Income Statement Flux Analysis

Get the detailed income statement for flux power holdings inc.

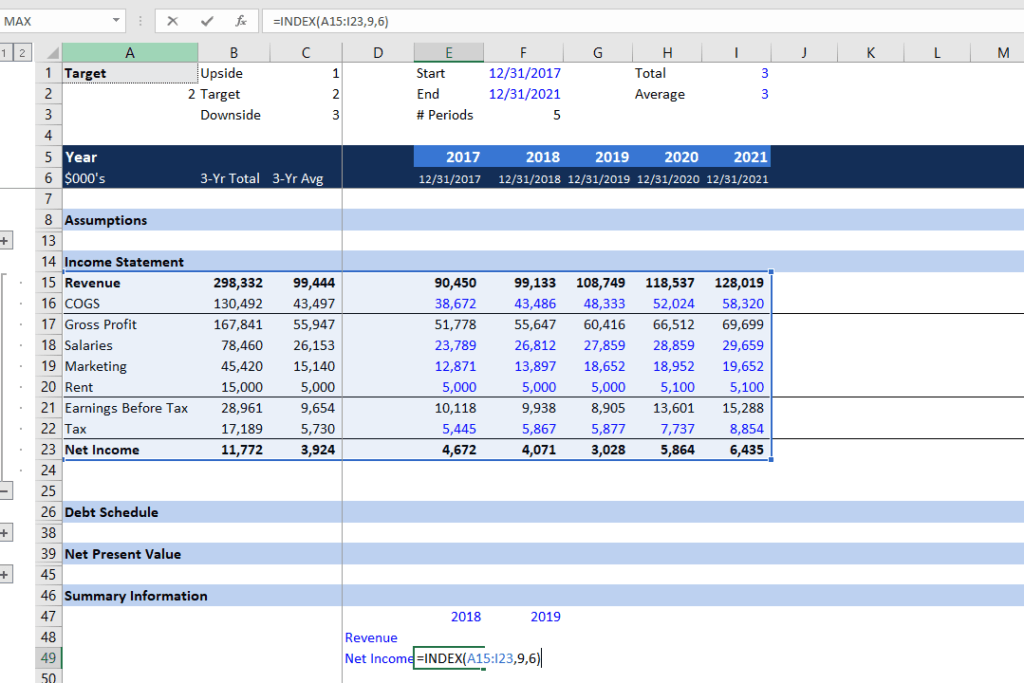

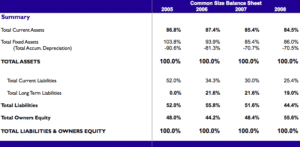

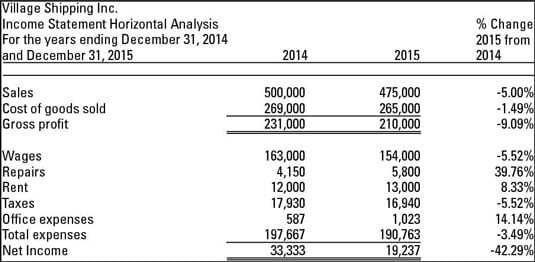

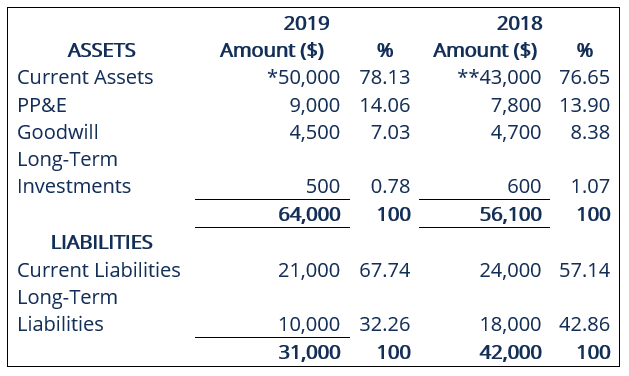

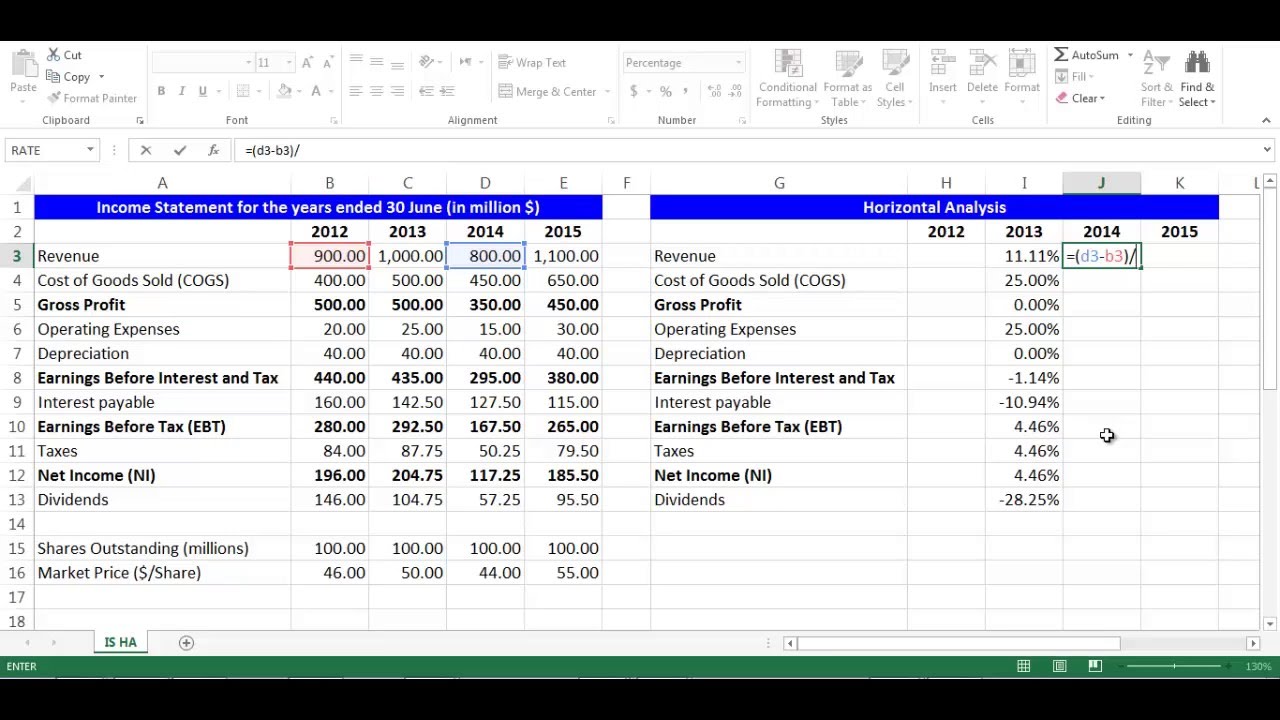

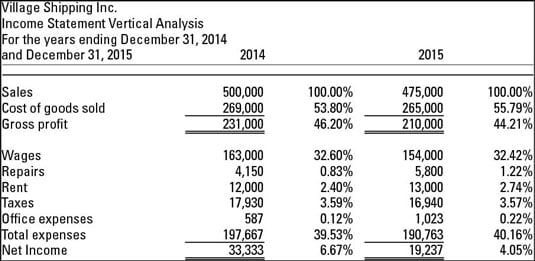

Income statement flux analysis. With this method of analysis of financial statements we will look up and down the income statement hence vertical analysis to see how every line item compares to revenue as a percentage. Comparing the bottom line of the business over time earnings per share earnings per share formula eps eps is a financial ratio which divides net earnings available to common shareholders by the average outstanding shares over a certain period of time. Most fluctuation analysis begins with the standard general ledger sgl account the financial statement line item and or the footnotes. Flux analysis means fluctuation analysis.

A flux analysis assists with forecasting budgeting and maintaining corporate integrity. It s only slightly better for income statement flux. Up to 10 years of financial statements. 4 financial statement footnote fluctuations and sgl accounting.

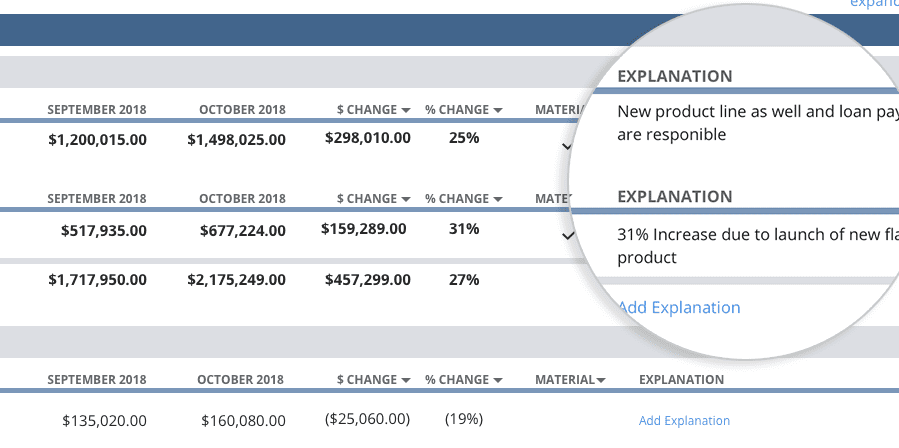

For example in the income. Up until now the flux analysis tool has only been offered to our scfo lab members. As a best practice both types of flux analysis should be a rote element of every close. Consistent analysis of change provides decision driving insight especially as flux data doesn t just function as a predictive force.

The flux analysis report creates a framework in which you can improve the profitability of your company. Most accountants at midsized companies and larger would agree. 3 where to start. A flux analysis is a powerful tool that analyzes fluctuations in account balances over time.

While it is arrived at through the income statement the net profit is also used in both the balance sheet and the cash flow statement. Only two thirds of teams do a monthly check of period to period fluctuations in line item revenues and expenses. View as yoy growth or as of revenue.