Income Tax Brackets 2020 Scotland

Here s what you need to know about the 2020 21 income tax rates and a rundown of how new budget measures will affect your.

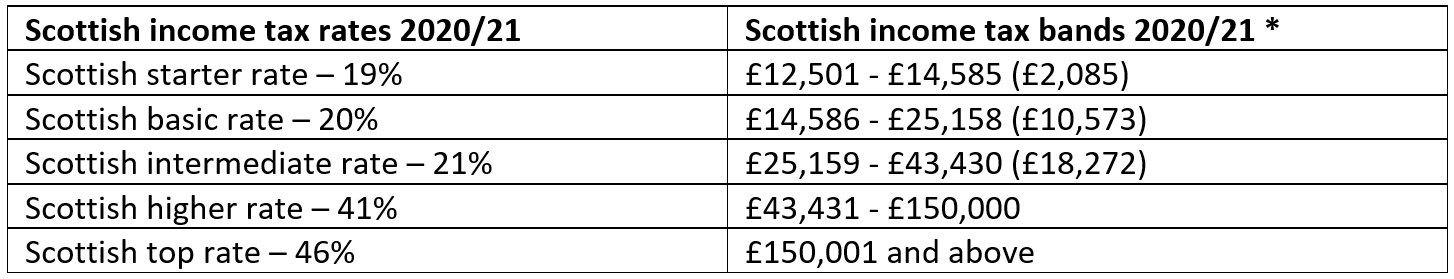

Income tax brackets 2020 scotland. The scottish government has announced in its draft budget that income tax rates north of the border will not change in 2020 21. Tax rates and allowances 2020 income tax rates scotland 2020 21 2019 20 scottish resident taxpayers are liable on non savings and non dividend income as set out below. This tool allows you to calculate income tax for various salary points under the new scottish tax regime for 2020 21. Scotland act 2016 provides the scottish parliament with the power to set all income tax rates and bands except the personal allowance which remains reserved that will apply to scottish taxpayers non savings non dividend nsnd income for tax year 2019 to 2020.

You do not get a personal allowance if you earn over 125 000. The new tax year in the uk starts on 6 april 2020. The scotland act 2016 provides the scottish parliament with the power to set all income tax rates and bands that will apply to scottish taxpayers non savings non dividend nsnd income for the tax year 2020 to 2021. The tax tables below include the tax rates thresholds and allowances included in the scotland salary calculator 2020 which is designed for salary.

England wales ni income tax rates if your main residence is out with scotland. 2019 to 2020 tax year you pay a different rate of tax for income from the tax year 6 april 2019 to 5 april 2020. The table shows the rates you pay in each band if you have the standard personal allowance of 12 500 effective from 6 april 2020. Unusually the budget.

Savings income and dividend income are taxed using uk tax rates and bands. And while the income tax brackets and personal tax allowance won t be changing in 2020 21 chancellor rishi sunak s highly anticipated budget speech on 11 march had good news for both the employed and self employed. Updated with the budget bill as passed in march 2020. Employers will continue to use these rates for paye calculations until 10 may 2020.