Acca Income Statement Format

Sales or revenue section presents sales discounts allowances returns and other related information.

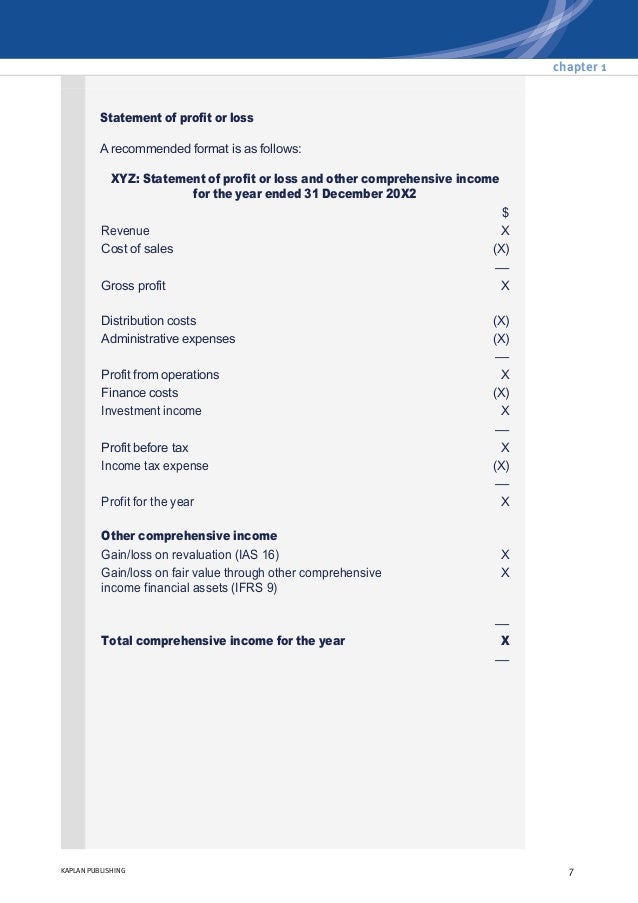

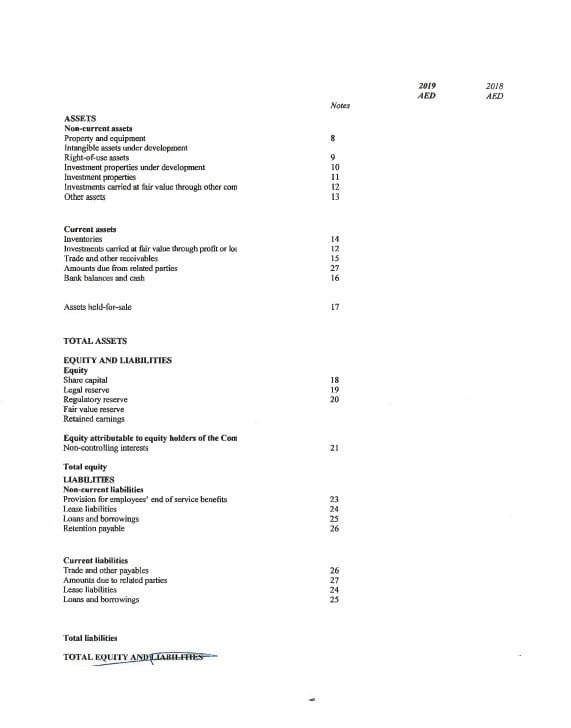

Acca income statement format. Income statement format 1. Acca and subsidiaries restated mar mar marmar mar 2019 2018 20152017 2016 000 000 000 000 000 operating income 206 074 201 176163 952 182 153 175 696 operating deficit surplus 37 087 other gains. Detailed income statements example the xyz company presents its results in two statements by their nature resulting in the following format beginning with the income statement. The format of the income statement is shown below.

Therefore the statement of profit or loss includes all realised gains and losses e g. Its purpose is to arrive at the net amount of sales revenue. Income statement format opentuition acca cima free acca and cima on line courses free acca cima fia notes lectures tests and forums. Cost of goods sold section.

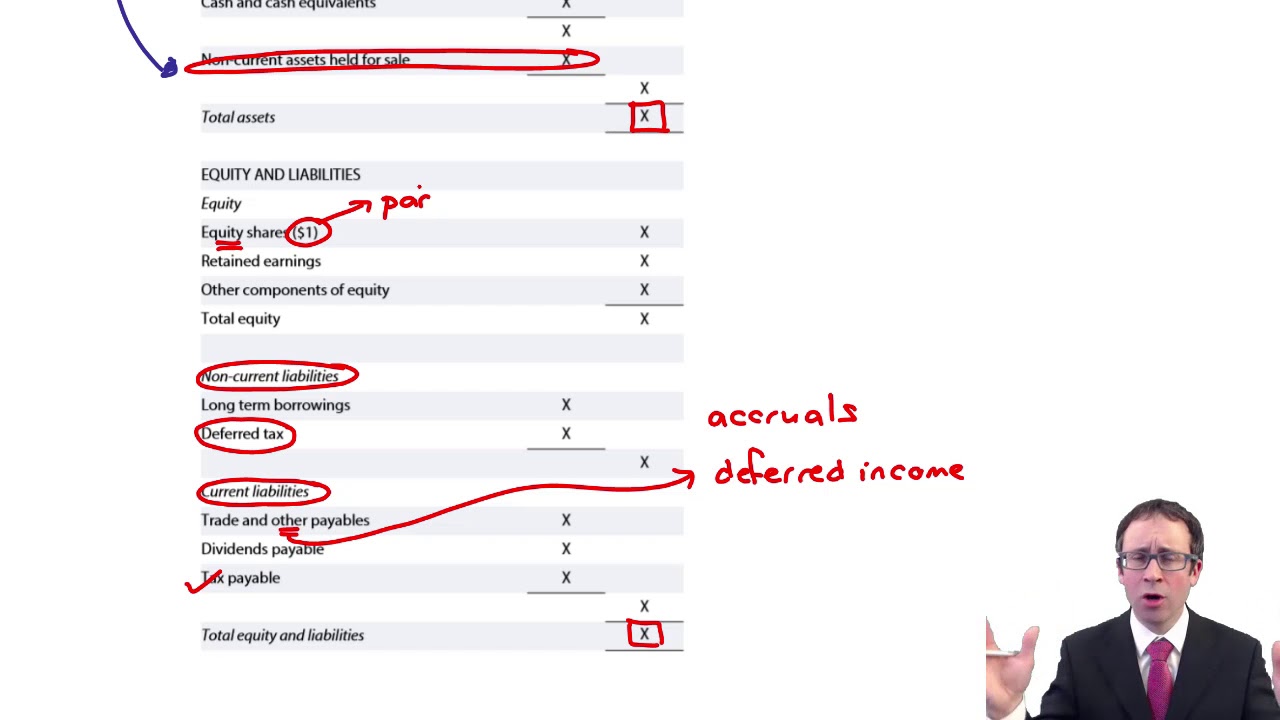

Net profit for the year the statement of comprehensive income would include both the realised and unrealised gains and losses e g. This may be presented in a tabular format as shown in the next section. Preparing partnership financial statements income statement the main part of the income statement is prepared exactly as for a sole trader. Statement of profit or loss and other comprehensive income ias 1 provides the following definitions.

From june 2009 onwards examiners may choose to use a single statement of comprehensive income see table 1. As i explain in the lecture it does not matter if the own decides to call it something else such as salary anything the owner takes is drawings and therefore does not appear in the statement of profit or loss. Income is increases in economic benefits during the period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity other than those relating to contributions from equity participants. Wages and salaries paid to other people are an expense and appear in the statement of profit or loss.

Other comprehensive income oci are incomes and expenses recognized outside of profit or loss as required by particular ifrs standards.