Realized Gains And Losses On Income Statement

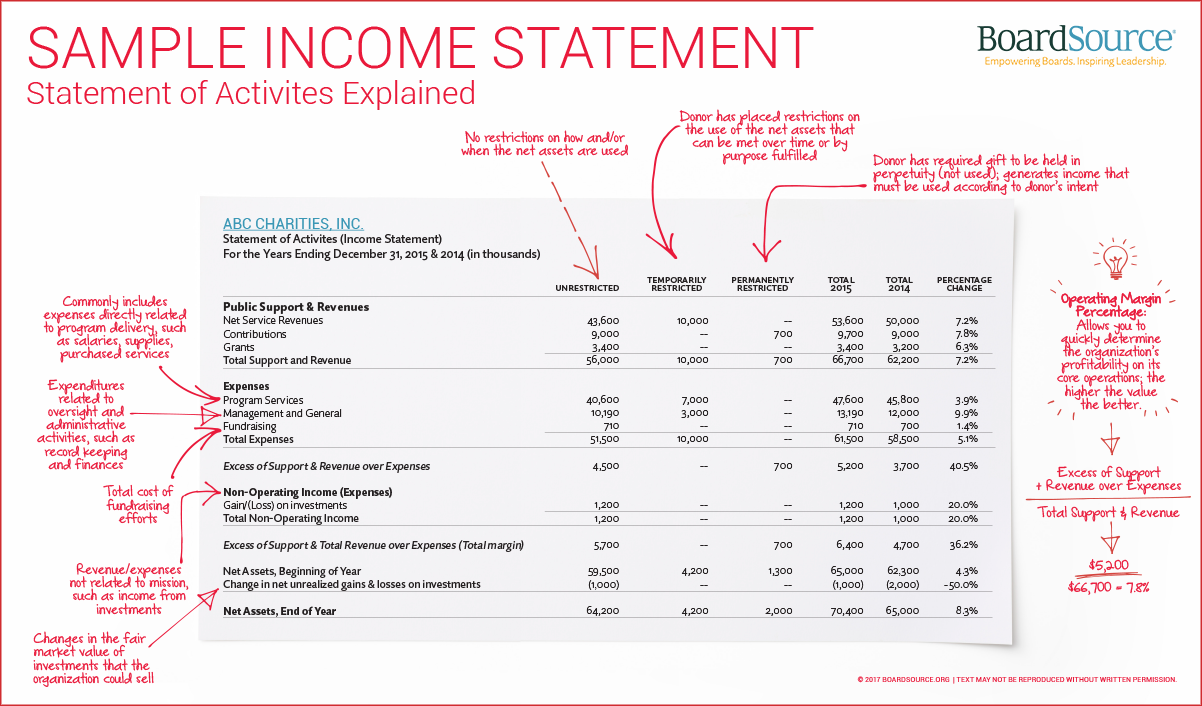

The first section presents the ordinary continuing sales income and expense operations of the business for the year.

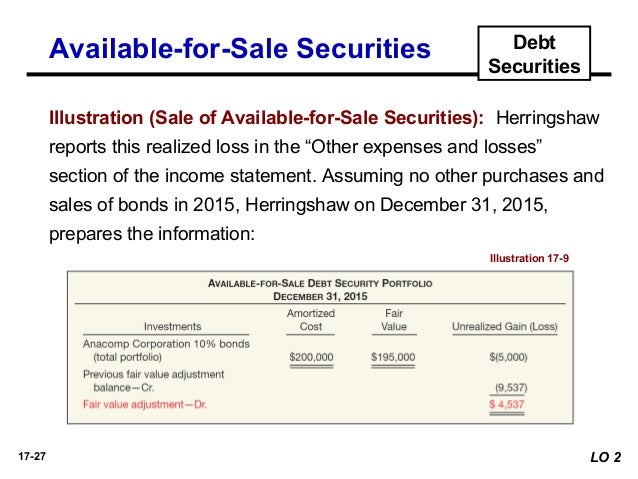

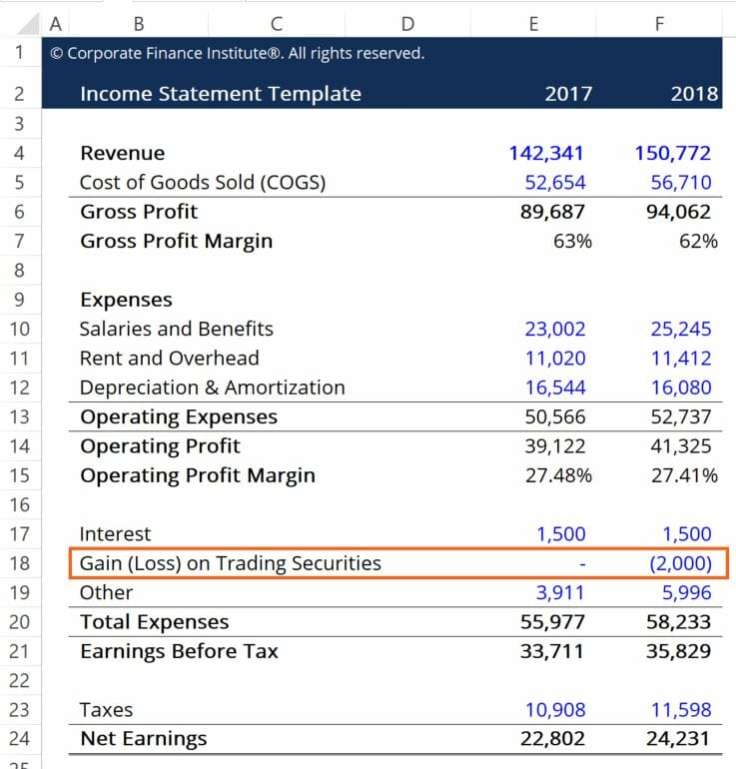

Realized gains and losses on income statement. These represent gains and losses. Unrealized gains or unrealized losses are recognized on the pnl statement and impact the net income of the company although these securities have not been sold to realize the profits. In these situations the income statement is divided into two sections. These represent gains and losses from transactions both completed and recognized.

The personal retirement account page 19 is a traditional ira and is a tax deferred account. If you sell an asset at a loss stock a car a building a subsidiary you report it as a realized loss on the income statement. Realized gains are listed on the income statement while unrealized gains are listed under an equity account known as accumulated other comprehensive income which records unrealized gains and losses. Most companies report such items as revenues gains expenses and losses on their income statements though some of the terms will sound.

Suppose you have a delivery truck with a book value of 10 000. Furthermore if your realized losses exceed your realized gains for a given tax year then you can deduct up to 3 000 of the remaining losses from your taxable income. Doe of this sample statement. There is no impact of such gains on the cash flow statement.

Record realized income or losses on the income statement. This sample includes three different accounts. Realized year to date gains losses and portfolio income. This account may be added to the end of the income statement which results in comprehensive income but is clearly marked as.

Unrealized income or losses are recorded in an account called accumulated other comprehensive income which is found in the owner s equity section of the balance sheet. Thus its investment gains and losses won t impact the account holder s income tax picture for 2016. The gains increase the net income and thus the increase in earnings per share and retained earnings. Gains losses vs.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)