Income Tax Rate Zug Switzerland

Personal income tax rates direct federal tax on income for 2019.

Income tax rate zug switzerland. The higher the income the higher the applicable tax rate. Tax wise zug belongs to the most attractive cantons in switzerland. The income tax rates for individuals in switzerland are progressive. Your average tax rate is 27 65 and your marginal tax rate is 27 71 this marginal tax rate means that your immediate additional income will be taxed at this rate.

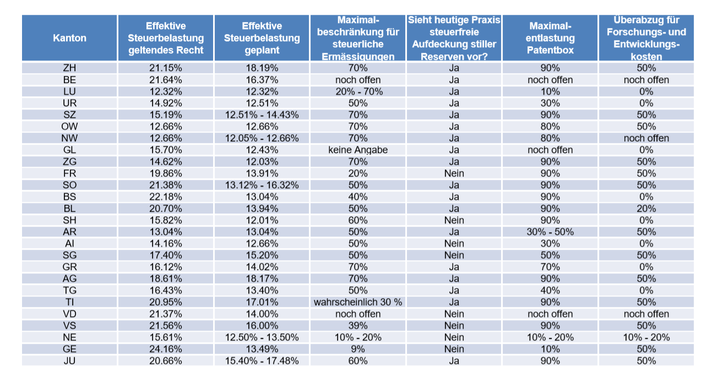

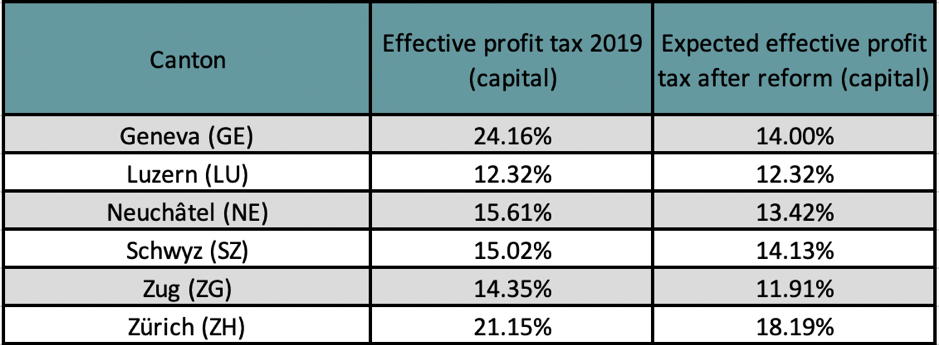

The tax rates between cantons vary and the only tax for which the same rate is charged throughout the country is the state tax. Furthermore dividend income from substantial participations may be taxed at a lower tax rate based on domestic federal and cantonal law. Based on applicable double taxation treaties dtts the actual taxable income in switzerland may differ from the tax rate determining income. If you make chf 2 876 400 a year living in the region of zug switzerland you will be taxed chf 795 388 that means that your net pay will be chf 2 081 012 per year or chf 173 418 per month.