Maximum Income While On Social Security 2018

This would provide an income of 33 456 which is below what the average american retiree is spending.

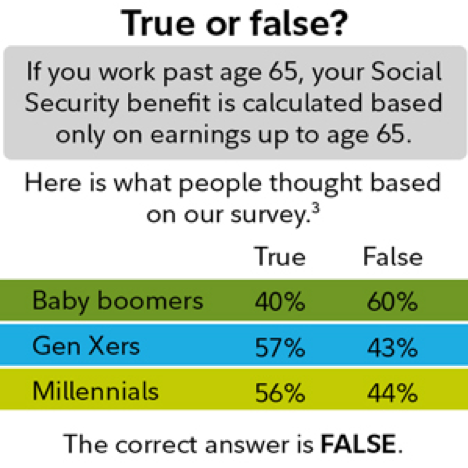

Maximum income while on social security 2018. The reason this cap exists is because a. If you will reach full retirement age during that same year it will be reduced every month until you reach full. Here are the 2017 and 2018 social security earnings test limits the earnings test determines if you can work and collect a social security retirement benefit at the same time. If you take social security benefits before you reach your full retirement age and you earn an annual income in excess of the annual earnings limit for that year your monthly social security benefit will be reduced for the remainder of the year in which you exceed the limit.

If you re not going to reach your full retirement age at any point during 2018 then the number you need to remember is 17 040. For instance if you turn 62 in november then social security will look at your earnings in the last two months of the year and compare them against the pro rated amount of 1 420 per month. For 2018 there are two separate earnings tests to be aware of. 28 240 total wages the social security income limit of 18 240 10 000 income in excess of limit because this is a full calendar year during which rosie is receiving benefits but is not yet full retirement age the benefits reduction amount is 1 reduction for every 2 in excess wages.

For 2017 that limit is 16 920 for 2018 it will be 17 040 after full retirement age no matter how much you continue to earn your benefits are not reduced by your earnings. If you ll be younger than full retirement age throughout 2018 then the social security income limit is 17 040. The maximum benefit that s available to retirees from social security in 2018 is just 2 788.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)