Income Tax Deferred Definition

When the amount is less than the estimated tax an entry is placed on the balance sheet in the form of a liability.

Income tax deferred definition. Deferred income tax definition. Common examples of tax deferred income fall into two broad categories. The first is income in certain retirement accounts. For this reason the.

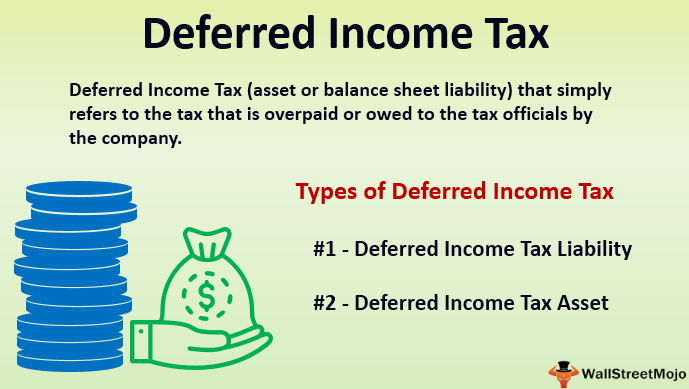

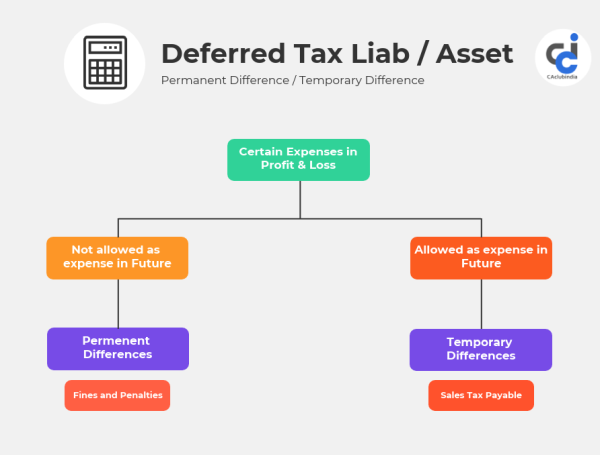

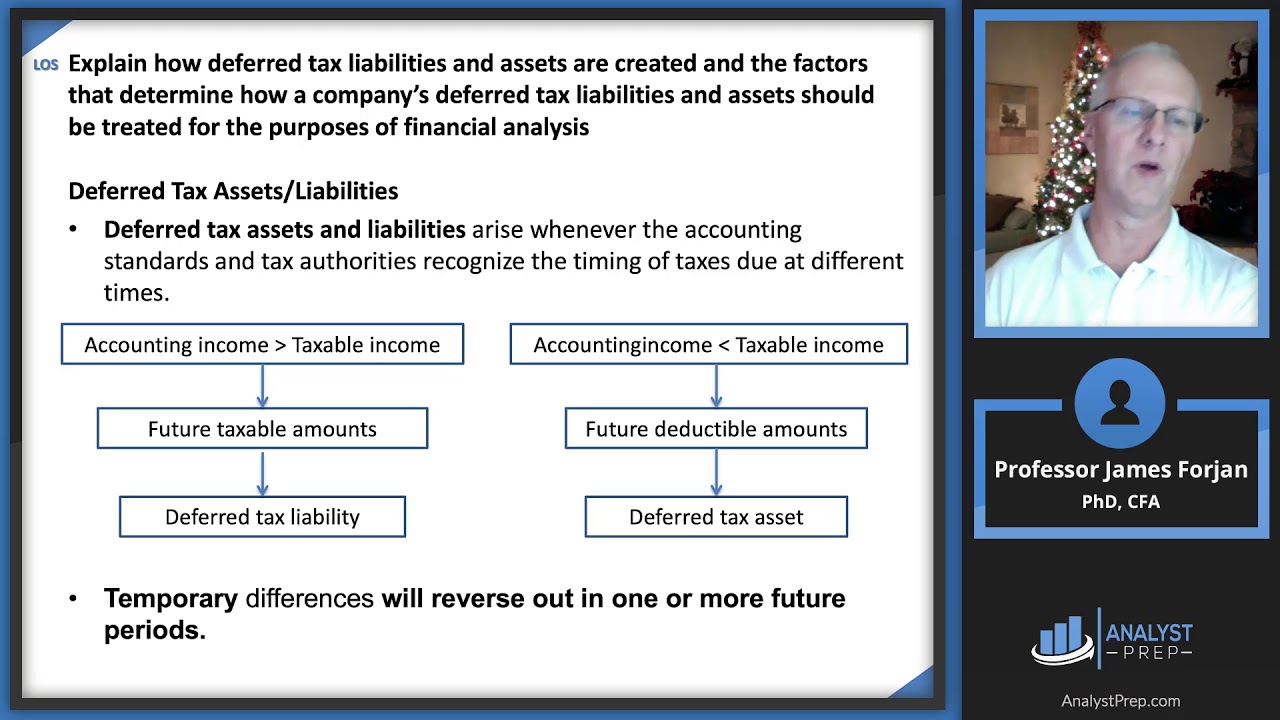

A deferred tax liability records the fact the company will in the future pay more income tax because of a transaction that took place during the current period such as an installment sale. The account holder is not liable for taxes until funds are disbursed. A deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company s accounting methods. The possibility of deferred income tax is a reason why investors and prospective investors should examine a company s balance sheet in conjunction with its income statement to determine if there is a remaining taxable portion of income for a given period.

Companies employ a third party. Any income that one earns but does not receive until a later date resulting in a situation in which taxes on the income are not paid until later. Definition of deferred income tax. A deferred tax liability occurs when a business has a certain amount of income for an accounting period and that amount is different from the taxable amount on their tax return.

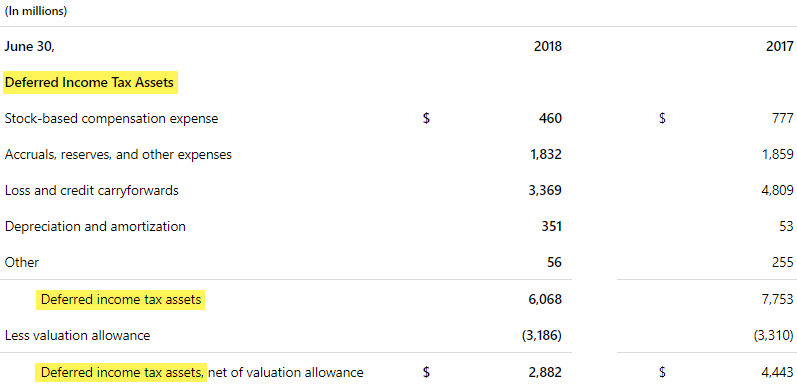

A deferred tax asset is an item on the balance sheet that results from overpayment or advance payment of taxes. The second is the capital gain on some bonds such as u s. Deferred tax is a notional asset or liability to reflect corporate income taxation on a basis that is the same or more similar to recognition of profits than the taxation treatment. A 401 k plan is a tax qualified defined contribution account offered by employers to help grow employees retirement savings.

It is the opposite of a deferred tax liability which represents income taxes owed. Deferred income tax are the taxes applicable on the taxable income of the entity which is payable in the future years as they are not due for payment in the current financial year which arises because of the difference in the tax amount reported in the accounting framework opted by the company and the tax amount reported in the taxation regime of the local.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/income-tax-4097292_19201-3af2a17857e34c5fb24b9986fa3d1991.jpg)