Zimbabwe Income Tax Calculator

The tax brackets below have changed.

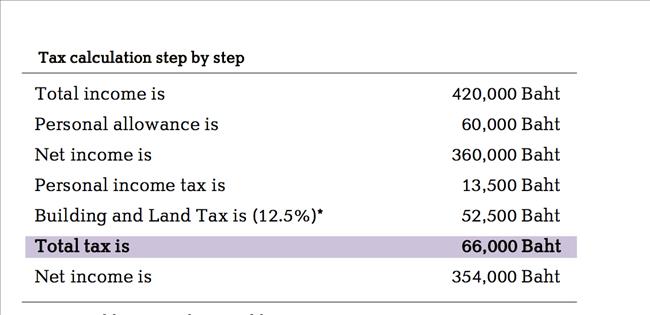

Zimbabwe income tax calculator. Income tax is levied on earnings income of an individual or a business. We will put the content up when we receive enough interest. Zimbabwe personal income tax nb. Income tax law the administration of income tax is governed by the income tax act of zimbabwe chapter 23 06 which guides on how income tax will be levied how it is calculated and other legislative guidelines.

France salary calculator 2020 21 zimbabwe income tax rates and personal allowances review the latest income tax rates thresholds and personal allowances in zimbabwe which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in zimbabwe. Please click here for updated tax tables. Personal income tax rate in zimbabwe averaged 40 76 percent from 2004 until 2020 reaching an all time high of 51 50 percent in 2015 and a record low of 24. This is a placeholder for the tax calculator for zimbabwe.

Tax registration tax forum tax amendment acts capital transfer tax income tax individuals companies partnerships trust funds non profit organisations pay as you earn other withholding taxes value added tax exemptions. How to calculate your salary after tax in zimbabwe follow these simple steps to calculate your salary after tax in zimbabwe using the zimbabwe salary calculator 2020 which is updated with the 2020 21 tax tables. Great advice and excellent service on. Income tax federal and provincial thereon 50 644 52 499 50 368 less.

The 3 aids levy. Zimbabwe presently operates on a source based tax system. Zimbabwe individual income tax is imposed at progressive rates up to 35. Non refundable tax credits 8 480 8 579 8 065 total income tax 42 165 43 920 42 303 employee contribution to pension plan 2 356 2 426 2 480 891 914.

Enter your salary and the zimbabwe salary calculator will automatically produce a salary after tax illustration for you simple. This means that income from a source within or deemed to be within zimbabwe will be subject to tax in zimbabwe unless a specific exemption is available. It has been indicated that zimbabwe is considering moving to a residence based system during the current tax reform exercise.