Income Tax Rates Quebec 2019

Canadian provincial corporate tax rates for active business income.

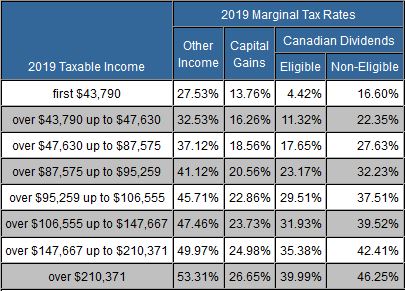

Income tax rates quebec 2019. For eligible dividends table takes into account the gross up of 38 the federal tax credit of 15 and the provincial tax credit of 11 78. Easy income tax calculator for an accurate quebec tax return estimate. Tax table 2019. For non eligible dividends table takes into account the gross up of 15 the federal tax credit of 9 03 and the provincial tax credit of 5 55.

The quebec basic personal amount has also been increased to 15 269 for 2019. There are 4 tax brackets in quebec and 4 corresponding tax rates. 2020 includes all rate changes announced up to july 31 2020. 2019 personal income tax rates québec marginal rate taxable.

To find the quebec provincial tax rates go to income tax return schedules and guide revenu québec web site. Taxable income tax effective rate marginal rate. Federal quebec total federal quebec total 10 000 11 000 12 000. The tax rates reflect budget proposals and news releases to 15 june 2019.

Income tax rates for 2019 the income tax rates for the 2019 taxation year determined on the basis of your taxable income are as follows. You will find the provincial or territorial tax rates on form 428 for the respective province or territory all except quebec. The chart below shows quebec s tax rates for 2019. For 2019 and later tax years you can find the federal tax rates on the income tax and benefit return.

Quebec federal tax3 taxable income2 excess rate on provincial tax taxable income2 taxable income2 combined tax rates on dividend income 20191 1. Canadian corporate tax rates for active business income. More than 43 790 but not more than 87 575. Your 2019 quebec income tax refund could be even bigger this year.

Where the tax is determined under the minimum tax provisions the above table is not applicable. The lowest rate is 15 00 and the highest rate is 25 75. 2019 includes all rate changes announced up to june 15 2019. More than 87 575 but not more than 106 555.

Enter your annual income taxes paid rrsp contribution into our calculator to estimate your return. This document is up to date as of august 1 2019 and reflects the status of legislation including proposed amendments at this date. 2020 includes all rate changes announced up to july 31 2020. 25 75 these amounts are adjusted for inflation and other factors in each tax year.