Income Tax Withholding Guide For Employers Virginia

All filers must file form va 6 employer s annual summary of virginia income tax withheld or form va 6h household employer s annual summary of virginia income tax withheld.

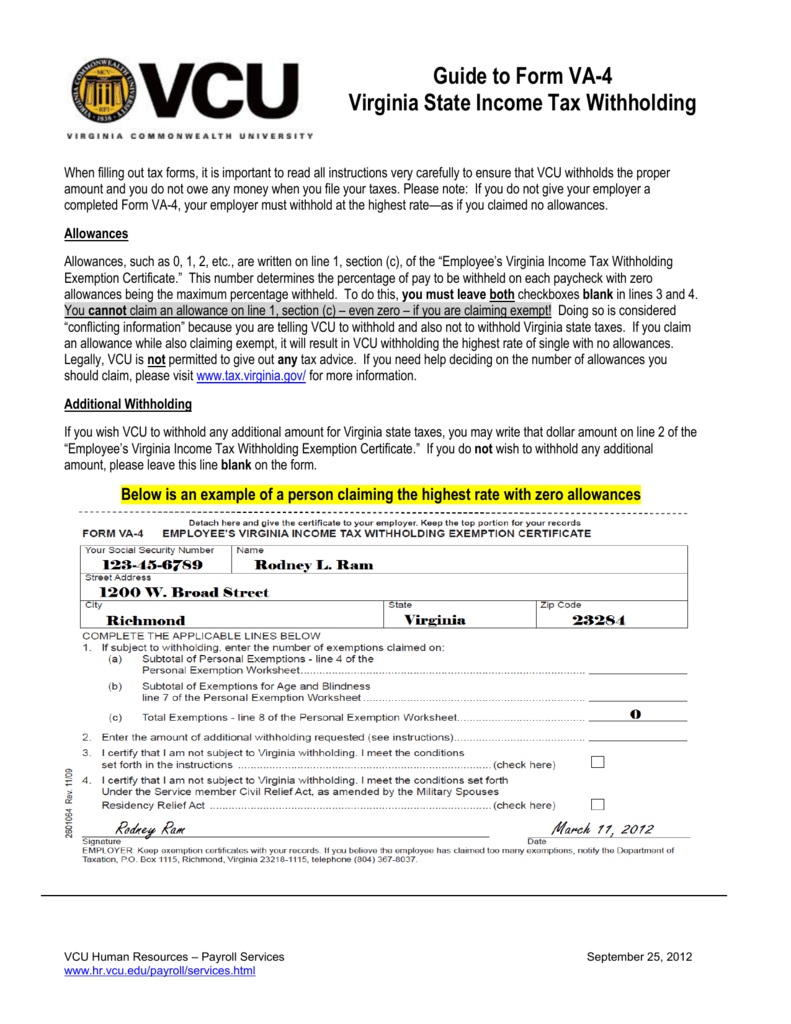

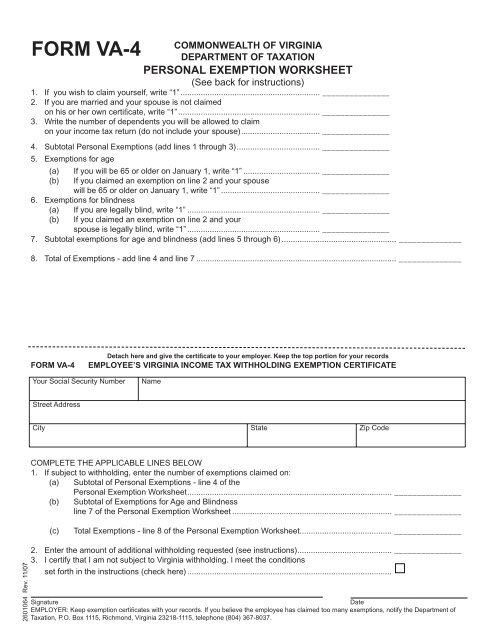

Income tax withholding guide for employers virginia. The va 6 and va 6h are due to virginia tax by jan. You should use this booklet as a reference guide not as a substitute for the complete tax law provided by the code of virginia or the regulations and public documents published by the department. Important due date for forms va 6 w 2 and 1099. 1 introduction this publication contains general information regarding the withholding of virginia income tax from wages.

31 of the following calendar year or within 30 days after the final payment of wages by your company. Subtract the nontaxable biweekly federal health benefits plan payment s includes flexible spending account health care and dependent care deductions from the amount computed instep 1. You should use this booklet as a reference guide not as a substitute for the complete tax law provided by the code of virginia or the regulations and public documents published by the department. Important due date for forms va 6 w 2 and 1099.

1 introduction this publication contains general information regarding the withholding of virginia income tax from wages. Withholding formula virginia effective 2020. You should use this booklet as a reference guide not as a substitute for the complete tax law provided by the code of virginia or the regulations and public documents published by the department. 3 daily payroll period virginia income tax withholding table for wages paid after december 31 2018 if wages are and the total number of personal exemptions claimed on form va 4 or va 4p is.