Us Income Mean And Standard Deviation

Standard deviation sd is a widely used measurement of variability used in statistics.

Us income mean and standard deviation. A volatile stock has a high standard deviation while the deviation of a stable blue chip stock is usually rather low. Key differences between standard deviation vs mean. If the standard deviation is less then the claim of the country may really be credible because of the low difference in the individual salaries from the mean salary. Thus sd is a measure of volatility and can be used as a risk measure for an investment.

The mean median and mode are all approximately the same value. What does it mean by 1 or 2 standard deviations of the mean. It is the most widely used risk indicator in the field of investing and finance. Descriptive statistics corresponds to measures and charts that are derived from sample data and are intended to provide information about the population being studied.

Two basic types of descriptive statistics are the measures of central tendency and the measures of dispersion. The mean is represented by μ mu. Standard deviation is commonly used to measure confidence in statistical conclusions regarding certain equity instruments or portfolios of equities. Standard deviation is statistics that measure the dispersion of dataset relative to it is mean and its calculated as the square root of variance it is calculated as the square root of variance by determining the variation between each data point relative to the mean.

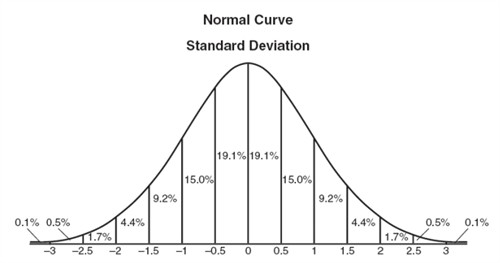

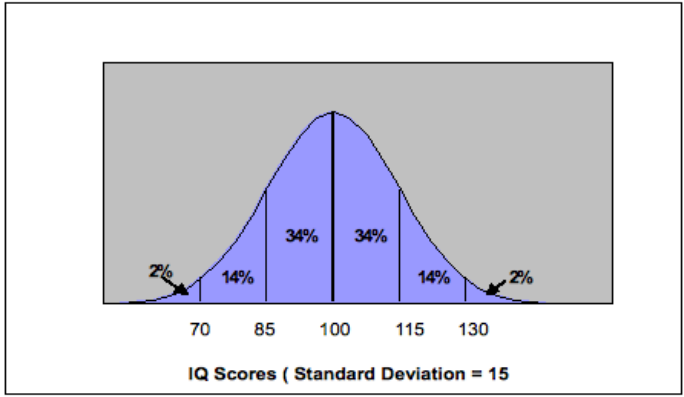

A thumb rule of standard deviation is that generally 68 of the data values will always lie within one standard deviation of the mean 95 within two standard deviations and 99 7. It shows how much variation there is from the average mean. Let us discuss some of the major differences between standard deviation vs mean. Capital income builder standard deviationthe standard deviation is a measure of how spread out the prices or returns of an asset are on average.

A low sd indicates that the data points tend to be close to the mean whereas a high sd indicates that the data are spread out over a large range of values. The measures of central tendency intend to give an idea of the location of the. More about descriptive statistics. Standard deviation measures the dispersion of a dataset relative to its mean.

Since i made so many assumptions and i don t have the data to make more accurate predictions this number is not quite right. On the other hand the standard deviation of the return measures deviations of individual returns from the mean. Consequently if we know the mean and standard deviation of a set of observations we can obtain some useful information by simple arithmetic.