Income Tax Withholding Election

Refer to the state income tax withholding information sheet for specific information concerning your state s withholding rates.

Income tax withholding election. August 2019 this fact sheet has been updated to reflect changes to the withholding tool. Tax withholding election form for individual retirement accounts page 2 of 2. If you elect not to have income tax withheld from your payments or you do not have enough income tax withheld you may be responsible for payment of estimated tax. Ufcw employers trust llc po box 4102 concord.

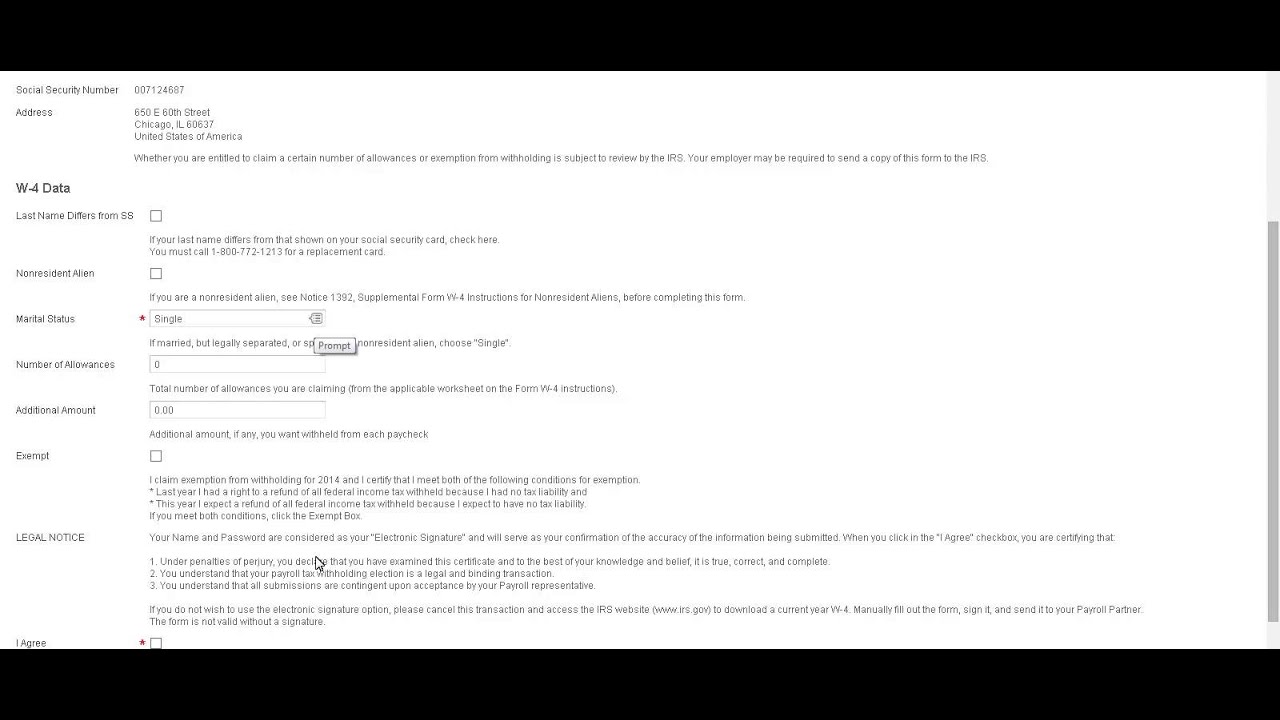

If you withhold at the single rate or at the lower married rate. Each allowance you claim reduces the amount withheld. Three types of information you give to your employer on form w 4 employee s withholding allowance certificate. The amount of income you earn.

State income tax withholding from your distribution may be required. State income tax withholding. Before completing this form please read the notice regarding federal and california tax withholding on. How many withholding allowances you claim.

You may incur penalties under the estimated tax rules if your withholding and estimated tax payments are not sufficient. Mail completed form to. If you withhold an additional amount. In some cases you may elect not to have.

Taxpayers pay the tax as they earn or receive income during the year. Federal income tax withholding notice under current federal income tax law any taxable portion of this distribution is subject to federal income tax withholding at the rate of 10 ten percent. Questions about income tax withholding if you have a q uestion ab ot ow m ch sld withhold plea e con lt a tax advisor. The irs urges everyone to do a paycheck checkup in 2019 even if they did one.

You may elect not to have withholding apply. Fs 2019 4 march 2019 the federal income tax is a pay as you go tax. Taxpayers can avoid a surprise at tax time by checking their withholding amount.