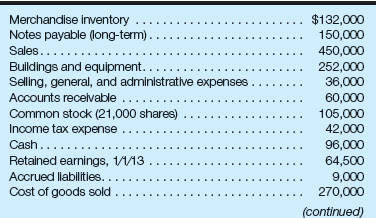

Your Firm Has The Following Income Statement Items Sales Of

Calculate the firm s gross profit margin.

Your firm has the following income statement items sales of. Operating expenses of 9 000 000. Cost of goods sold of 36 000 000. Sales of 52 000 000 income tax of 1 880 000 operating expenses of 9 000 000 cost of goods sold of 36 000 000 depreciation and amortization of 1 500 000 and interest expense of 800 000. Assuming there are no other items to be considered and that the income taxes are 35 of net income before taxes what is the operating income of this firm.

What is the amount of the firm s income before tax. And interest expense of 750 000. Cost of goods sold of 13 000. Sales of 52 000 000.

Income tax of 1 744 000. 5 000 10 000 9 750 15 000 sales revenue 100 000 00 income taxes 35 cost of sales 60 000 00 administrative expenses 10 000 00 rental expenses 20 000 00 operating income 10 000 00 4. Operating expenses of 10 115 000. Cost of goods sold of 35 025 000.

Cost of goods sold of 35 025 000. Your firm has the following income statement items. Income tax of 1 744 000. And interest expense of 800 000.

Your firm has the following income statement items. And interest expense of 2 000. Compute the firm s gross profit margin. Your firm has the following income statement items.

4 360 000 750 000 10 865 000 25 115 000. Income tax of 1 744 000. Your firm has the following income statement items. What is the amount of the firm s income before tax.

Cost of goods sold of 36 000 000. Income tax of 1 880 000. Operating expenses of 10 115 000. Income tax of 2 500.

Income tax of 1 744 000. Your firm has the following income statement items. Your firm has the following income statement items. Operating expenses of 9 000 000.

Your firm has the following income statement items sales of 0 250 000 income tas of s1 744 000 operating espenses of s10 115 000 cost of goods sold of 35 025 000 and interest expense of 750 000 what is the amount of the firm s eb117 2. For purposes of determining free cash flow what is the amount of the firm s after tax cash flow. What is the amount of the firm s ebit. And interest expense of 800 000.

Find an answer to your question a firm reports the following income statement items for fy2019. Operating expenses of 10 115 000. And interest expense of 750 000.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)