Michigan Income Tax Withholding Tables 2020

For recipients born during the period 1946 and 1952 the pension withholding tables incorporate the deductions of.

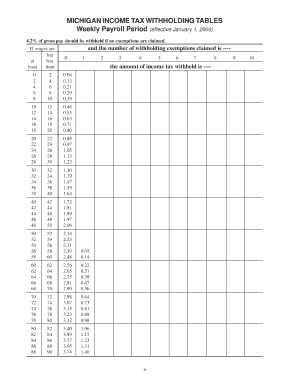

Michigan income tax withholding tables 2020. The personal exemption amount will be 4 750. Payroll management guide at 6686 in a future release. Withholding tax frequently asked questions faq city tax forms for michigan cities that impose an income tax disclosure of tax information confidentiality of tax information taxpayer bill of rights administrative rules. Michigan has issued the 2020 withholding rate and wage bracket tables for wages paid on and after january 1 2020.

Before the official 2020 michigan income tax rates are released provisional 2020 tax rates are based on michigan s 2019 income tax brackets. These numbers are subject to change if new michigan tax tables are released. Extensions offered for filing deadlines are not applicable to accelerated withholding tax payments. Covid 19 updates for withholding tax.

The 2020 state personal income tax brackets are updated from the michigan and tax foundation data. Pension administrators should follow the directions from recipients on any mi w 4p received. Michigan tax forms are sourced from the michigan income tax forms page and are updated on a yearly basis. 11 15 2019 11 44 14 am.

2020 michigan tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Taxpayer rights and responsibilities brochure. Subtract the nontaxable biweekly thrift savings plan contribution from the gross biweekly wages. Withholding formula michigan effective 2020.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. The tables will be reproduced in the. 446 t 2020 michigan income tax withholding tables created date. Before the official 2020 michigan income tax brackets are released the brackets used on this page are an estimate based on the previous year s brackets.

Michigan income tax withholding tables form 446 t to calculate the appropriate withholding. Withholding tables for pension and retirement payments from a government entity exempt from social security paid to recipient born after 1952 upon reaching age 62 5080 2020 sales use and withholding taxes monthly quarterly return. Taxes site withholding tax. State of michigan 2020 withholding tax return february and march monthly periods and first quarter return period filing deadline is may 20 2020.