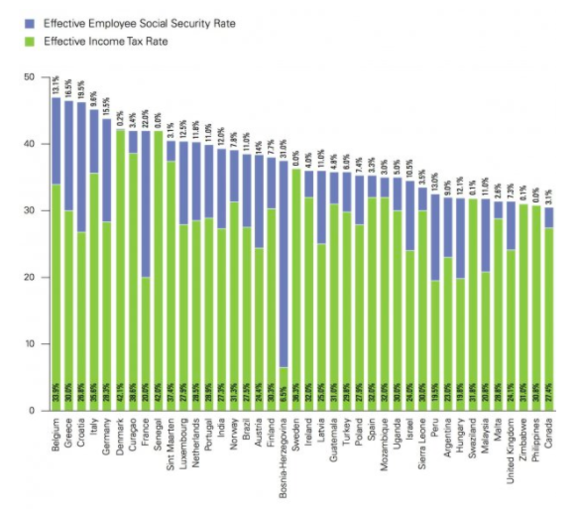

Zimbabwe Income Tax Brackets 2018

Zimbabwe personal income tax nb.

Zimbabwe income tax brackets 2018. Taxation zimbabwe tx zwe f6 june and december 2018 tax rates and allowances the following tax rates and allowances are to be used when answering the questions. Income tax federal and provincial thereon 50 644 52 499 50 368 less. Personal income tax rate in zimbabwe averaged 40 76 percent from 2004 until 2020 reaching an all time high of 51 50 percent in 2015 and a record low of 24 72 percent in 2020. The corporate tax rate in zimbabwe stands at 25 percent.

Zimbabwe individual income tax is imposed at progressive rates up to 35. View notes 2018 tax tables pdf from accountanc ac108 at university of zimbabwe. Corporate tax rate in zimbabwe averaged 27 22 percent from 2006 until 2018 reaching an all time high of 30 90 percent in 2007 and a record low of 25 percent in 2017. Prior to the monetary policy statement of 01 10 18 the imtt was calculated at the rate of us 0 05 for each transaction exceeding us 10.

Imtt has been amended by statutory instrument 205 of 2018 effective from 13 october 2018 and is now calculated at the rate of us 0 02 on every dollar transacted 2. The personal income tax rate in zimbabwe stands at 24 72 percent. Zimbabwe revenue authority pay as you earn paye forex tables for january to december 2018 daily. Non refundable tax credits 8 480 8 579 8 065 total income tax 42 165 43 920 42 303 employee contribution to pension plan 2 356 2 426 2 480 891 914.

The tax brackets below have changed. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 500 000 and higher for single filers and 600 000 and higher for married couples filing jointly. Personal income tax rates these tax brackets only apply to employment income. The 3 aids levy.

This page provides zimbabwe personal income tax rate actual values historical data forecast chart statistics economic calendar and news. Annual taxable income rates of tax usd 0 to 4 200 0 4 201 to 18 000 0 20 for each usd above 4 201 18 001 to 60 000 2 760 25 for. In 2018 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1 and 2. Please click here for updated tax tables.