Non Controlling Interest Income Statement Presentation

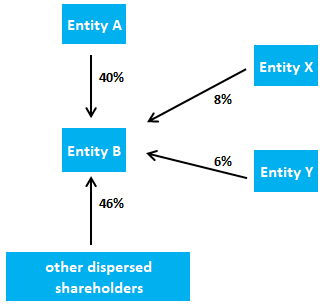

X bought 10 shares of company b.

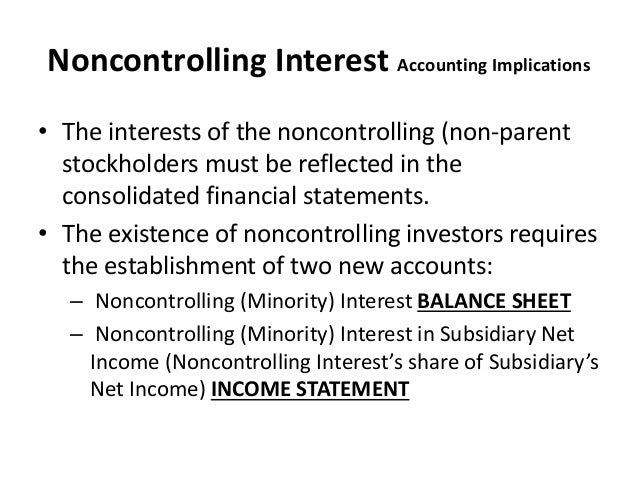

Non controlling interest income statement presentation. Add prorate income attributed to the non controlling equity interest. Total comprehensive income for the period showing separately the total amounts attributable to the parent s owners and to non controlling interest. The consolidated statements should reflect only the parent s dividends. Non controlling interest presents an allocation of net income to the primary shareholders and to the non controlling interest also referred to as minority interest.

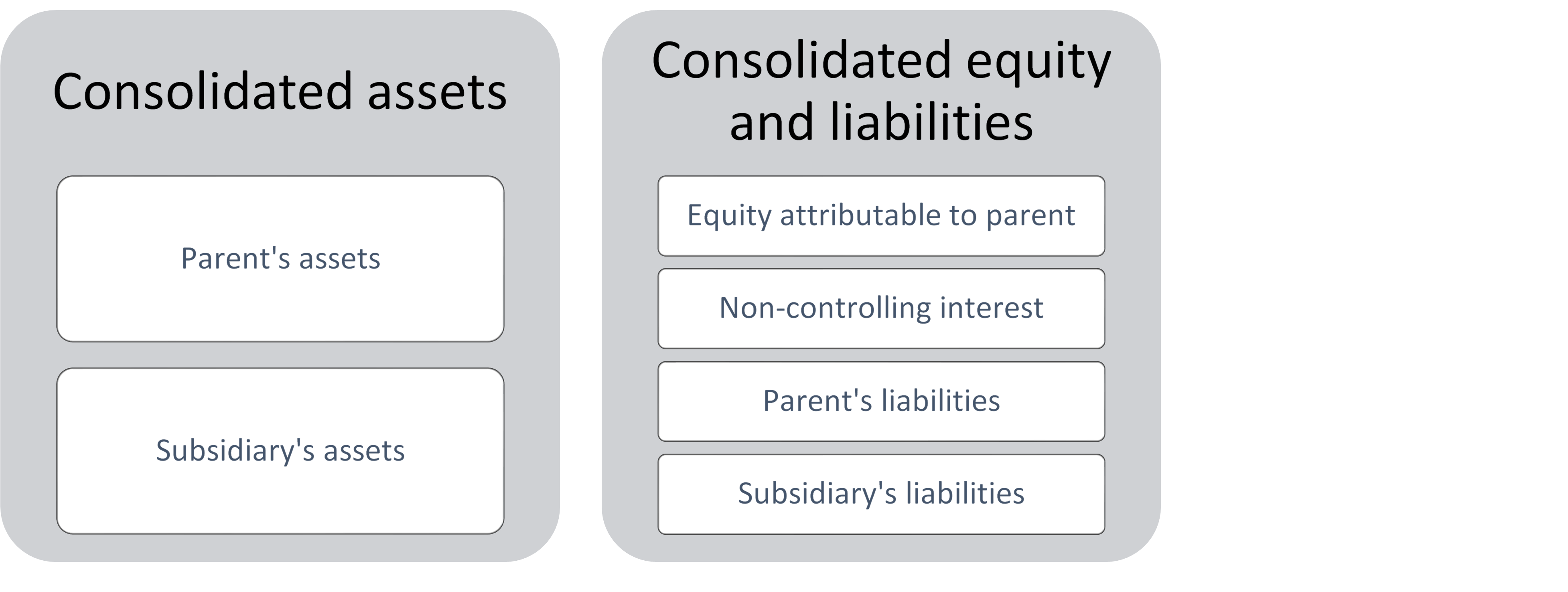

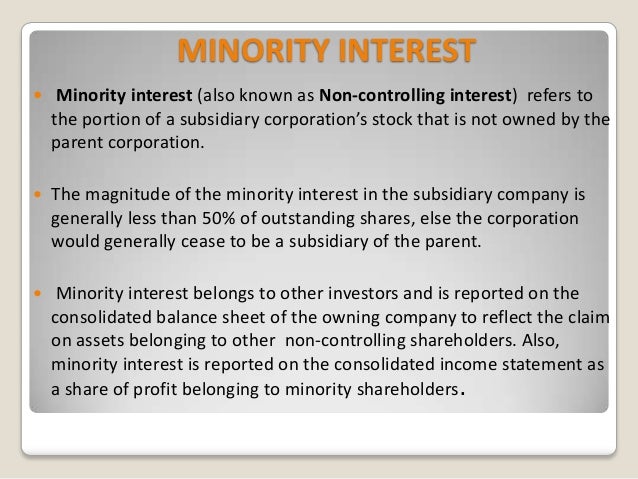

It requires the profit or loss and other comprehensive income for the period to be disclosed in the statement of profit or loss and other comprehensive income showing separately the comprehensive income attributable to non controlling interests and that attributable to. Company a acquires 85 of the 50 000 shares outstanding of company b leaving a non controlling interest of 15. Illustration 4 4 sample supporting schedule. However to keep track of the value owned by the non controlling shareholders the parent company needs to report separate non controlling interest lines on its balance sheet and income statement.

Company b has reserved as on 31 03 2018 aggregating to 550 000. The non controlling interest accounts for their respective ownership amounts. Non controlling interest nci is a component of shareholders equity as reported on a consolidated balance sheet which represents the ownership interest of shareholders other than the parent of the subsidiary non controlling interest is also called minority interest. The income statement therefore shows the recognizing a minority interest in consolidated financial statements.

Presentation of the income statement under u s. Companies owning less than 50 of the subsidiary implement either the cost method 20 or less or the equity method above 20 and below 50. The consolidated income statement shows all the revenues and all the expenses of the less than wholly owned subsidiary but the parent cannot claim all the resulting income. Subtract prorate share of.

Since it is a case of direct non controlling interest mr. Gaap follows either a single step or multiple step format. X would be entitled to 10 of pre existing past profits of company b in addition to the future profits accruing post 01 04 2018. Ias 1 presentation of financial statements confirms these disclosures.

At the time of sale if the company had an income of 5 million then the prorate share of income for non controlling interest will be 20 of 5million 1 million. For each component of equity the effects of retrospective application or retrospective restatement recognised in accordance with ias 8. At the end of the fiscal year company a parent reports revenues of 812 000 and expenses of 354 000 whereas company b subsidiary reports revenues of 250 000 and expenses of 188 000. The entry will be the same under both approaches.