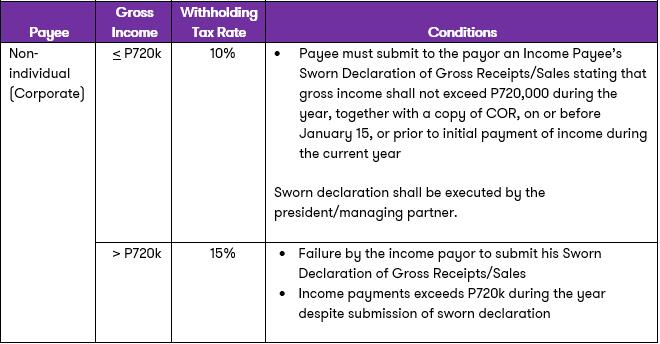

Income Tax Withholding Rules

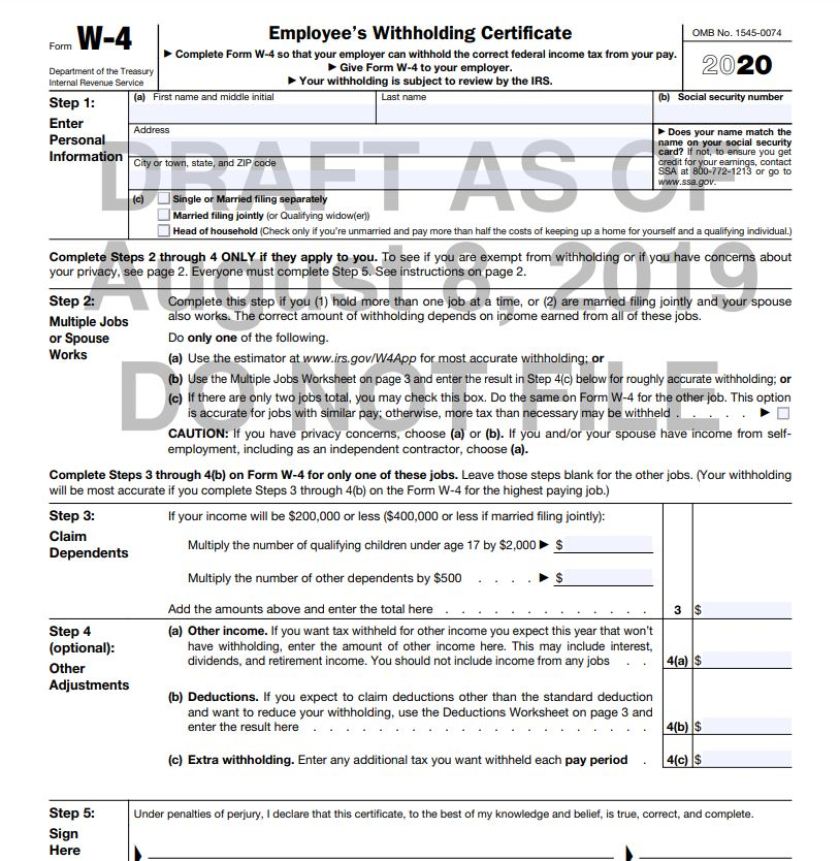

The internal revenue service and the treasury have proposed regulations updating the income tax withholding rules to reflect the changes in the tax cuts and jobs act the recently redesigned form w 4 and the irs s new tax withholding estimator.

Income tax withholding rules. The money taken is a credit against the employee s annual income tax. A withholding tax takes a set amount of money out of an employee s paycheck and pays it to the government. Three types of information you give to your employer on form w 4 employee s withholding allowance certificate. The amount of income tax your employer withholds from your regular pay depends on two things.

Each allowance you claim reduces the amount withheld. 50 state guide to income tax withholding requirements everything you need to know about income tax withholding in any state. For help with your withholding you may use the tax withholding estimator. In most jurisdictions withholding tax applies to employment income.

The amount you earn. The tax is thus withheld or deducted from the income due to the recipient. Prior to the tax cuts and jobs act tcja if no withholding certificate was in effect for a taxpayer s periodic. Many jurisdictions also require withholding tax on payments of interest or dividends.

A withholding tax or a retention tax is an income tax to be paid to the government by the payer of the income rather than by the recipient of the income. Domestic income tax withholding rules do not provide for withholding rates in case of resident beneficiaries. Withholding tax is income tax collected from wages when an employer pays an employee. Department of the treasury and the internal revenue service today issued final regulations updating the federal income tax withholding rules for certain periodic retirement and annuity payments made after december 31 2020.

If you withhold an additional amount. The amount of income you earn. Although in general no withholding should be applied a case by case review may be necessary. Ir 2020 223 september 28 2020.

These proposed guidelines for income tax withholding also put up the re designed and new form w 4 employee s withholding certificate that is starting to be used in 2020. The information you give your employer on form w 4. How many withholding allowances you claim. If you withhold at the single rate or at the lower married rate.

The beginnings of withholding tax dates back to 1862 when it was used to help fund the civil war. Washington the u s. The proposed regulations are designed by the joint effort of both the irs and treasury in usa that are available in the federal register now. If your small business has employees working you ll need to understand the state law requirements for withholding and paying state income tax on their salaries.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.03.26AM-e376b945aa4e4b7381f63b10e4de9cc2.png)