Income Tax Brackets 2020 Bc

In 2020 is 5 06 and it applies to income up to 41 725.

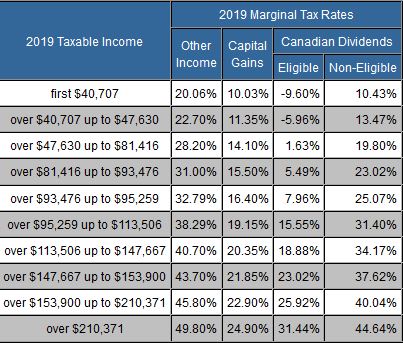

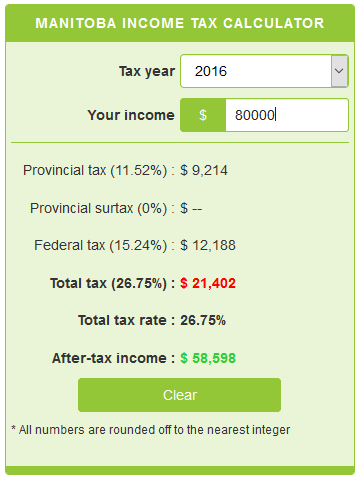

Income tax brackets 2020 bc. The personal income tax brackets and tax rates in british columbia are average compared to more heavily taxed provinces like manitoba and quebec. You pay the higher tax rate on each additional dollar of income. Tax rates are applied on a cumulative basis. The highest combined bc tax bracket is 53 50 on every dollar you make over 220 000.

British columbia tax rates current marginal tax rates bc personal income tax rates bc 2021 and 2020 personal marginal income tax rates bc income tax act s. It is set up as a progressive tax system similar to other jurisdictions in canada and you pay more in taxes as your taxable income increases. The lowest tax rate in b c. The federal tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of 1 010.

Bc tax brackets are added to federal tax brackets to determine the total amount of income tax you pay. For example if your taxable income is more than 41 725 the first 41 725 of taxable income is taxed at 5 06 the next 41 726 of taxable income is taxed at 7 70 the next 12 361 of taxable income is taxed at 10 5 the next 20 532 of taxable income is.