Ohio Federal Income Tax Calculator

Like the federal government ohio collects taxes based on income brackets that is the higher a taxpayer s income the higher rate he or she pays.

Ohio federal income tax calculator. Using our ohio salary tax calculator. Use this free tax return calculator to estimate how much you ll owe in federal taxes on your 2020 return using your income deductions and credits in just a few steps. Ohio has a progressive income tax system with eight tax brackets. Rates range from 0 to 4 797.

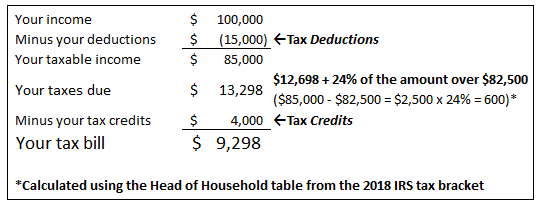

After a few seconds you will be provided with a full breakdown of the tax you are paying. The table below shows the marginal rate paid on taxable income for filers in ohio. If you make 55 000 a year living in the region of ohio usa you will be taxed 10 688 that means that your net pay will be 44 312 per year or 3 693 per month. To use our ohio salary tax calculator all you have to do is enter the necessary details and click on the calculate button.

This breakdown will include how much income tax you are paying state taxes federal taxes. The provided information does not constitute financial tax or legal advice. The ohio salary calculator is a good calculator for calculating your total salary deductions each year this includes federal income tax rates and thresholds in 2021 and ohio state income tax rates and thresholds in 2021. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax.

There are more than 600 ohio cities and villages that add a local income tax in addition to the state income tax. For all filers the lowest bracket applies to income up to 21 750 and the highest bracket only applies to income above 217 400. You can quickly estimate your ohio state tax and federal tax by selecting the tax year your filing status gross income and gross expenses this is a great way to compare salaries in ohio and for. We strive to make the calculator perfectly accurate.