Income Tax Rate Table 2020 Philippines

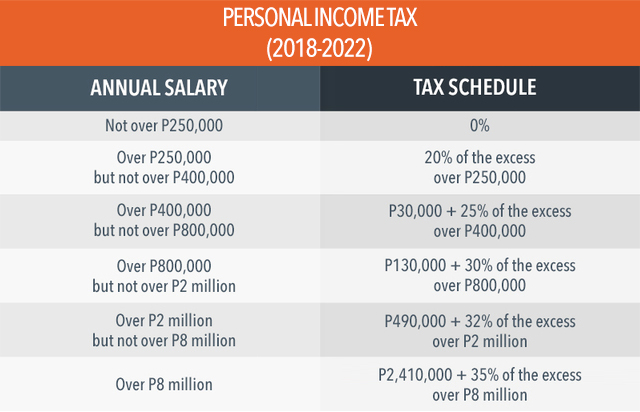

Graduated income tax rates until december 31 2022.

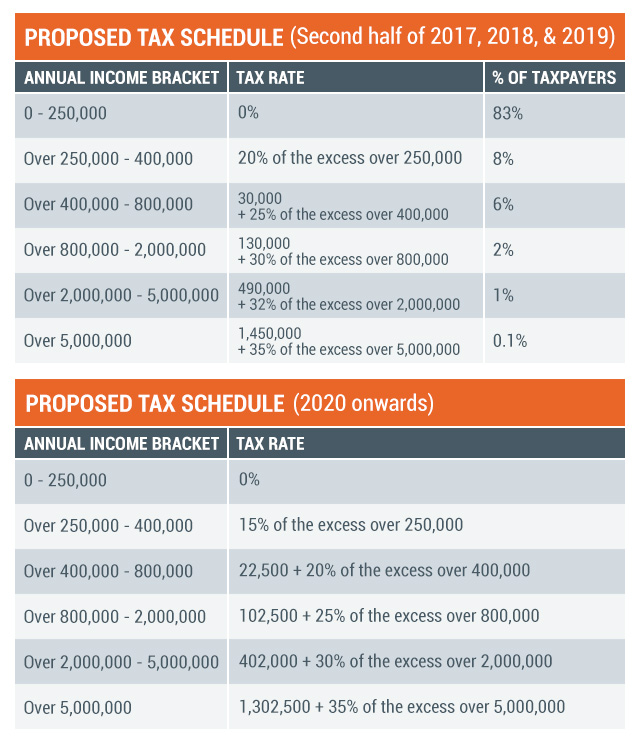

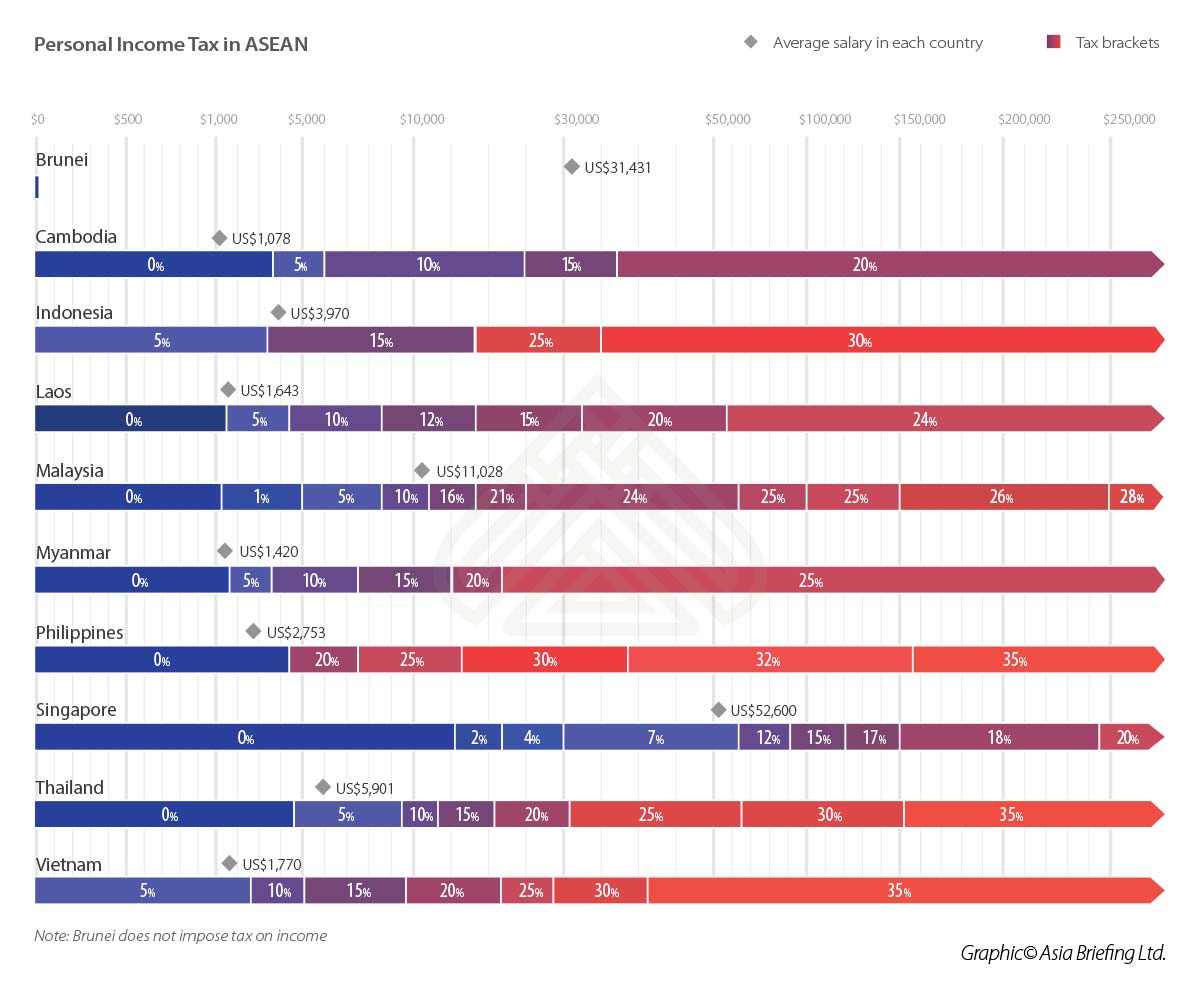

Income tax rate table 2020 philippines. This page provides philippines personal income tax rate actual values historical data forecast chart statistics economic calendar and news. The results will be displayed below it. Figures shown by the calculator are based on the tax reform s tax schedule for 2017 2018 and 2019 including deductible exemptions and contributions. Bir income tax table.

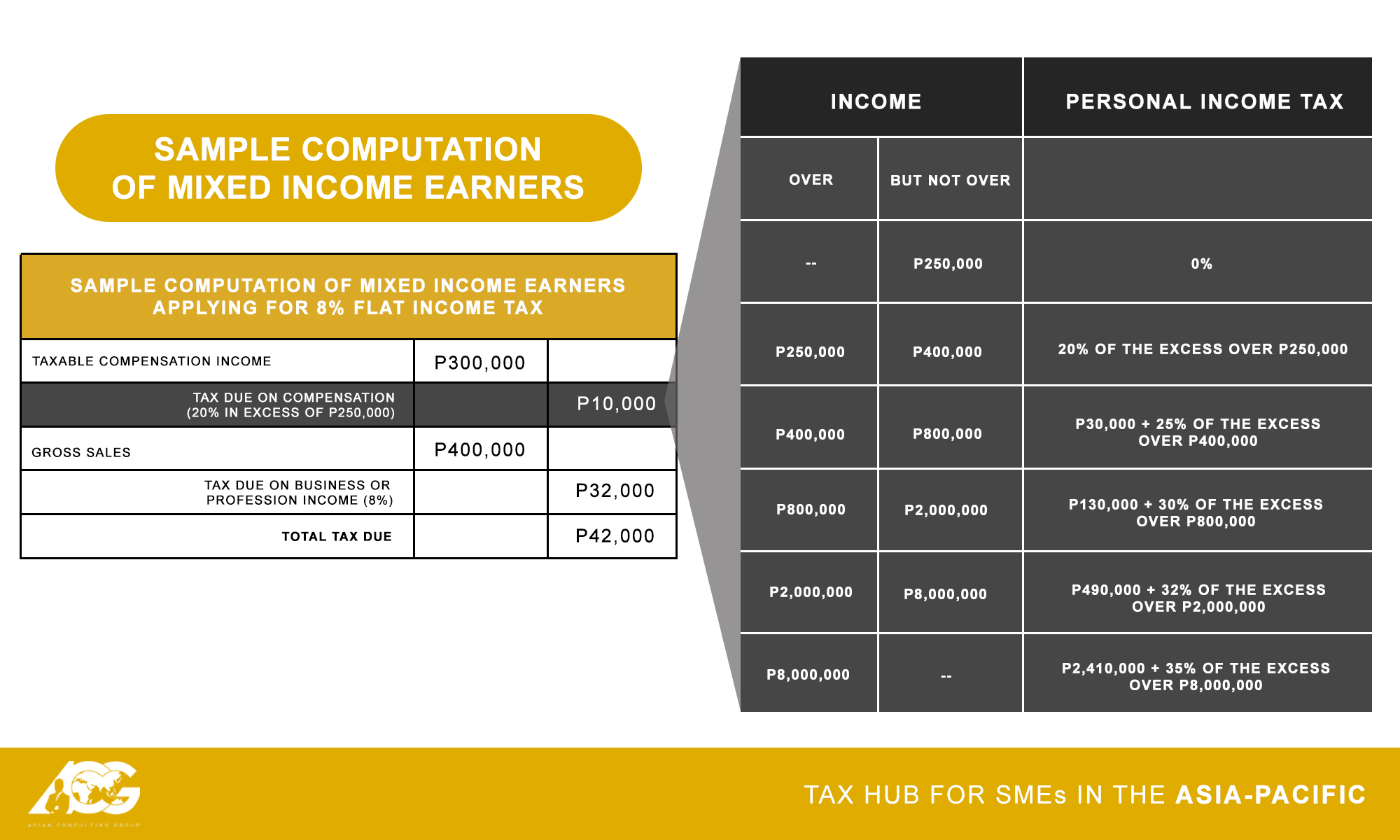

Those earning an annual salary of p250 000 or below will no longer pay income tax zero income tax. Income tax rates in the philippines. How to use bir tax calculator 2020. For resident and non resident aliens engaged in trade or business in the philippines the maximum rate on income subject to final tax usually passive investment income is 20.

How to compute your income tax based on graduated rates. Those earning between p250 000 and p400 000 per year will be charged an income tax rate of 20 on the excess over p250 000. In the approved tax reform bill under train from the initial implementation in the year 2018 until the year 2022. This tax calculator will provide a simplified computation of your monthly tax obligation under the new tax reform.

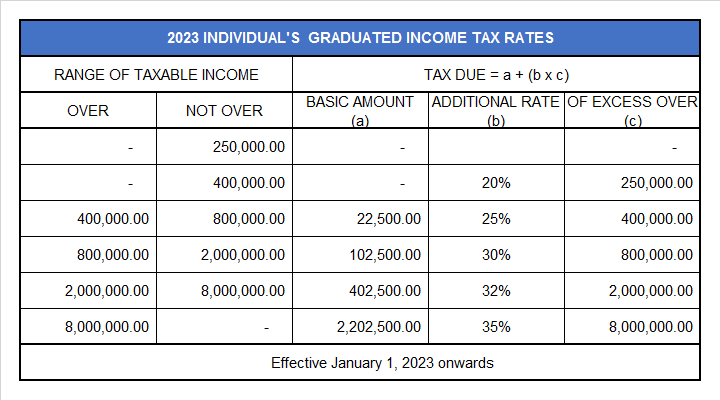

Tax rates for income subject to final tax. The tax caculator philipines 2020 is using the lastest bir income tax table as well as sss philhealth and pag ibig monthy contribution tables for the computation. For non resident aliens not engaged in trade or business in the philippines the rate is a flat 25. Graduated income tax rates for january 1 2023 and onwards.

The personal income tax rate in philippines stands at 35 percent. Click on calculate button. Please enter your total monthly salary.