A Gaap Income Statement Combines Which Of The Following Costs

Fixed costs with variable costs.

A gaap income statement combines which of the following costs. Lo2 c 39. A gaap income statement combines which of the following costs. This article has been a guide to income statement examples. The general accepted accounting principles gaap income statement is a financial report prepared in accordance with guidelines set by the financial accounting standards board fasb.

Income statement states the financial health of the organization. Boc hong s in come statement includes all of the major items in the list above except for discontin ued operations. What are income statement accounts. A b and c.

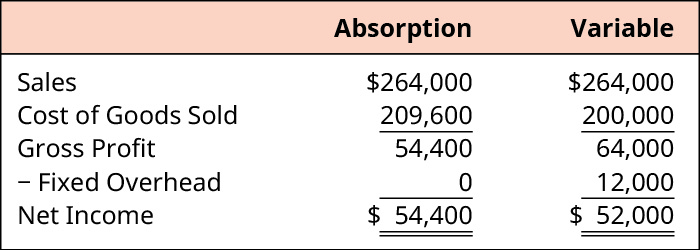

Here we discuss income statement examples using ifrs gaap accounting and also the single step and multi step income statement. Chapter 4 income statement and related information 4 3 illustration illustration 4 2 presents an income statement for boc hong company. The standard requires a complete set of financial statements to comprise a statement of financial position a statement of. Managers can choose the method of accounting for inventory costs fifo lifo that best fits their business needs 2.

Controllable costs with non controllable costs c. Which of the following is not an example of a service firm. Lo2 d 38. Organizations that follow these principles can assure investors of a certain amount of consistency which can make it easier to weigh investment options.

Using a different accounting method leads to reporting a different amount for cost of goods sold. Lo2 e 3 7. Gaap allow either a one statement approach or a two statement approach while ifrs require a two statement approach using the direct method. Gaap allow either a one statement approach or a two statement approach while ifrs require a two statement approach and allow more items to be classified as oci.

These accounts are usually positioned in the general ledger after the accounts used to compile the balance sheet a larger organization may have hundreds or even thousands of income statement accounts in order to track the revenues and. The analysis of the income statement involves comparing the different line items within a statement as well as following trend lines of individual line items over multiple periods. Income statement accounts are those accounts in the general ledger that are used in a firm s profit and loss statement. Ias 1 sets out the overall requirements for financial statements including how they should be structured the minimum requirements for their content and overriding concepts such as going concern the accrual basis of accounting and the current non current distinction.

Product costs and period costs. Gaap and ifrs are the two major financial reporting methods. What distinguishes services firms from other firms. A gaap income statement combines which of the following costs.

A and b only. Selling and administrative costs and period costs. In arriving at net income the statement presents the following subtotals.