Zakat And Income Certificate

Zakat base represents the net worth of the entity as calculated for zakat purposes.

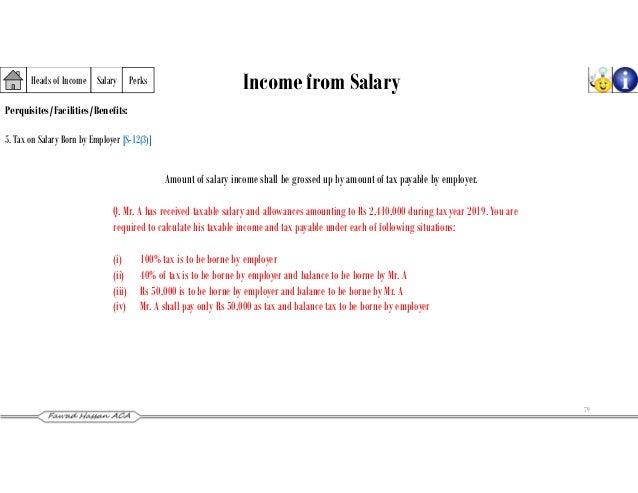

Zakat and income certificate. Zakat declarations provide assistance in preparing the tax and zakat declarations and to conduct a follow up with the competent authorities. Obtaining final and recorded zakat and income tax certificate. The common minimum amount for those who qualify is 2 5 or 1 40 of a muslim s total savings and wealth. Zakat is based on income and the value of possessions.

105 according to one source the hidaya foundation the suggested zakat al fitr donation is based on the price of 1 saa approx. This site can be viewed in all major sizes and it supports internet explorer firefox safari opera. It should be noted that although the income tax rate is 20 income from the following two activities is subject to different rates. Zakat al fitr is a fixed amount assessed per person while zakat al mal is based on personal income and property.

Actual expenses supported by verifiable documentation or other evidence. The zakat a form of tithe is paid annually by saudi individuals and companies within the provisions of islamic law as laid down by royal decree no. تهدف الهيئة إلى القيام بأعمال جباية الزكاة وتحصيل الضرائب وتحقيق أعلى درجات الالتزام من قبل المنشآت بالواجبات المفروضة عليهم وفقا لأفضل الممارسات وبكفاءة عالية ضريبة القيمة المضافة هي ضريبة غير مباشرة ت فرض على جميع. Related to the subject tax year.

The authority aims to carry out the work of collecting zakat and collecting taxes and achieving the highest degree of commitment by the establishments to the duties. Related to earning taxable income. This certificate shows gazt is committed to its role in providing high quality services to taxpayers liable to zakat and tax systems in saudi arabia riyadh. Housing and general authority for zakat and income tax launch an e portal to issue a certificate containing the first housing tax.

The zakat is an annual flat rate of 2 5 percent of the assessable amount. 17 2 28 8634 dated 29 6 1370 h. Zakat is charged on the company s zakat base at 2 5.