Zimbabwe Income Tax Law

Income tax law the administration of income tax is governed by the income tax act of zimbabwe chapter 23 06 which guides on how income tax will be levied how it is calculated and other legislative guidelines.

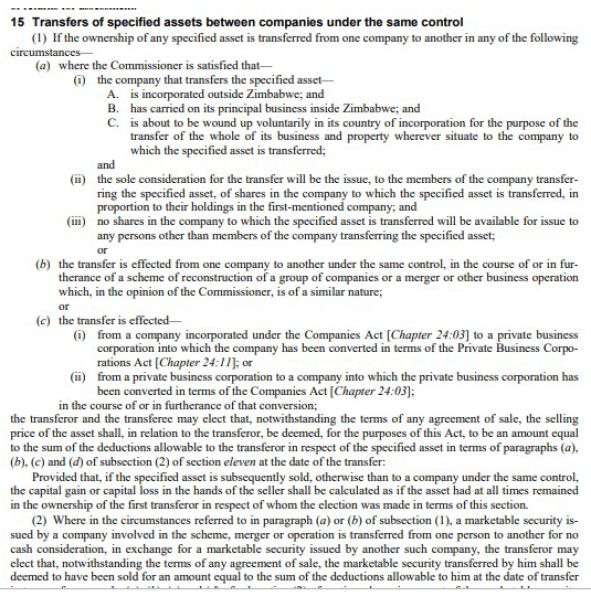

Zimbabwe income tax law. Yes investment income is taxable at an effective rate of 25 75 percent being 25 percent plus 3 percent aids levy while capital gains on specified assets are taxable at 20 percent. Zimbabwe has thin capitalisation rules based on a 3 1 debt to equity ratio. Section 63 of the act squarely cast the burden of proof on the appellant and not on the commissioner. The 3 aids levy is also imposed.

Exempt income is also spelt out. The zimbabwean tax system is currently based on source and not on residency. In addition any disallowed interest will be treated as a deemed dividend and subjected to a 15 wht. Its sources and what could be deemed as a source of income including employment benefits.

Income tax is levied on earnings income of an individual or a business. This book looks at the tax law and practice in zimbabwe. It identifies what constitutes gross income. It also differentiates between capital receipts and revenue receipts in its bid to identify gross income.

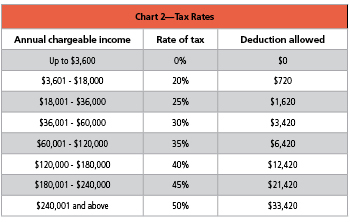

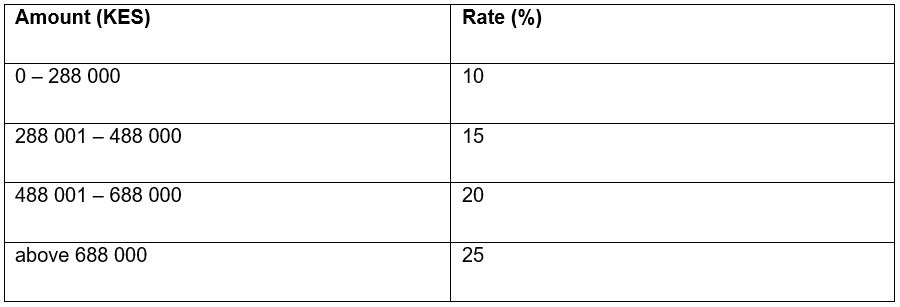

Compensation for services rendered in zimbabwe is deemed to be derived from a zimbabwean source regardless of where the payment is made or where the payer resides. Income tax rates deduction 0 1 980 00 0. Iii no amount in respect of the contribution is allowed as a deduction in terms of any law imposing a tax on income which is in force in a country other than zimbabwe. I the amount of any arrear contributions which are paid by the taxpayer in respect of past service with his employer to a pension fund other than a retirement annuity fund or to the consolidated revenue fund and which.

Income derived or deemed to be derived from sources within zimbabwe is subject to tax. It has been indicated that zimbabwe is considering moving to a residence based system during the current tax reform exercise. A portion of the overall interest may be disallowed if this ratio is exceeded.