Consolidated Income Statement Def

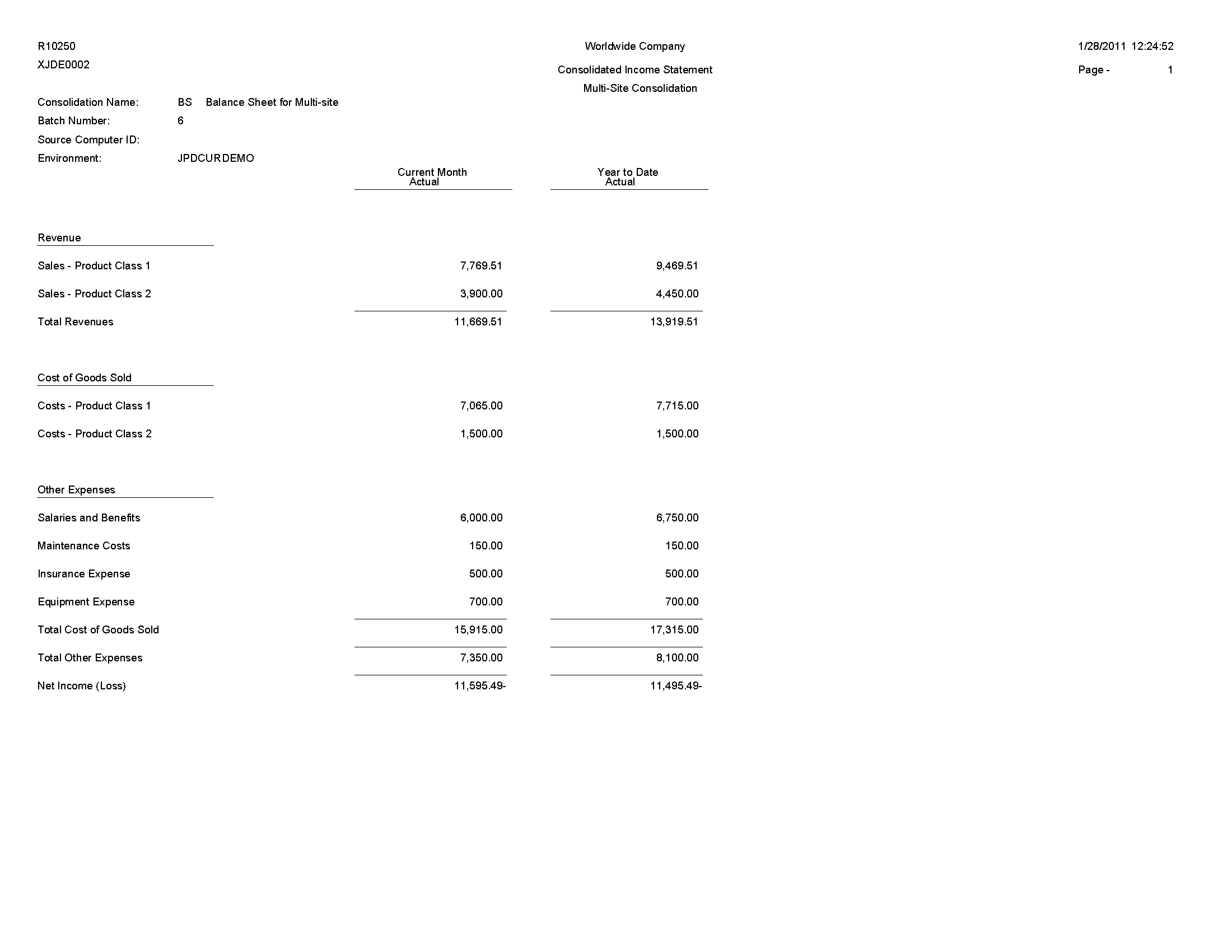

Consolidated financial statements is the financial statements of the overall group which represents the sum total of its parents and all of its subsidiaries and includes all three key financial statements income statement cash flow statement and balance sheet.

Consolidated income statement def. P consolidated income statement for the year ended 31 december 20x9. At the end of the year company xyz s income statement reflects a large amount of royalties and fees with very few expenses because they are recorded on the subsidiary income statements. A bond that consolidates the issues of multiple properties. If the properties covered by the consolidated mortgage bond are already mortgaged the bond acts as a new.

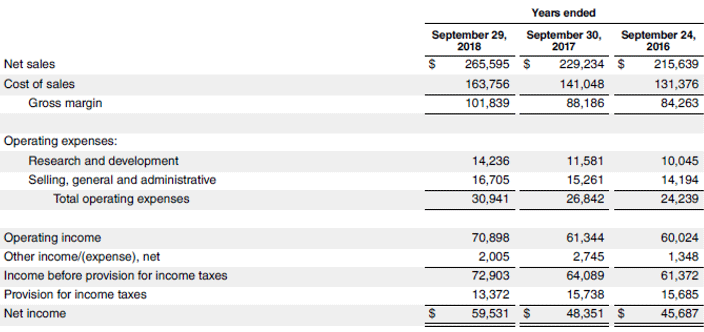

An investor looking solely at company xyz s holding company financial statements could easily get a misleading view of the entity s performance. Consolidated financial statements are used when the parent company holds a majority stake by controlling more than. Consolidated net income is reported on the consolidated income statement for periods after. A parent company when it owns a significant stake in another company.

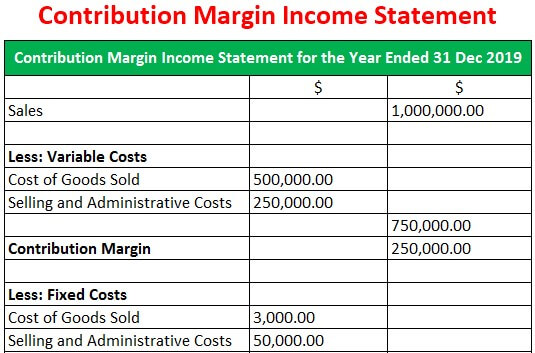

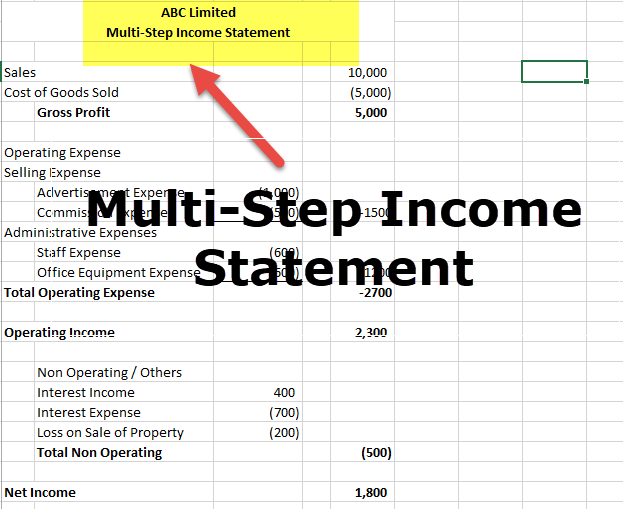

This is the date on which control passed and hence thedate from which the results of s should be reflected in the consolidatedincome statement. What is the consolidated financial statement. A consolidated income statement presents an aggregated picture of the whole corporation rather than its individual parts. This information is also reported on the income statement of the parent company.

Consolidated net income is the sum of net income of the parent company excluding any income from subsidiaries recognized in its individual financial statements plus net income of its subsidiaries determined after excluding unrealized gain in inventories income from intra group transactions etc.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/ExxonIncojmestatement2019June-55cdf08720b24bc7b27ade3de5b6dc32.jpg)