The Traditional Income Statement Format Is Prepared Under Absorption Costing

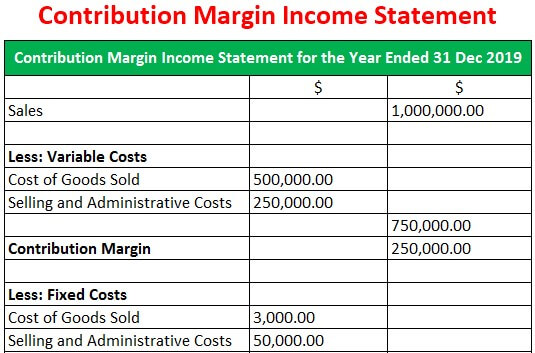

B it shows contribution margin as a line item.

The traditional income statement format is prepared under absorption costing. C it is not allowed under gaap. But marginal cost statement offers an alternative layout to the traditional income statement prepared under absorption costing. In absorption costing technique no difference is made between fixed and variable cost in calculating profits. Start studying acct 2302 ch 21.

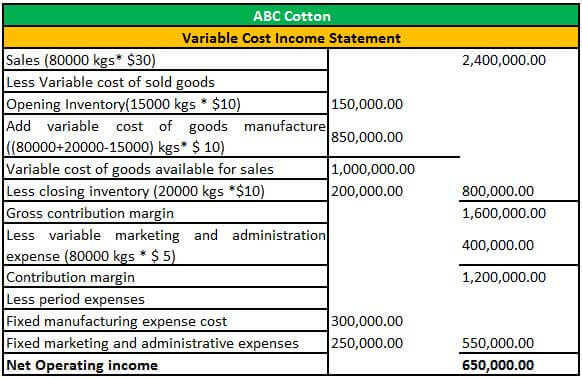

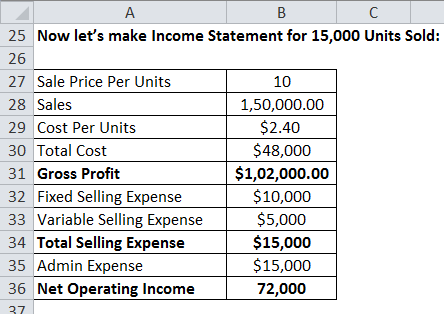

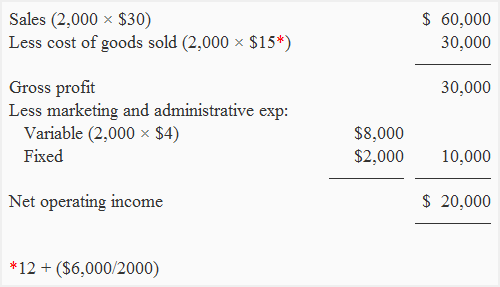

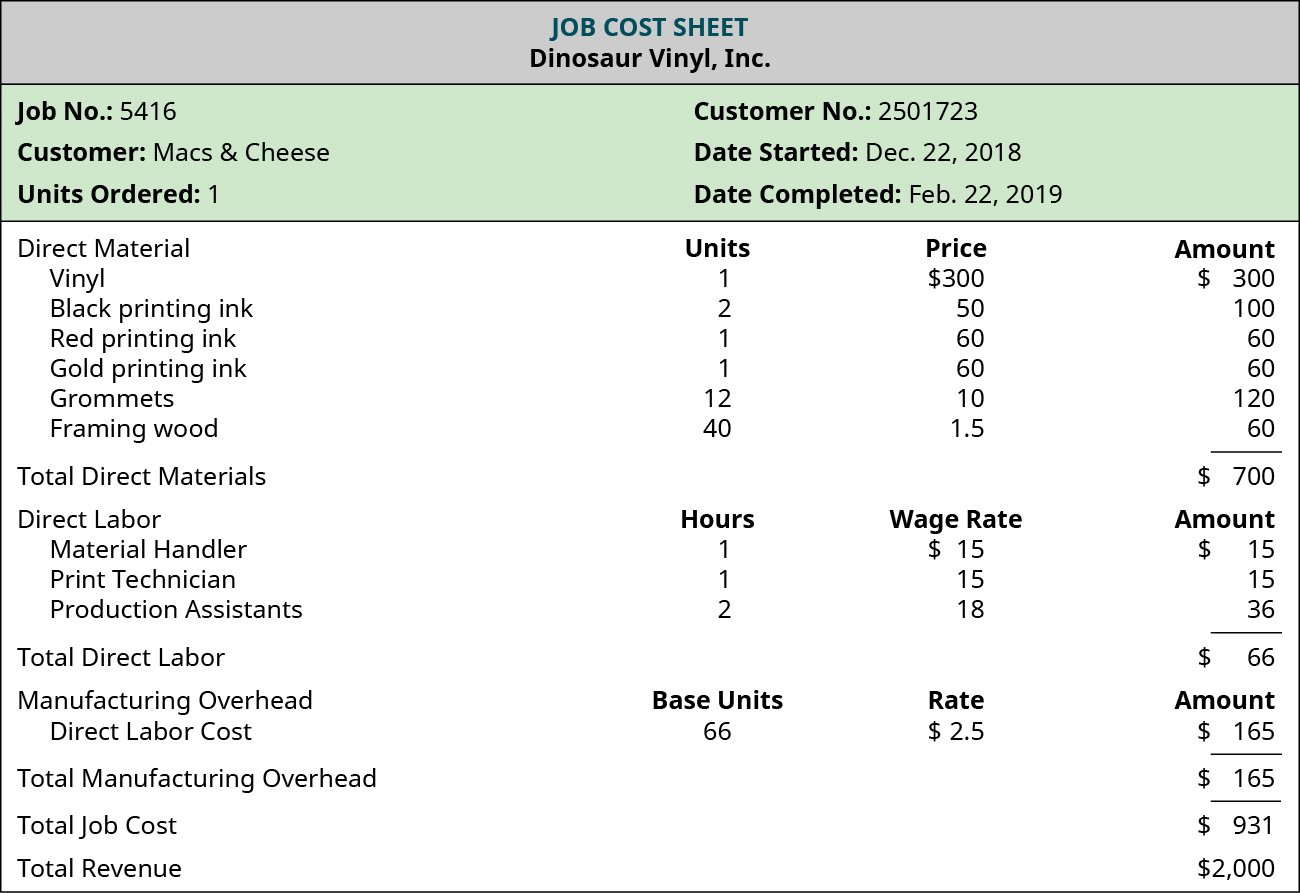

The contribution margin. True 7 under absorption costing all product costs are first recorded as assets in inventory accounts and later transferred to the cost of goods sold account when sold. Absorption costing direct materials direct labor variable moh fixed moh 41 28 3 7 79 c prepare a contribution format income statement for the month using variable costing. If price per unit sold is 4 5 calculate net income under the absorption costing and reconcile it with variable costing net income which comes out to be 20 727.

True 6 the traditional income statement format is prepared under absorption costing. Accounting 225 quiz section chapter 6 1 worksheet solution 4 d repare a traditional format income statement for the month using absorption costing. A it is prepared under the variable costing method. A it is prepared under the variable costing method.

Because an absorption costing income statement provides a more complete picture of the actual costs to manufacture a product it is often the preferred method for tracking profitability. Learn vocabulary terms and more with flashcards games and other study tools. This type of income statement tends to be more helpful to company management in evaluating labor efficiency in production and allows a better opportunity to identify cost prohibitive practices. When all of the units produced are sold the operating income is the same under both the absorption and variable.

D it is 43 unit. D it is prepared under. Which of the following is true of the traditional format of the income statement. Calculate unit cost first as that is probably the hardest part of the statement.

A traditional income statement uses absorption or full costing where both variable and fixed manufacturing costs are included when calculating the cost of goods sold. C it is not allowed under gaap. Solution number of units sold 3 000 22 000 4 000 21 000.

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)