a certain date.

These statements are the balance sheet income statement and statement of cash flows. Net refers to the fact that management has simply subtracted interest income from interest expense to come up with one figure. If part of the amount are received the remaining are recorded in balance sheet as receivable. Interest incomes here are not represent the total interest income that entity received during the period.

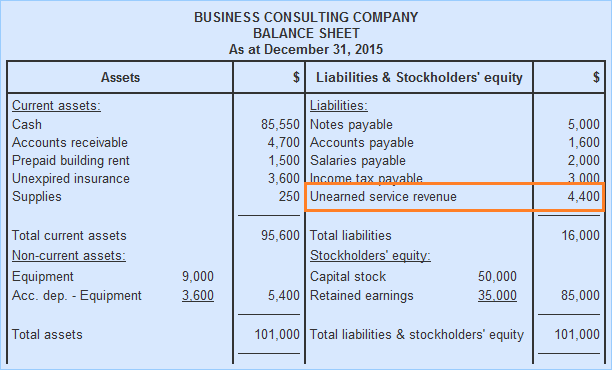

In other words if a company paid 20 in interest on its debts and earned 5 in interest from its savings account the income statement would only show interest expense net of 15. Unearned revenue is shown in balance sheet under the head of current liabilities. In financial accounting the balance sheet and income statement are the two most important types of financial statements others being cash flow statement and the statement of retained earnings. Accrued income reported on the balance sheet.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)