Withholding Income Tax Brazil

It applies to labor income capital income remittances abroad money prizes advertising services provided by legal entities and remuneration for services provided by legal entities.

Withholding income tax brazil. A corporation is resident in brazil if it is incorporated in brazil. Withholding tax unless the rate is reduced under a tax treaty. In the case of income tax it is generally calculated monthly and payments should generally be collected and paid. Corporate income tax irpj is levied on the taxable profits of an entity at a rate of 15.

There are several tax brackets for individuals. Brazil provides double taxation relief through a foreign tax credit system applicable to income tax paid to countries with which brazil has entered into a tax treaty or on a reciprocity basis when the source country also grants a foreign tax credit for taxes paid in brazil on brazilian source income. Brazilian resident companies are taxed on worldwide income. The standard tax rates for business are 1 and 1 5.

Withholding income tax wht at a 15 rate or 25 rate if the beneficiary is located in a tax haven or a country with a privileged tax regime. Offshore income is tax exempt. Irrf short for imposto sobre a renda retido na fonte in portuguese is the brazilian withheld income tax. The withholding tax is a modality of the federal tax over taxable income.

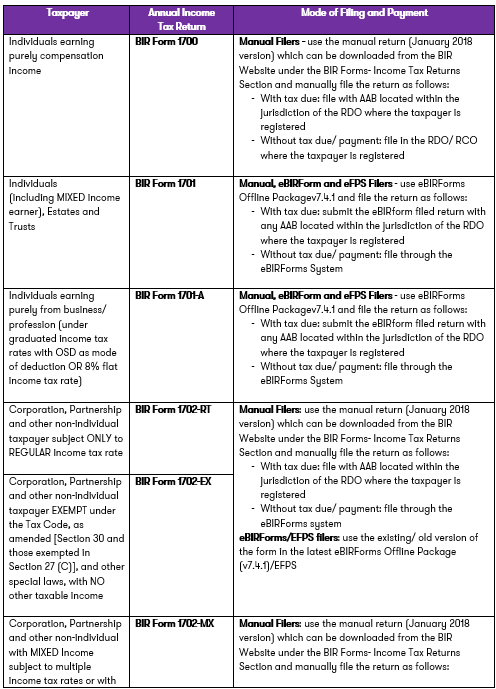

The 25 percent withholding income tax payment is to be effected by the local payer of the income through a voucher darf with the code 0473 income tax on non resident s income. Taxpayers in this condition are considered exempt and are not required to complete and file a brazilian annual tax return. Non resident companies are generally taxed in brazil through a registered subsidiary branch or pe based on income generated locally. Income tax employee discount for the individuals who have a local labor contract in brazil the company is responsible for the calculation and payment of the related income tax withholding which is due on a monthly basis and based on a progressive tax table rates vary from 0 to 27 5 as shown below.

Profits dividends distributed to resident or non resident beneficiaries individuals and or legal entities are generally not subject to irrf brazilian term for withholding income tax please see the income determination section for more information this provision is also applicable to dividends paid to non resident companies located in a tax haven jurisdiction. However as noted below taking. Please note that there are a number of other declarations returns imposed by the rfb for different taxes at federal municipal and state levels which make the tax administration in brazil notably bureaucratic.