Income Tax Rates Spain 2020

Income tax rates for the year ended 31st december 2020.

Income tax rates spain 2020. This places spain on the 20th place in the international labour organisation statistics for 2012 after united kingdom but before luxembourg. Icalculator es excellent free online calculators for personal and business use. Due to political impasse in spain the 2020 budget was not passed and therefore the 2018 2019 tax rates and allowances continue to be used for 2020. Spain has one of the lowest income taxes in the world charging a maximum income tax of 27 13.

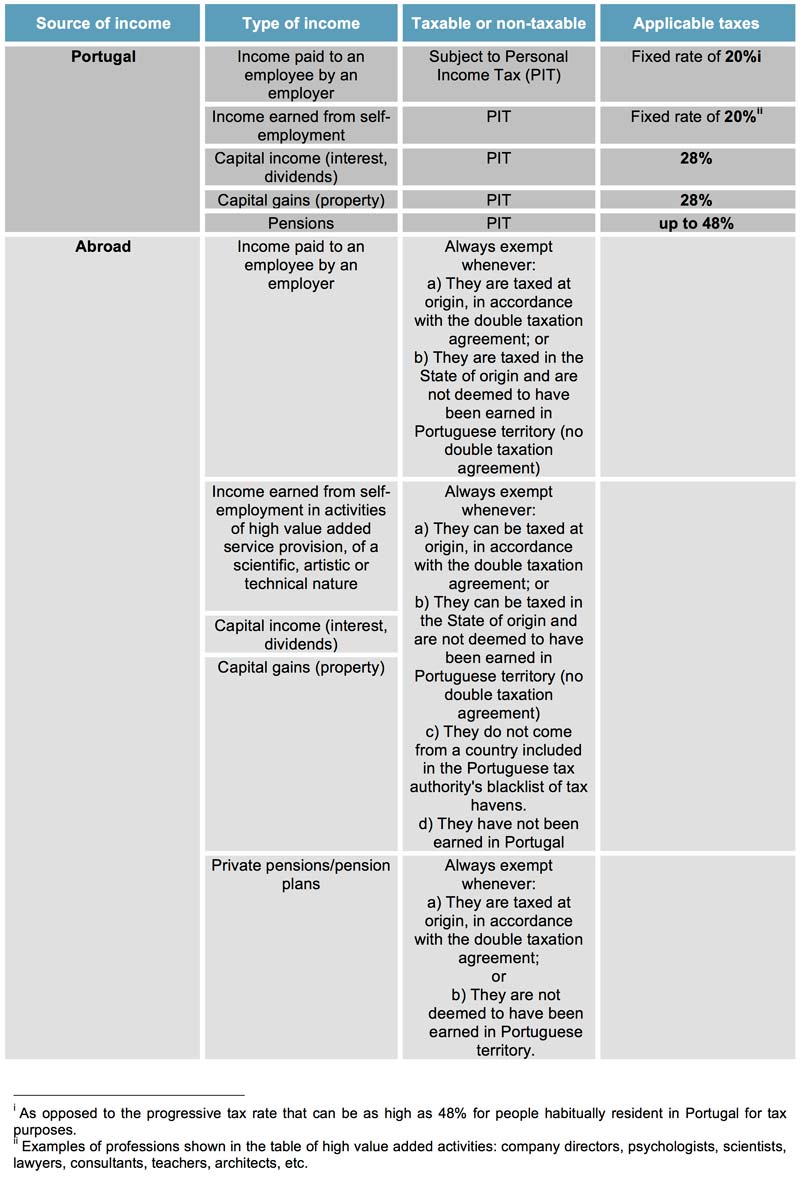

Let s suppose for example that you live in the uk but have a property in spain. Spain s tax rates are in the mid range for european countries. Spanish tax rates 2019. If you reside in spain for 183 or more days in a given year you are considered a tax resident of the country and must declare your worldwide income.

Personal income taxes in spain are known as impuestos sobre la renta de personas físicas or irpf. The income tax operates on income obtained during the whole year by both spanish residents and non residents. In the first case for those who stay in the country for more than 183 days per year. Review the 2020 spain income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other salary taxes in spain.

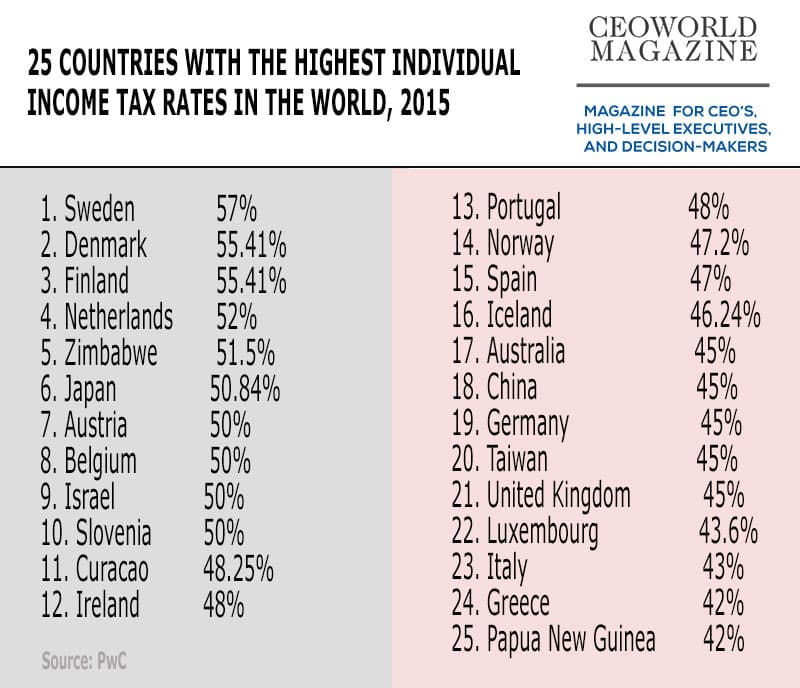

For non residents income obtained without a pe is taxed at the following rates. For residents in other eu member states or european economic area eea countries with which there is an effective exchange of tax information the rate is 19. Spain s tax rates in 2019 are as follows. Taxes in spain for self employed individuals.

Taxation for the self employed in spain during 2020 is mainly composed of 5 different taxes direct and indirect. Non resident income tax nrit rates. Countries with similar tax brackets include canada with a maximum tax bracket of 29 00 mexico with a maximum tax bracket of 30 00 and finland with a maximum tax bracket of 30 00. Personal income tax pit or irpf.

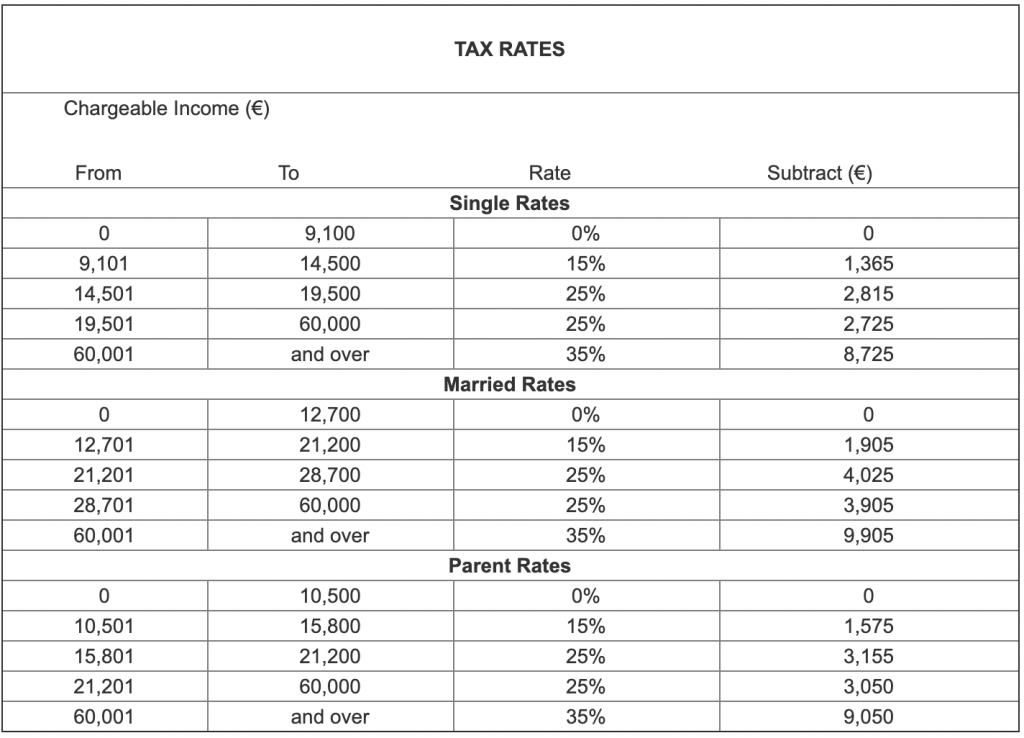

The spanish system for direct taxation of individuals is progressive with higher rates being applied to higher income levels. And with a fixed tax rate of 25 on the gross income not like with the income tax for residents which is progressive as we will see in a moment. In reality your total liable tax will be a calculation of the state s general tax rates plus the relevant regional tax rates. Although tax rates in spain are not uniform across the country for simplicity purposes below are the basic spanish tax rates on employment income.

The average monthly net salary in spain es is around 1 390 eur with a minimum income of 764 eur per month.