Zimbabwe Personal Income Tax Rates

The 3 aids levy is also imposed.

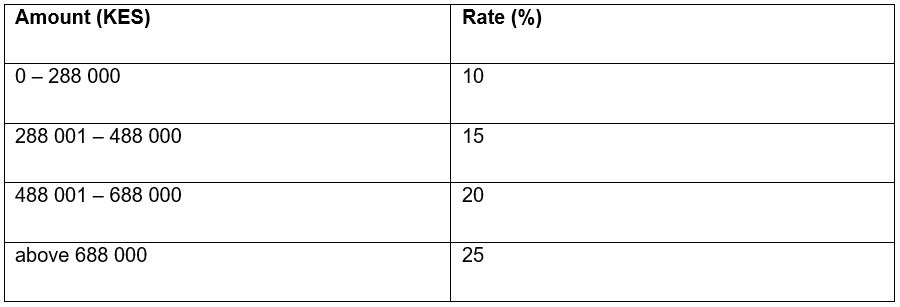

Zimbabwe personal income tax rates. Taxable income r rates of tax r 1 189 880 18 of taxable income 189 881 296 540 34 178 26 of taxable income above 189 880 296 541 410 460 61 910 31 of taxable income above 296 540 410 461 555 600. 2020 tax brackets for taxes due april 15 2021 tax rate single head of household married filing jointly or qualifying widow married filing separately source. Tax rate income of individual from trade and investments 14 2b 24 income of company or trust 14 2c 24 income of pension fund from trade or investment 14 2 d 15 income of licensed investor during first five years of 14 2 e. Income tax rates deduction 0 1 980 00 0 1 981 6 000 00 20 396 6 001 12 000 00 25.

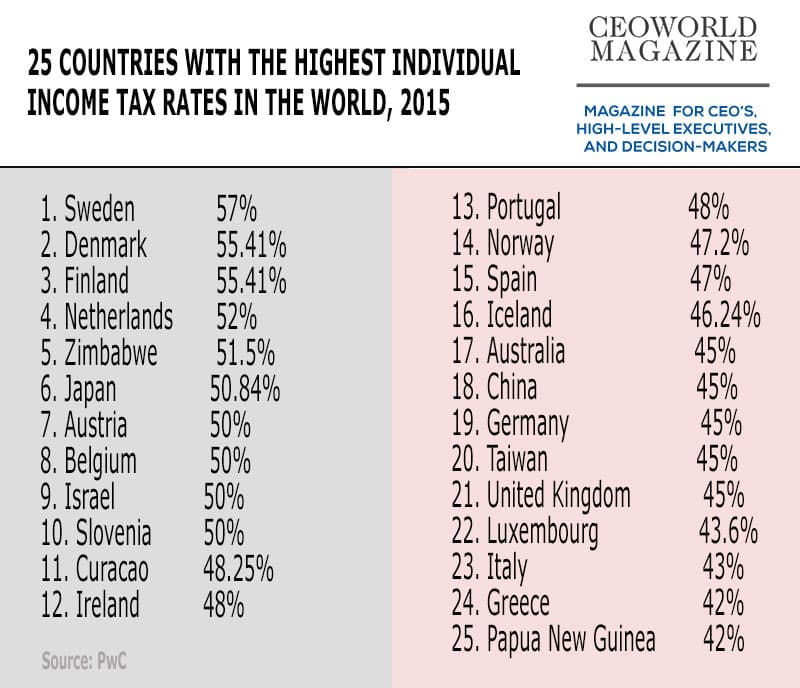

As of 1 january 2020 the corporate income tax cit rate for companies other than mining companies with special mining leases but including branches is reduced to 24 72 previously 25 75. Personal income tax rate in zimbabwe averaged 40 76 percent from 2004 until 2020 reaching an all time high of 51 50 percent in 2015 and a record low of 24. The corporate tax rate in zimbabwe stands at 25 percent. Resident tax rates 2020 21 taxable income tax on this income 0 18 200 nil 18 201 45 000 19 cents for each 1 over 18 200 45 001 120 000 5 092 plus 32 5 cents for each 1 over 45 000 120 001 180 000.

This rate includes a base rate of 24 plus a 3 aids levy. Annual taxable income rates of tax usd 0 to 4 200 0 4 201 to 18 000 0 20 for each usd above 4 201 18 001 to 60 000 2 760 25 for each usd above 18 001 60 001 to 120 000 17 660 30 for each usd above 60 001. Yes investment income is taxable at an effective rate of 25 75 percent being 25 percent plus 3 percent aids levy while capital gains on specified assets are taxable at 20 percent. Zimbabwe presently operates on a source based tax system.

Corporate tax rate in zimbabwe averaged 27 22 percent from 2006 until 2018 reaching an all time high of 30 90 percent in 2007 and a record low of 25 percent in 2017.

.png)