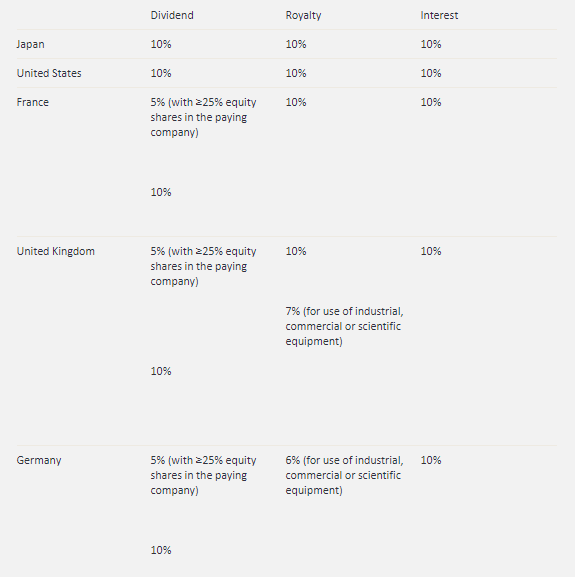

Interest Income Withholding Tax Japan

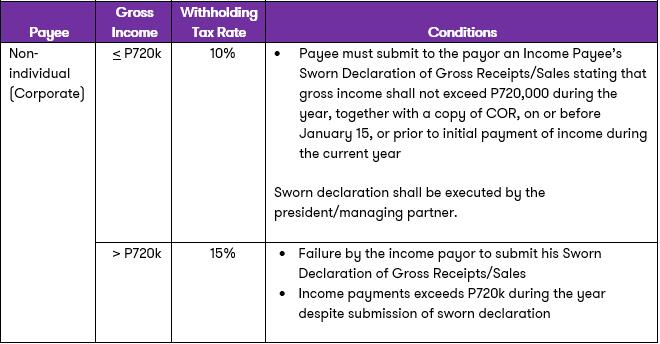

Interest on bank deposits and or certain designated financial instruments is subject to a 15 national wht and 5 local inhabitants wht 20 combined.

Interest income withholding tax japan. The contents reflect the information available up to. 31 2037 in which special income tax for reconstruction is withheld when withholding income tax and is paid with the income tax. Above to a non resident or a foreign corporation or such payments made overseas by payers with a domicile or business office etc. A non resident taxpayer whose employment income has not been subject to a 20 42 percent withholding tax must file a return by the day of their departure from japan or by 15 march of the following year if a tax agent is appointed and pay the 20 42 percent tax.

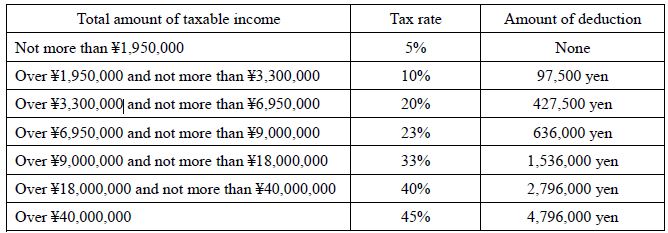

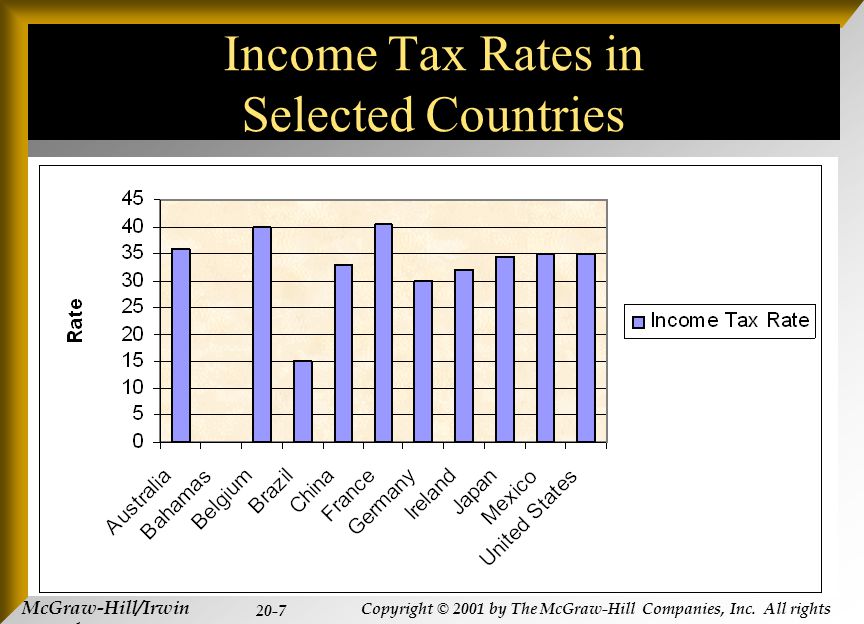

Because their stay is significantly shorter than a regular tax period their income is subject to withholding tax at the source. Taxation of such interest is fully realised by tax withholding so resident individuals are not required to aggregate such interest income with other income. G between january 1 2013 and december. Income tax in japan is based on a self assessment system a person determines the tax amount himself or herself by filing a tax return in combination with a withholding tax system taxes are subtracted from salaries and wages and submitted by the employer.

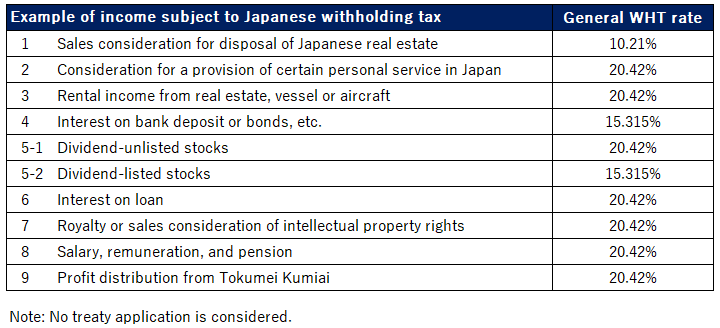

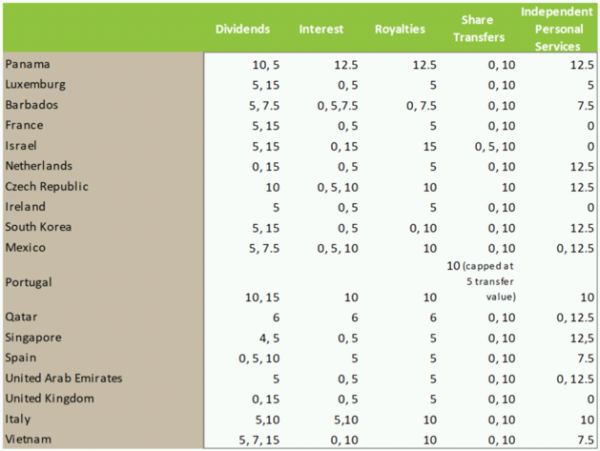

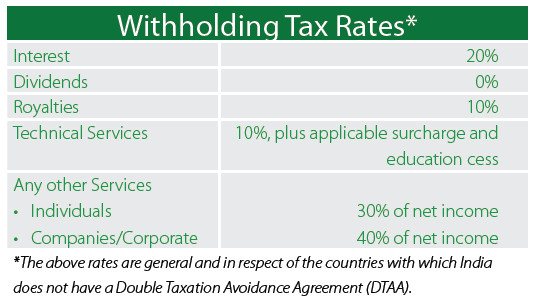

Japan highlights 2020 page 3 of 10 participation exemption there is no participation exemption in respect of capital gains but there is a 95 foreign dividend exemption see above under taxation of dividends. Assuming the non resident does not have a permanent establishment pe in japan a non resident s income from japan source interest dividends rental income and royalties is generally subject to tax at a rate of 20 42 15 315 in the case of interest on bank deposits and or certain designated financial instruments or lower treaty rates. In japan tax should be withheld. With regard to special income tax for reconstruction the withholding tax system has been adopted for the.

Non residents who engage in gainful employment or have earned some form of domestic income during their stay in japan are subject to income tax and special income tax for reconstruction. With regard to non resident. For 2019 application for exemption for spouse of employment income earner pdf 287kb outline of japan s withholding tax system related to salary the 2020 edition outline of japan s withholding tax system related to salary the 2019 edition pdf 271kb for those applying for an exemption for dependents etc. Upon the payments made in japan of the prescribed domestic sourced income described in 3 2 1 2.

Taxation in japan preface this booklet is intended to provide a general overview of the taxation system in japan.