United States Income Tax Brackets

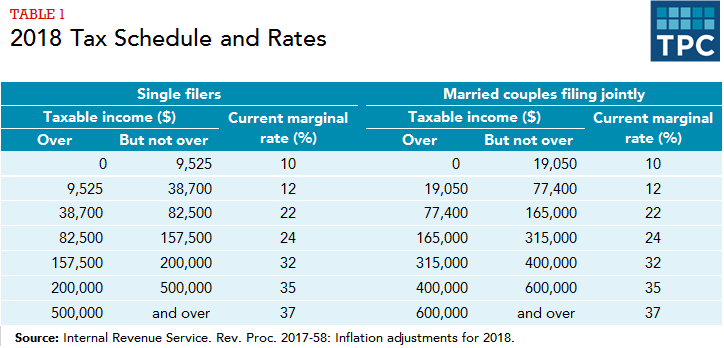

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

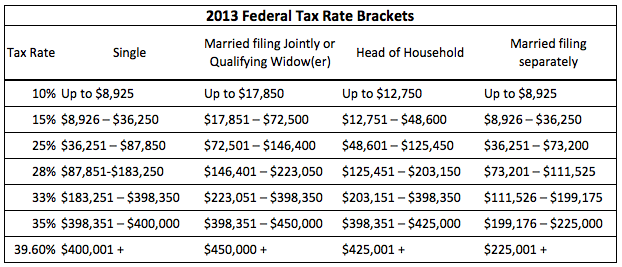

United states income tax brackets. Income tax brackets and rates in 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510 300 and higher for single filers and 612 350 and higher for married couples filing jointly. For tax year 2019 the 28 tax rate applies to taxpayers with taxable incomes above usd 194 800 usd 97 400 for married individuals filing separately. Use this tax bracket calculator to discover which bracket you fall in.

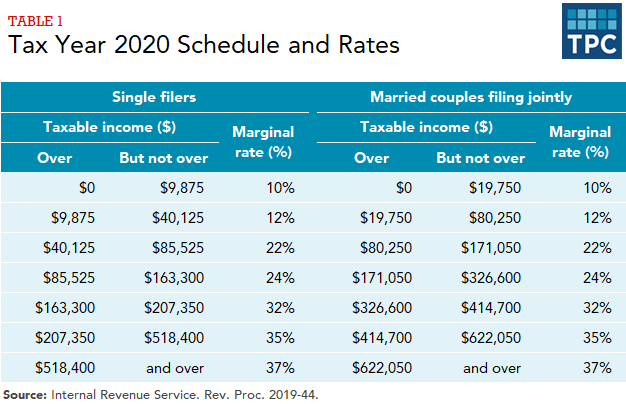

For tax year 2020 the 28 tax rate applies to taxpayers with taxable incomes above usd 197 900 usd 98 950 for married individuals filing separately. In north dakota the range is 1 1 to 2 9. These are the rates for taxes due in. 37 for incomes over 518 400 622 050 for married couples filing jointly 35 for incomes over 207 350 414 700 for married couples filing jointly 32 for incomes over 163 300 326 600 for married couples filing jointly 24 for incomes over 85 525 171 050 for married couples filing jointly.

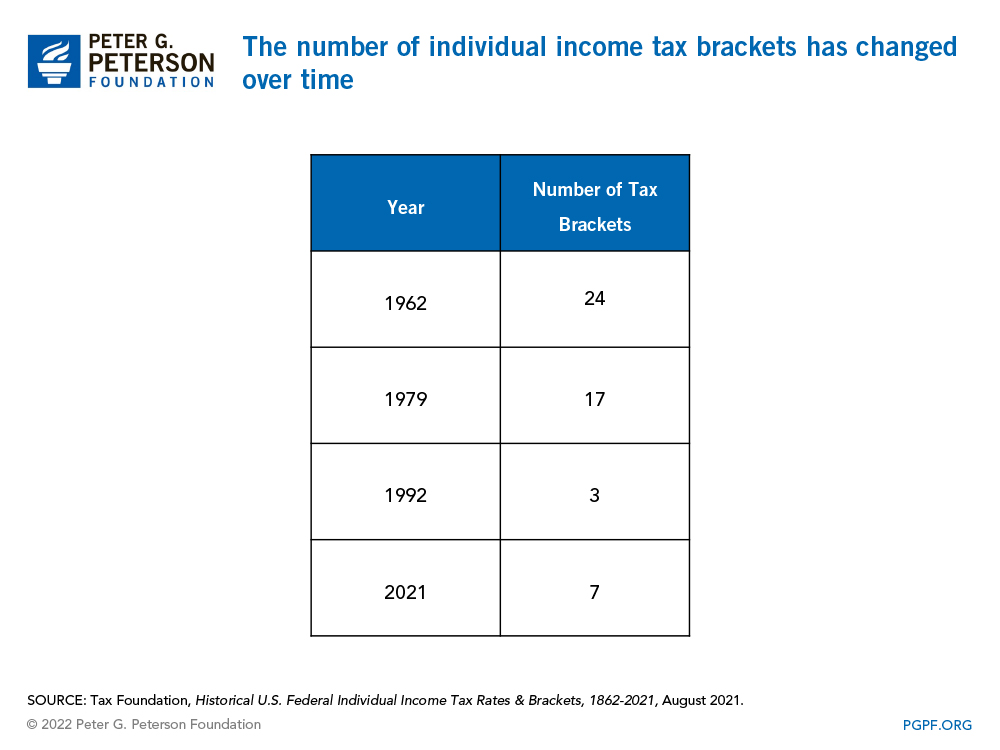

The united states internal revenue service uses a tax bracket system. There are seven federal tax brackets for the 2020 tax year. The rest of the states in the nation as well as d c use their own set of tax brackets. Has a progressive tax system which means that.

Your bracket depends on your taxable income and filing status. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples filing jointly. Tax brackets for income earned in 2020. Instead 37 is your top marginal tax rate.

The tax rate increases as the level of taxable income increases. 10 12 22 24 32 35 and 37. There are seven tax brackets for most ordinary income. The 2020 tax rate ranges from 10 to 37.

Being in a higher tax bracket doesn t mean all of your income is taxed at that rate. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1.