State Income Tax Percentage Ohio

For the 2019 tax year which you file in early 2020 the top rate is 4 797.

State income tax percentage ohio. Beginning with tax year 2019 ohio income tax rates were adjusted so taxpayers making an income of 21 750 or. Forty one tax wage and salary income while two states new hampshire and tennessee exclusively tax dividend and interest income. To use our ohio salary tax calculator all you have to do is enter the necessary details and click on the calculate button. Ohio collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Taxpayers with 22 150 or less of income are not subject to income tax for 2020. For example suppose you made a total of 38 500 in taxable income. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. What is ohio income tax rate.

This puts you in the 4 457 percent bracket meaning you would have to pay about 1 700 in state income tax. This page has the latest ohio brackets and tax rates plus a ohio income tax calculator. State income taxes which vary by state are a percentage of your earned or unearned income that you pay to the state government. The following are the ohio individual income tax tables for 2005 through 2020.

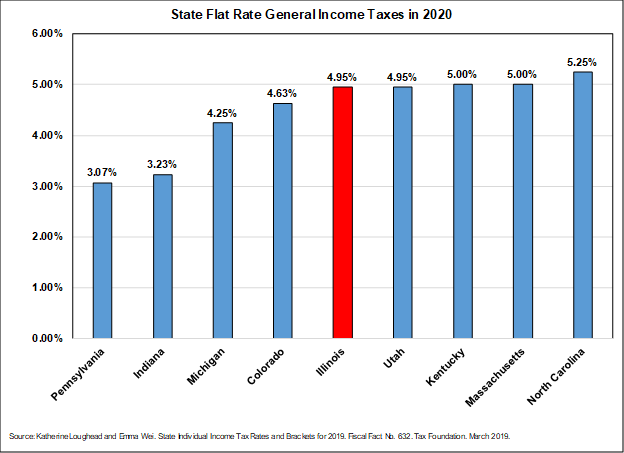

Alone that would place ohio at the lower end of states with an income tax but many ohio municipalities also charge income taxes some as high as 3. The tax brackets have been indexed for inflation per ohio revised code section 5747 025. Income tax tables and other tax information is sourced from the ohio department of taxation. Please note that as of 2016 taxable business income is taxed at a flat rate of 3.

Individual income taxes are a major source of state government revenue accounting for 37 percent of state tax collections in fiscal year fy 2017. Ohio s maximum marginal income tax rate is the 1st highest in the united states ranking directly below ohio s you can learn more about how the ohio income tax. Ohio s 2020 income tax ranges from 2 85 to 4 8. Forty three states levy individual income taxes.

Ohio state income tax rate table for the 2019 2020 filing season has six income tax brackets with oh tax rates of 0 2 85 3 326 3 802 4 413 and 4 797. The ohio tax rate ranges from 0 to 4 797 depending on your taxable income. Apply the appropriate tax rate to the income you earned. Starting in 2005 ohio s state income taxes saw a gradual decrease each year.