Uk Income Tax Rates 1980 To Present

Pdf 1 4 where s best for my spare cash after interest rates were held at 0 1.

Uk income tax rates 1980 to present. 1990 91 to 2020 21 1990 91 1991 92 1992 93 bands of rate of bands of rate of bands of rate of taxable income 1 tax taxable income 1 tax taxable income 1 tax lower rate 1 2 000 20 basic rate 1 20 700 25 1 23 700 25 2 001 23 700 25 higher rate over 20 700 40 over 23 700 40 over 23 700 40 1993 94 1994 95 1995 96. But who at present do not satisfy the test in relation to an income year receive and allowance. Single persons allowance. Historical information on the uk tax regime.

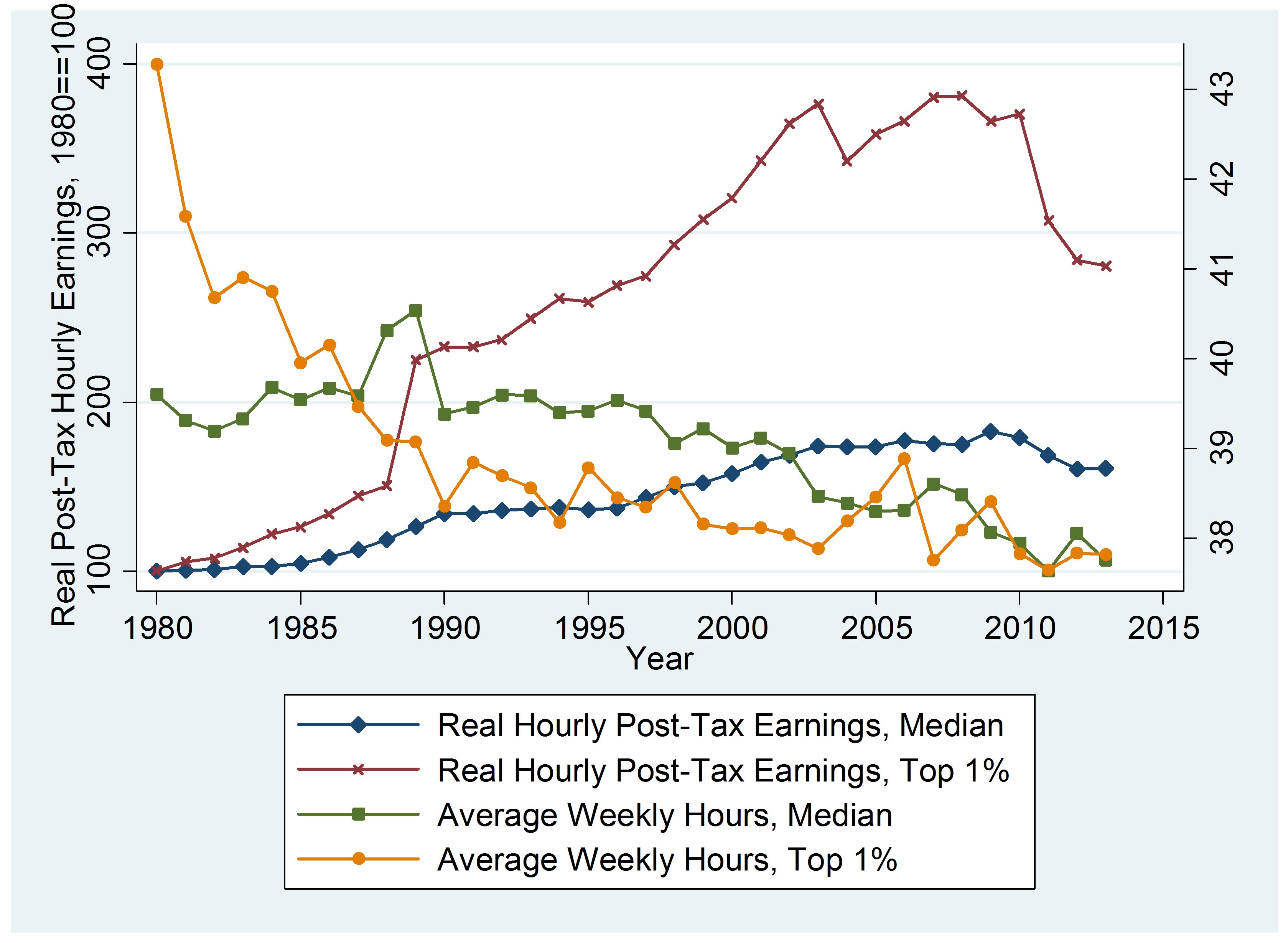

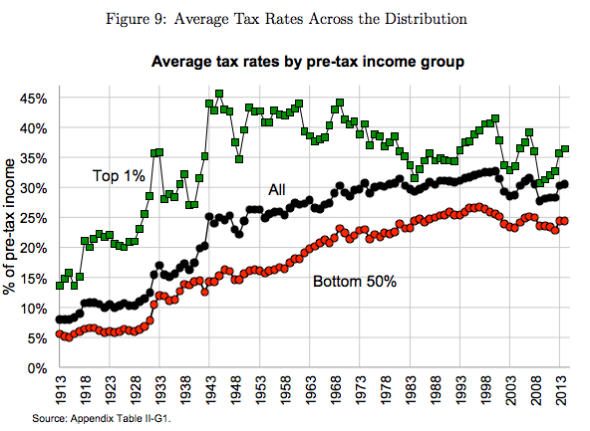

These statistics are for tax year 1990 to 1991 to tax year 2020 to 2021. 413 200 in 2015 the 39 6 percent top marginal rate probably yields. Published 28 march 2014. A study from the congressional research service concludes that the effective tax rate for the top 0 01 percent of income earners during the period of 91 percent income taxes was actually 45 percent.

When the united kingdom of great britain came into being on may 1 1707 the window tax which had been introduced across england and wales under the act of making good the deficiency of the clipped money in 1696 continued. Rates of income tax. Wedding gifts are not subject to tax within certain limits. Given that the top bracket is so much lower today 3 425 766 in 1955 vs.

The highest rate of uk income tax currently 45 on incomes above 150 000 stood at 83 before margaret thatcher was elected prime minister in 1979. In the first budget after her election victory in 1979 the top rate was reduced from 83 to 60 and the basic rate from 33 to 30. Income limit for personal allowance. Allowances 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018.

Parents are able to gift up to 5 000 per child and grandparents up to 2 500 per grandchild while other relatives and friends can gift up to 1 000 without paying tax. 0000033350 00000 n br br 0000030120 00000 n inheritance tax would still be. Not less not more. Historical tax rates and allowances.

Tax on total taxable income. For previous years please see the national archives website. Margaret thatcher who favoured indirect taxation reduced personal income tax rates during the 1980s. It had been designed to impose tax relative to the prosperity of the taxpayer but without the controversy that then surrounded the idea of income tax.

1980 81 2 funeral expenses 100 each bereavement 3 life assurance and superannuation 1 200. In 1974 as many as 750 000 people were liable to pay the top rate of income tax. In the usa the top marginal income tax rate was reduced to 70 in 1964 but for 2019 was down at 37 and then only for single incomes above 510 000.