Income Tax Rates By Country 2020

:max_bytes(150000):strip_icc()/UAETaxBrackets2-0db7d9918b414b2e978772ebeeb0f101.jpg)

The lowest earners make 562.

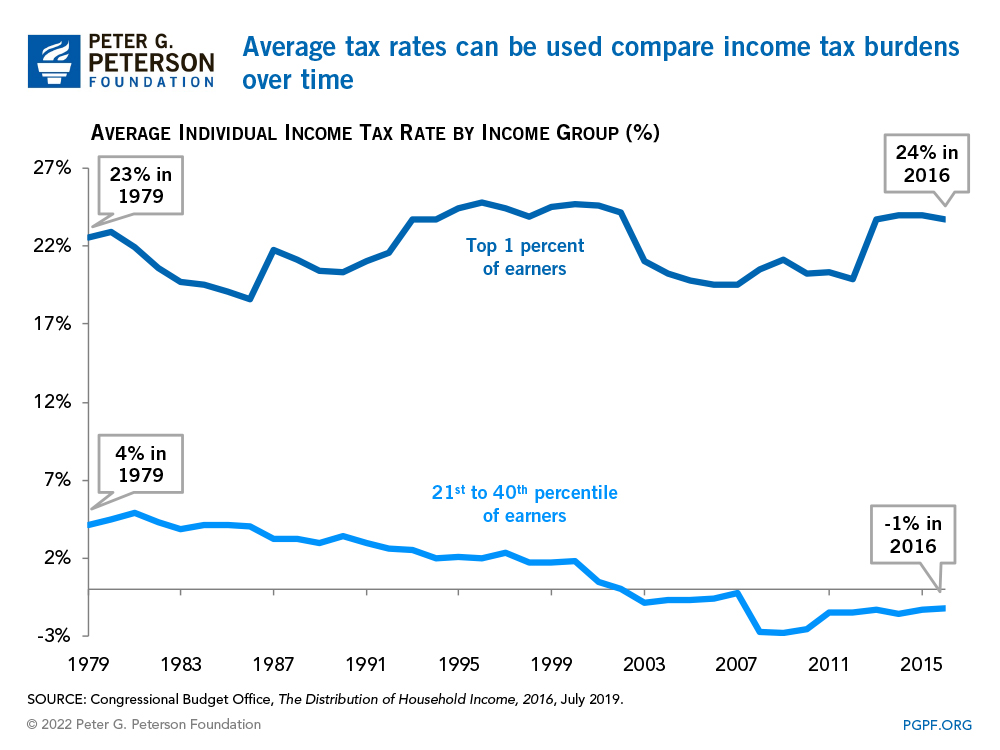

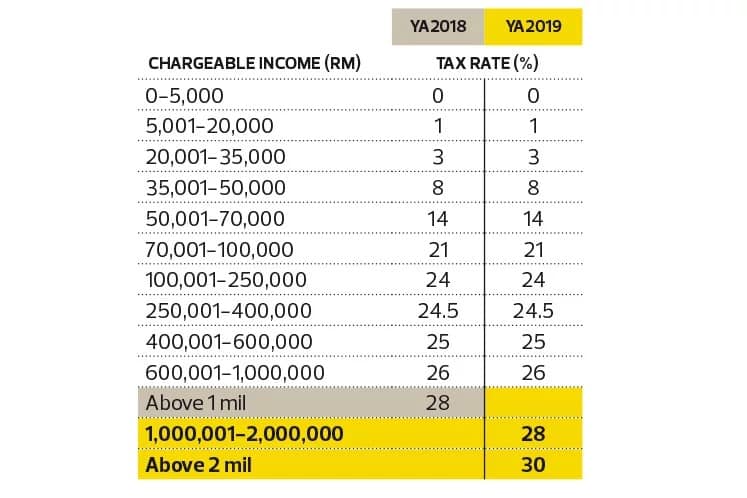

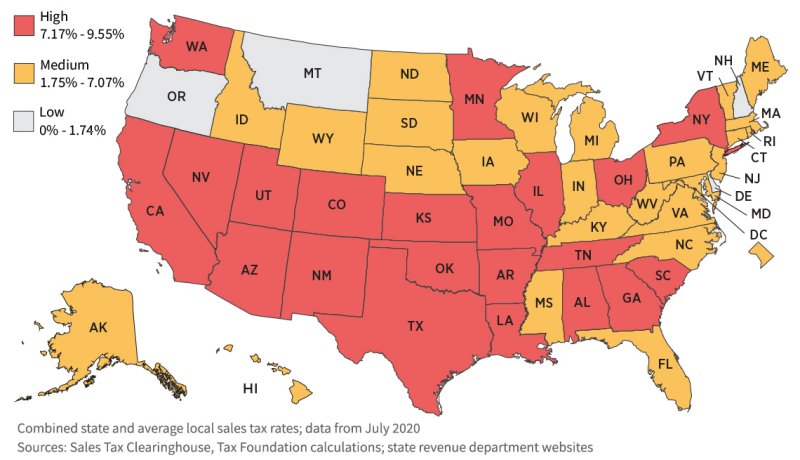

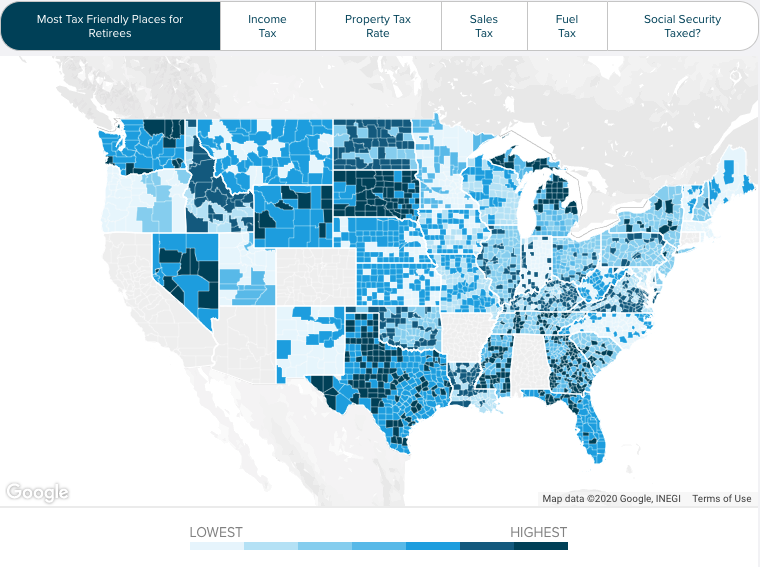

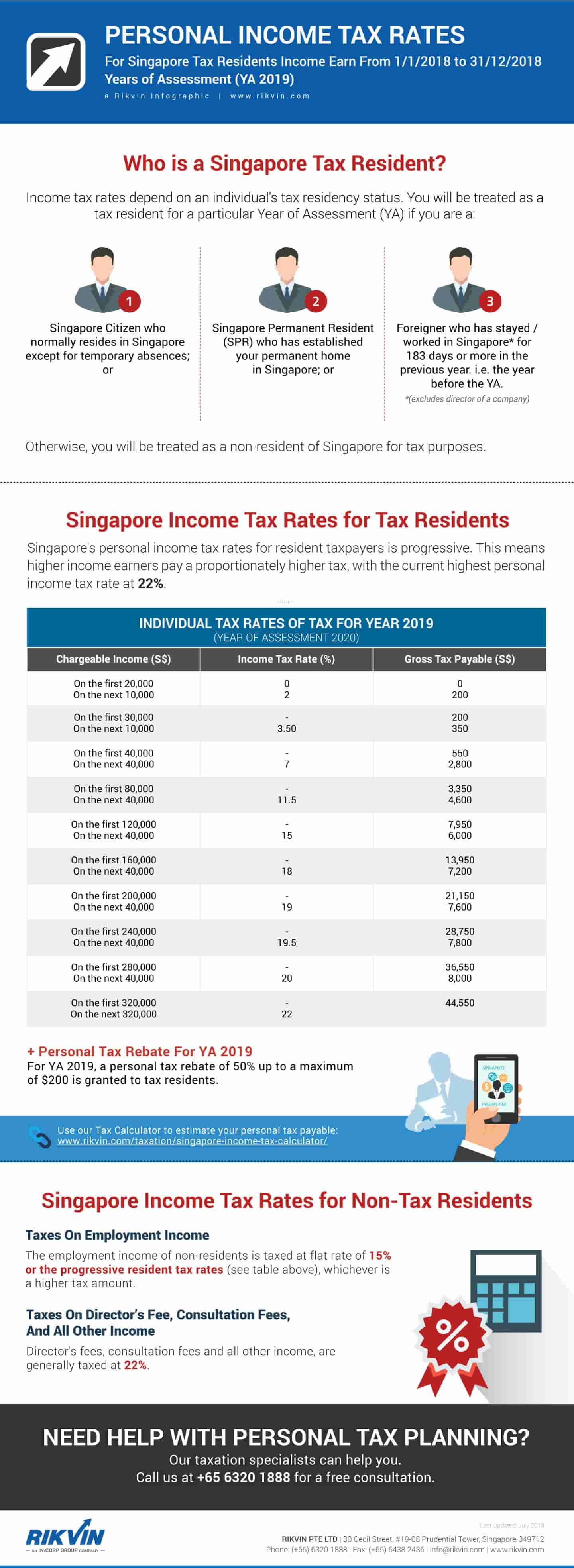

Income tax rates by country 2020. Data is also available for. A b quebec combined federal and provincial personal income tax rates 2020 ernst young. Corporate tax rates 2020. List of countries by personal income tax rate provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data.

The content is current on 1 january 2020 with exceptions noted. Kpmg s individual income tax rates table provides a view of individual income tax rates around the world. The content is straightforward. Corporate tax rates 2020 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax e g branch profits tax or branch remittance tax.

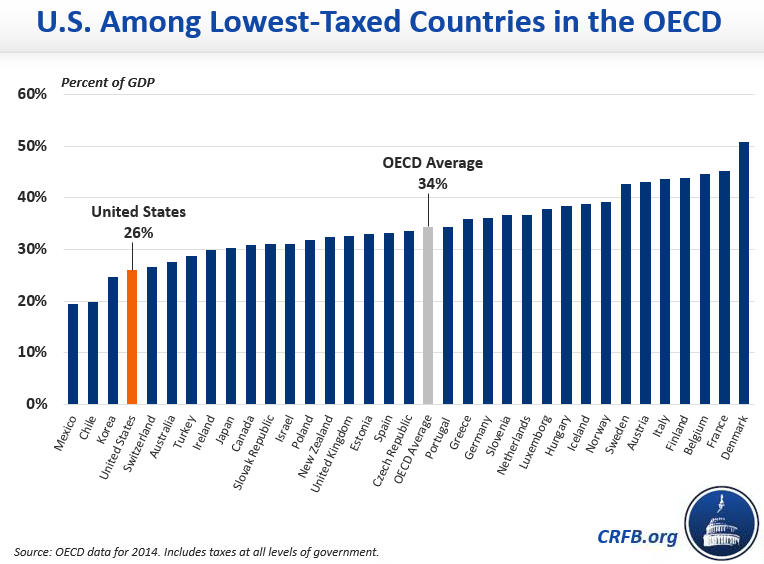

Top statutory personal income tax rate and top marginal tax rates for employees accessed may 26 2020. Chapter by chapter from albania to zimbabwe we summarize corporate tax systems in more than 160 jurisdictions. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or region. Organisation for economic co operation and development.

The netherlands is another great european country for a visitor but living here is just too expensive due to the high tax rate. Accessed may 26 2020. The personal income tax for aruba has a progressive structure. International tax canada highlights 2017.

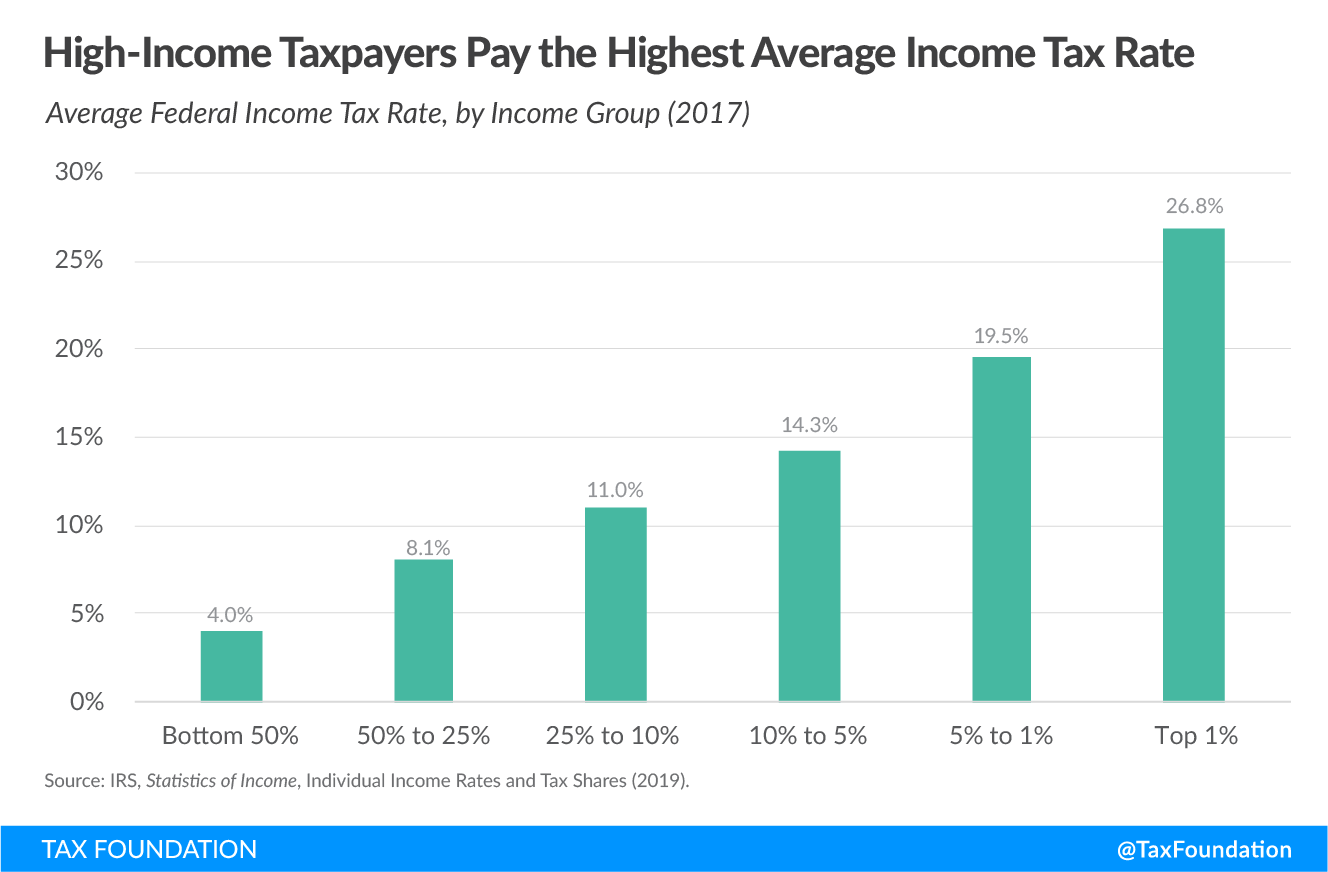

According to the personal income tax rate by country data the personal income tax rate had an average value of 59 22 from 2004 until 2018. Data is also available for. The czech republic 31 1 percent estonia 32 4 percent and hungary 33 5 percent had the lowest rates. Keep up to date on significant tax developments around the globe with ey s global tax alert library here.

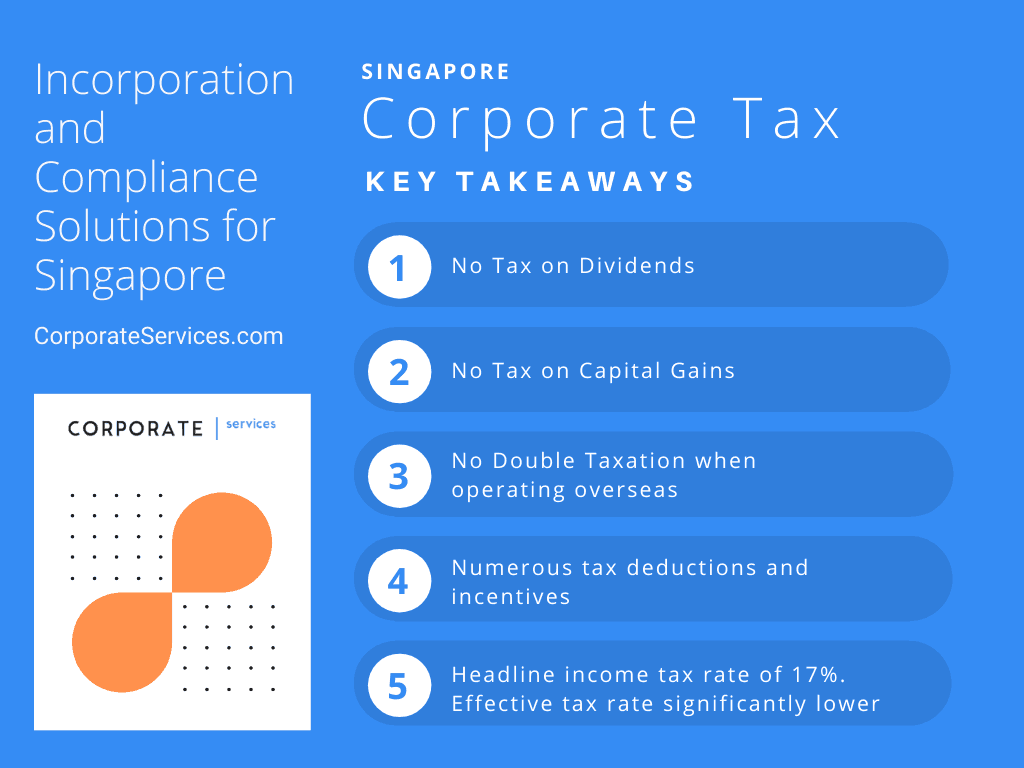

Kpmg s corporate tax rates table provides a view of corporate tax rates around the world. Corporate tax rates indirect tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or region. Income tax rates revenu québec. Still on top 10 countries with the highest income tax rates 2020.

According to older data the residents of aruba have an average monthly employment income of 1 543 per person. Line 44000 refundable quebec abatement canada revenue agency. Slovenia 61 1 percent belgium 60 2 percent and sweden 60 2 percent had the highest top marginal income tax rates among european oecd countries in 2019.

/2019GlobalTaxRateAveragesbyRegion-343a58758a514d4a8a64ee3e7b81e4bd.jpg)