What Does The Income Statement Reports Quizlet

The income statement can either be prepared in report format or account format.

What does the income statement reports quizlet. Notice that the income statement reports the financial effects of business activities that occurred during just the current period. The december income statement must report one month s interest expense. A major expense shown in our first income statement example above is tax. Revenues when cash is received from customers expenses reported when cash is paid for services or assets to the company.

The income statement sometimes called an earnings statement or profit and loss statement reports the profitability of a business organization for a stated period of time. 100 000 x 12 x 1 12 1 000. Cash basis income statement reports the net change in cash for the period. The income statement must report the interest incurred regardless of the date the interest is paid.

950 4 000 3 500 900 450 sales discounts office salaries expense rent expense office space advertising expense sales returns and allowances office supplies expense cost of goods sold sales insurance expense sales staff salaries 900 13 000 60 000 3 000 4 500 required. In reality companies often use more complicated multiple step income statements where key expenses are separated into groups or categories. The period can be a quarter if it is a quarterly income statement or a year if it is an annual report. This is a key distinction between the income statement and the balance sheet.

The income statement reports economic events that happened during a period to earn income. Interest expense of 1 000. They relate only to the current period and do not have a lingering financial impact beyond the end of the current period. Required by generally accepted accounting principles.

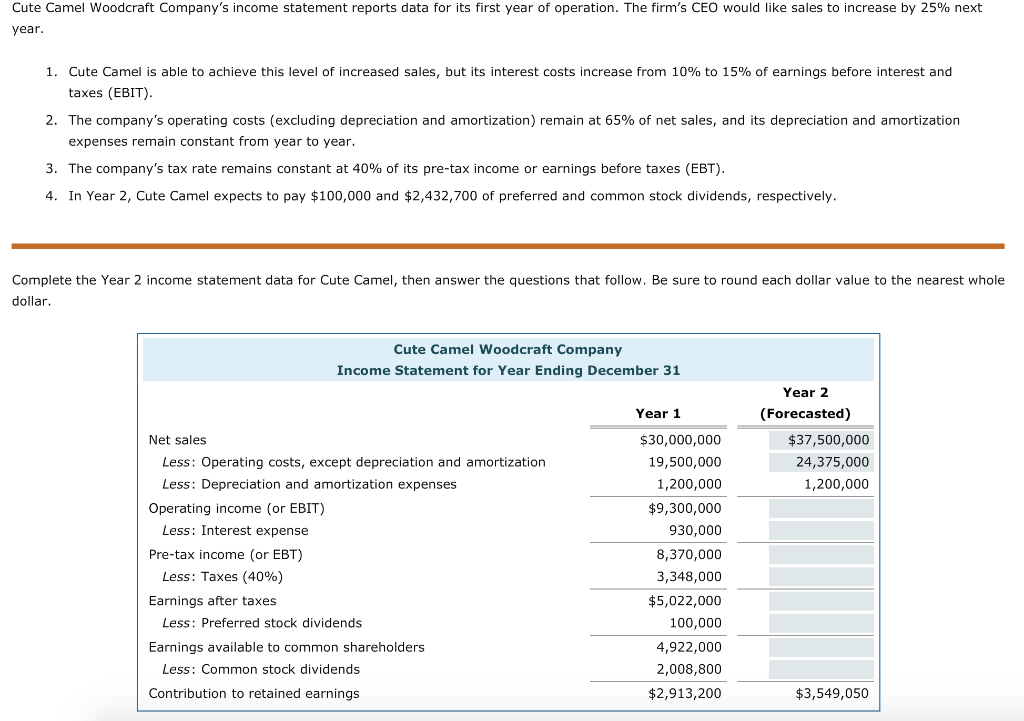

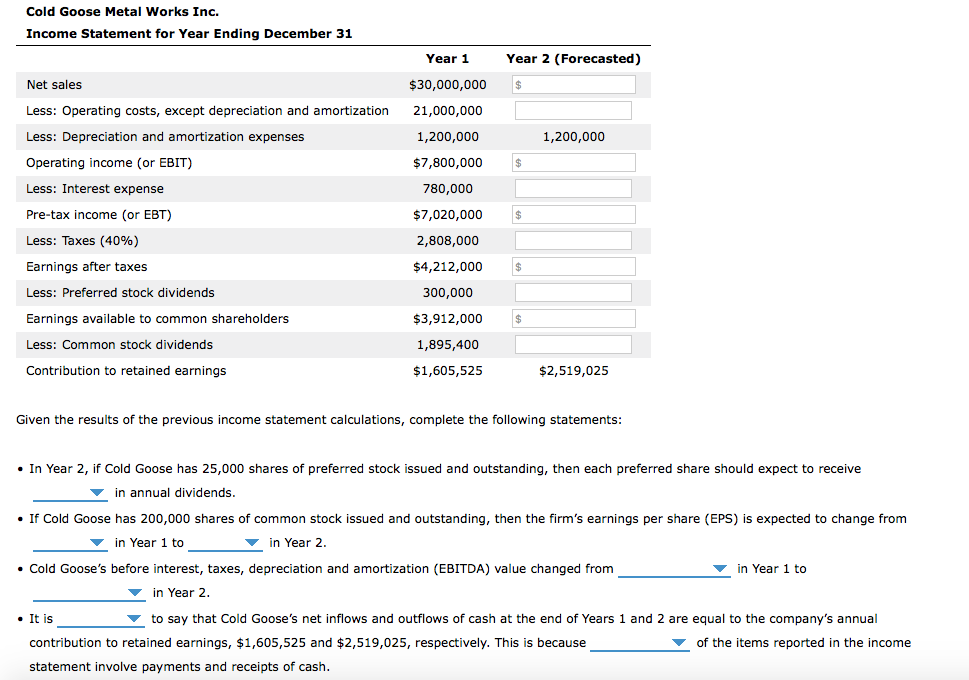

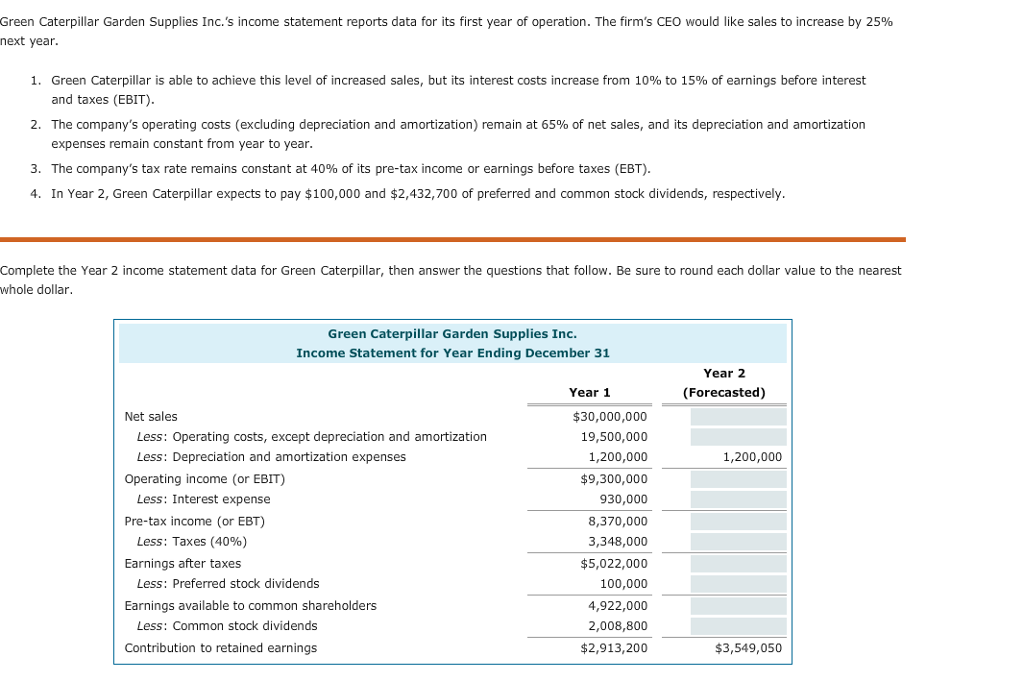

The income statement also called the profit and loss statement is a report that shows the income expenses and resulting profits or losses of a company during a specific time period. Prepare a multiple step. The next is the income statement shown in figure 3 2 which provides information on the revenues and expenses of the firm and the resulting income made by the firm during a period. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting.

Reports the following income statement accounts for the year ended december 31. In accounting we measure profitability for a period such as a month or year by comparing the revenues earned with the expenses incurred to produce these revenues. An income statement is one of the three along with balance sheet and statement of cash flows major financial statements that reports a company s financial performance over a specific accounting.