United States Federal Income Tax Brackets 2019

For tax year 2019 the 28 tax rate applies to taxpayers with taxable incomes above usd 194 800 usd 97 400 for married individuals filing separately.

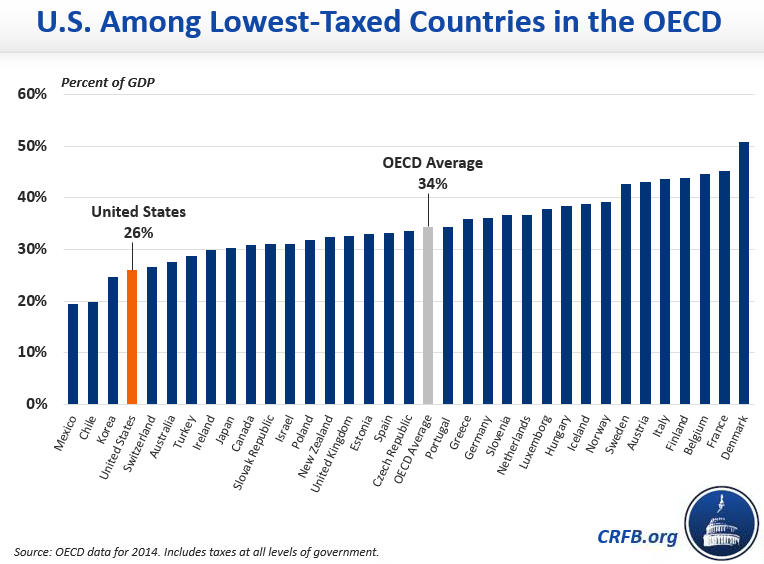

United states federal income tax brackets 2019. The 2020 federal income tax brackets on ordinary income. In the united states the internal revenue service irs is responsible to carry out the functions of federal tax returns. The exclusion is increased to 157 000 for gifts to spouses who are not citizens of the united states. In general the more income you have the higher your tax liability.

10 tax rate up to 9 875 for singles up to 19 750 for joint filers. The federal income tax rates remain unchanged for the 2019 and 2020 tax years. Your bracket depends on your taxable income and filing status. The income brackets though are adjusted slightly for inflation.

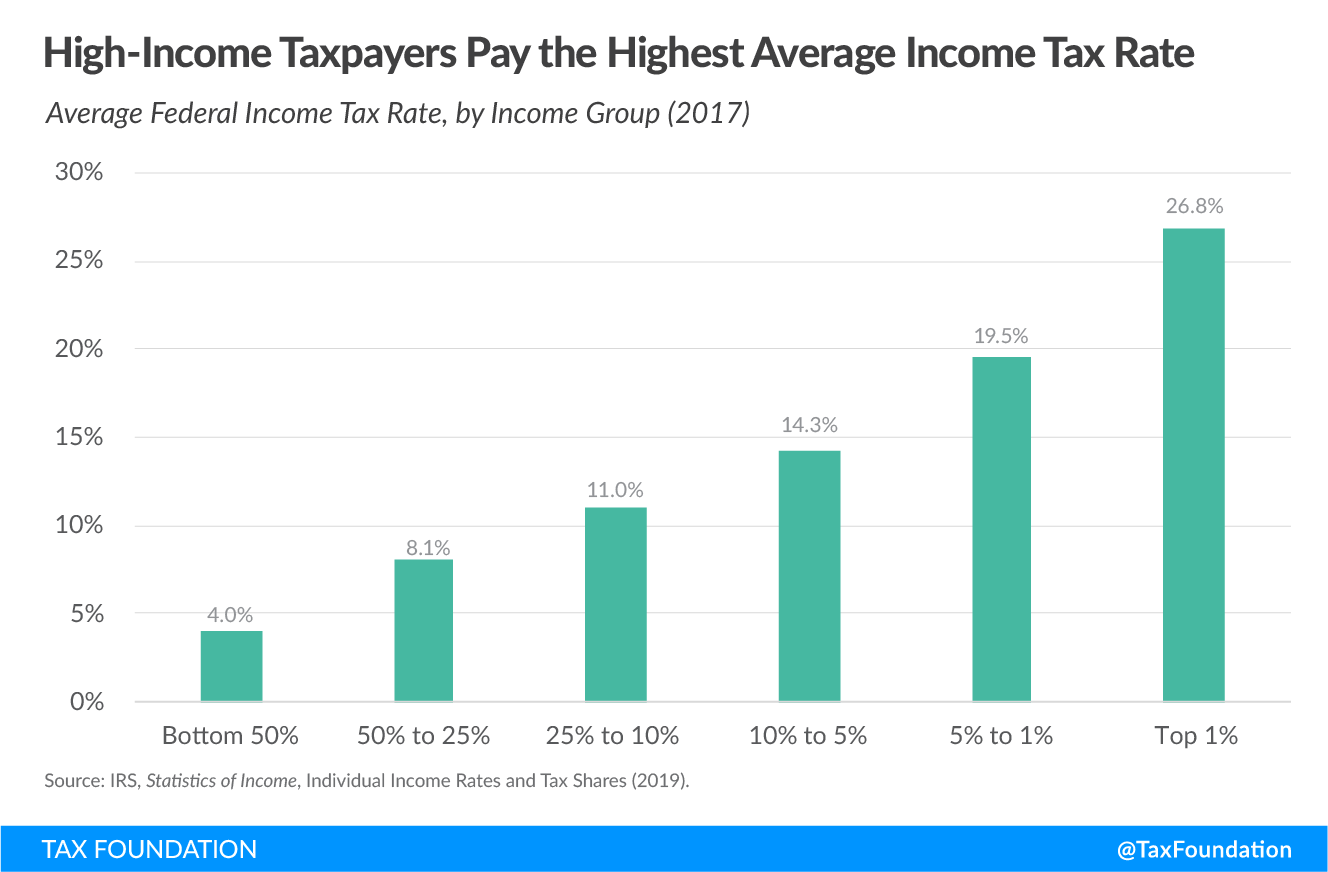

Read on for more about the federal income tax brackets for tax year 2019 due july 15 2020 and tax year 2020 due april 15 2021. A progressive tax system is applied by the irs which means that the tax scale also moves up as the pay scale of the individual goes up. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. Specific tax planning strategies such as investments in ira or 401 k can be used to minimize the tax burden.

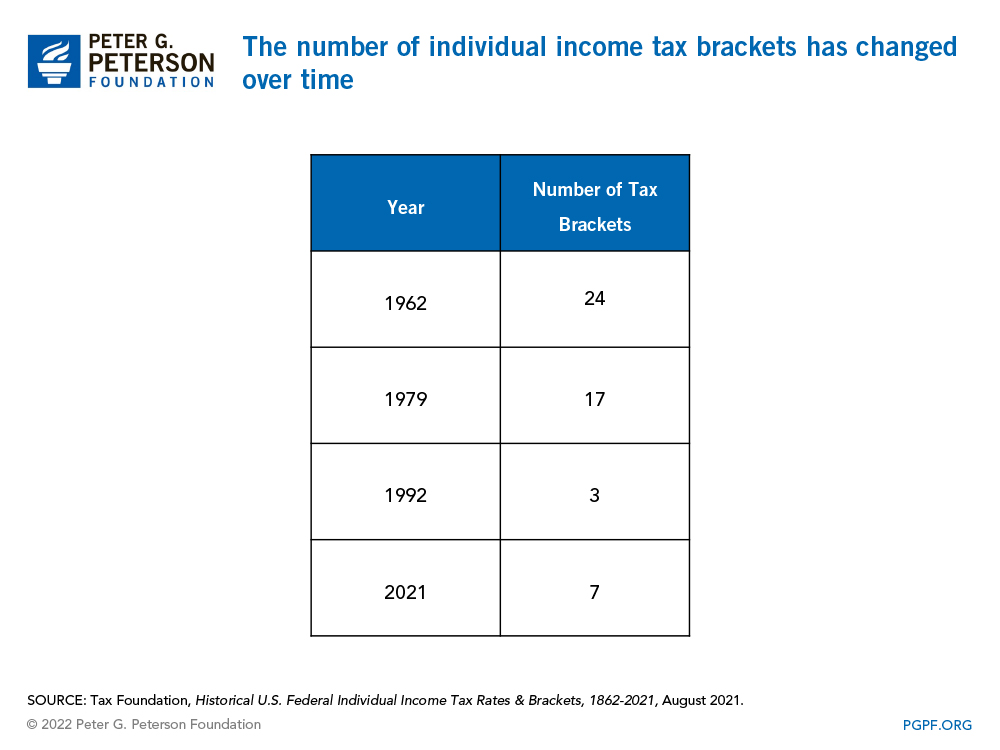

These are the rates for taxes due in. 10 12 22 24 32 35 and 37. There are seven federal tax brackets for the 2020 tax year. For single taxpayers and married individuals filing separately the standard deduction rises to 12 200 for 2019 up 200 and for heads of households the standard deduction will be 18 350 for tax year 2019 up 350.

The current irs federal income tax brackets above are what should be used to figure out your taxable income. Income tax brackets and rates. Notice that new tax brackets and the corresponding income thresholds go into effect for the 2019 tax year. 10 15 25 28 33 35 and 39 6.

The standard deduction for married filing jointly rises to 24 400 for tax year 2019 up 400 from the prior year. The brackets before the tax reform were. Use the 2018 tax rates when you file taxes in april 2019. For tax year 2020 the 28 tax rate applies to taxpayers with taxable incomes above usd 197 900 usd 98 950 for married individuals filing separately.

10 12 22 24 32 35 and 37. Final thoughts on the new 2019 federal income tax brackets and rates if you re very familiar with the tax code as it was through 2017 the changes you ll see in 2019 may seem dramatic. See 2019 tax brackets.

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)