Income Tax Malaysia Definition

How to pay income tax in malaysia.

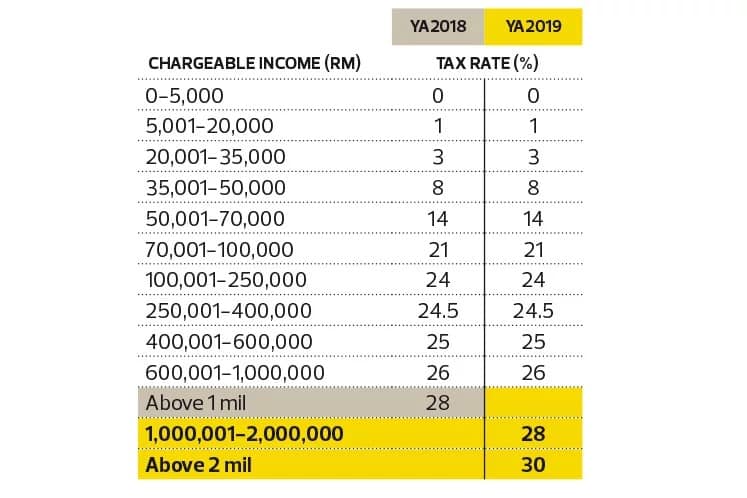

Income tax malaysia definition. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Malaysia income tax e filing guide. The employment income of an individual who is a knowledge worker and resides in a specific region iskandar malaysia exercising employment with a person who carries on any qualifying activity namely green technology biotechnology educational services healthcare services creative industries financial advisory and consulting services logistic services and tourism will be taxed at the.

Deduction of tax on the distribution of income of a unit trust 109 e. Deduction of tax from income derived from withdrawal of a deferred annuity or a private retirement scheme 109 h. A public ruling as provided for under section 138a of the income tax act 1967 is issued for the purpose of providing guidance for the public and officers of the inland revenue board of malaysia. What is income tax return.

Overall income that is earned by household members whether in cash or kind and can be referred to as gross income. In 2019 the average monthly income in malaysia is rm7 901. No other taxes are imposed on income from petroleum operations. Resident status is determined by reference to the number of days an individual is present in malaysia.

There are no other local state or provincial. Deduction of tax from gains or profits in certain cases derived from malaysia 109 g. Under the income tax act 1967 a malaysian tax resident company and a unit trust are not taxed on their foreign sourced income regardless of whether such income is received in malaysia. Tax offences and penalties in malaysia.

The gross amount of interest royalty and special income paid by the payer to a nr payee are subject to the respective withholding tax rates of 15 10 and 10 or any other rate as prescribed under the double taxation agreement between malaysia and the country where the nr payee is a tax resident. It sets out the interpretation of the director general of inland revenue in respect of the particular tax law and the policy and procedure. How to file income tax as a foreigner in malaysia. However income of a resident company from the business of air sea transport banking or insurance is assessable on a worldwide basis.

Parent is a malaysian tax resident and at any time in that year aged sixty and above parent whose annual income does not exceed rm24 000 for that year of assessment taxpayer does not claim expenses on medical treatment and care of parents. Deduction of tax on the distribution of income of a family fund etc. Is the middle income number within a range of.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)