Yearly Income Minimum Wage California

Although there are some exceptions almost all employees in california must be paid the minimum wage as required by state law.

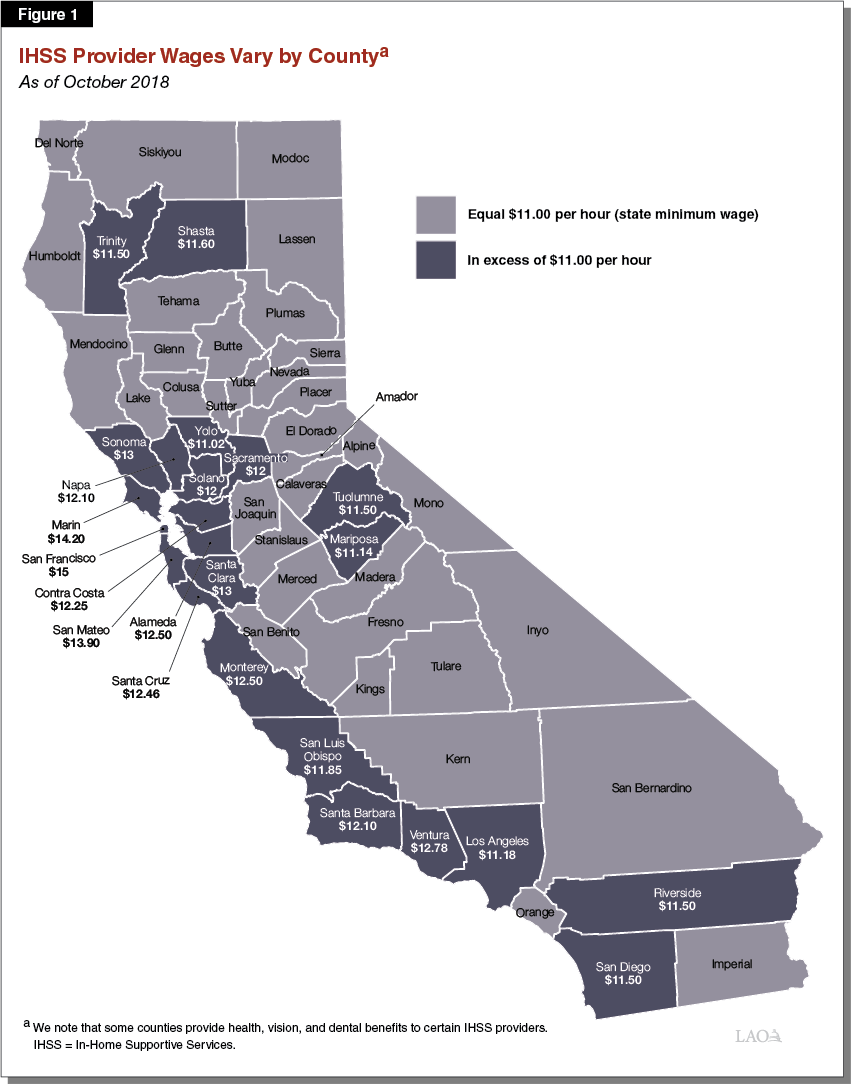

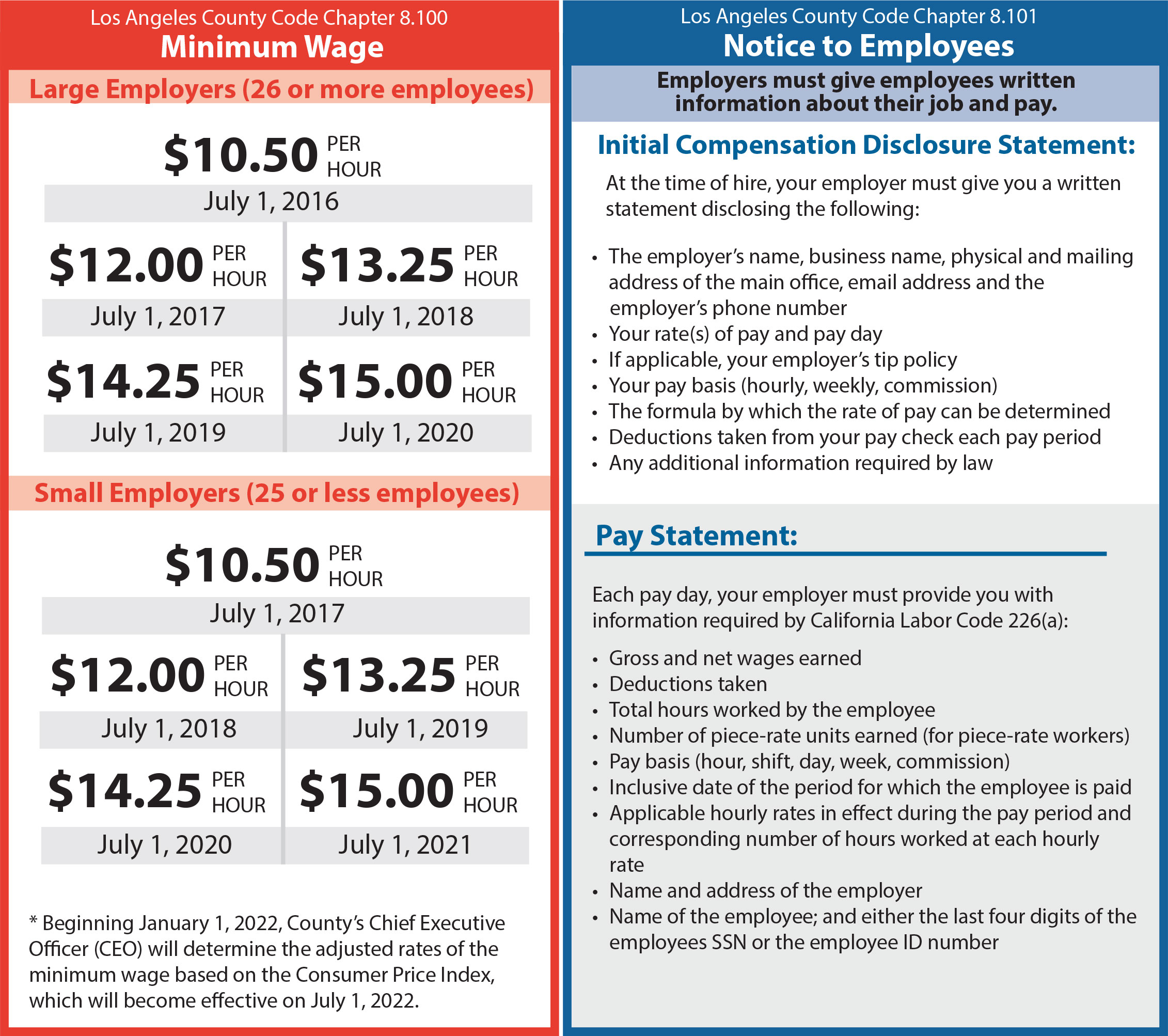

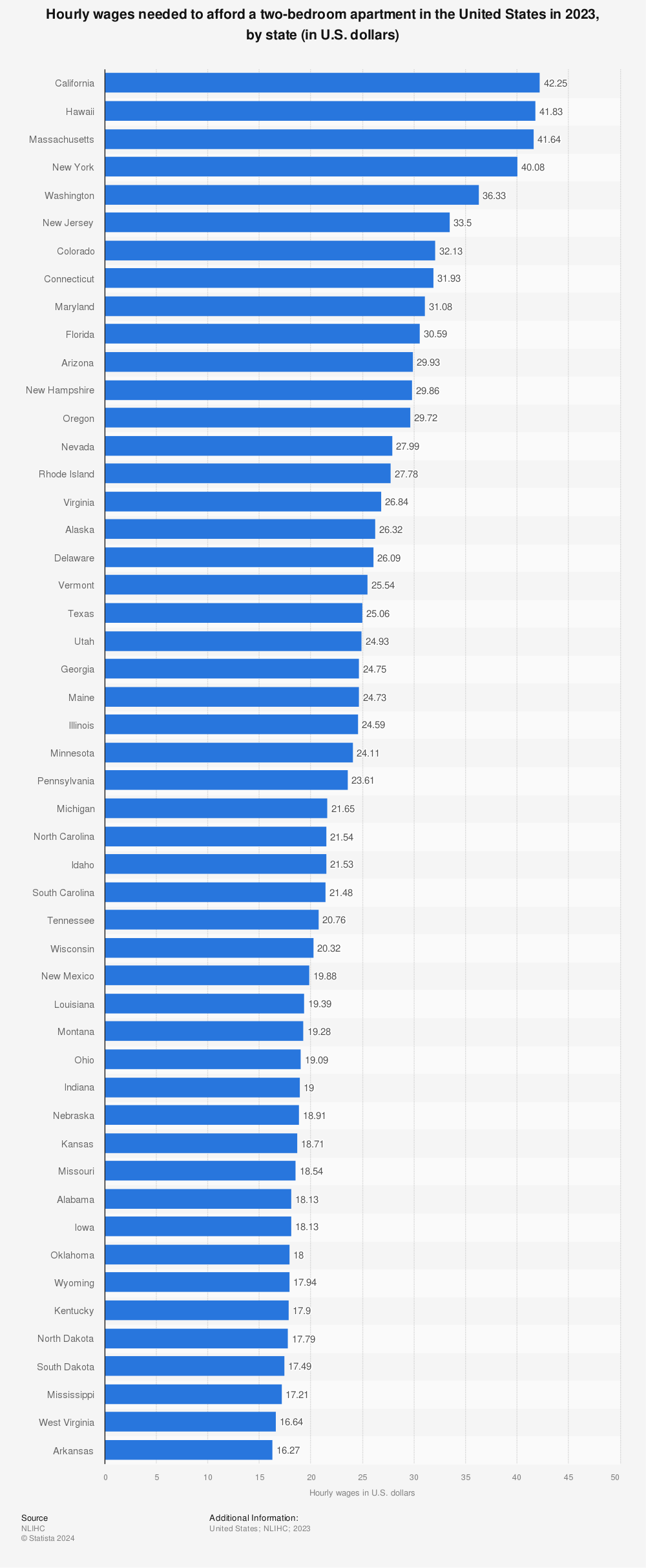

Yearly income minimum wage california. The california minimum wage is the lowermost hourly rate that any employee in california can expect by law. California s state minimum wage rate is 13 00 per hour this is greater than the federal minimum wage of 7 25. In california the applicable minimum wage depends on the size of the employer. In 2020 california s minimum wage is 12 00 per hour for employees that work for employers with 25 or fewer employees and 13 00 per hour for larger employers.

This means that the minimum salary for exempt employees in california will also be increasing annually. The california minimum wage was last changed in 2008 when it. For example in 2011 sheepherders must earn a minimum of 1 333 20 per month which comes out to 15 998 40 per year slightly less than the annual minimum wage for workers not subject to this requirement. The minimum wage applies to most employees in california with limited exceptions including tipped employees some student workers and other exempt occupations.

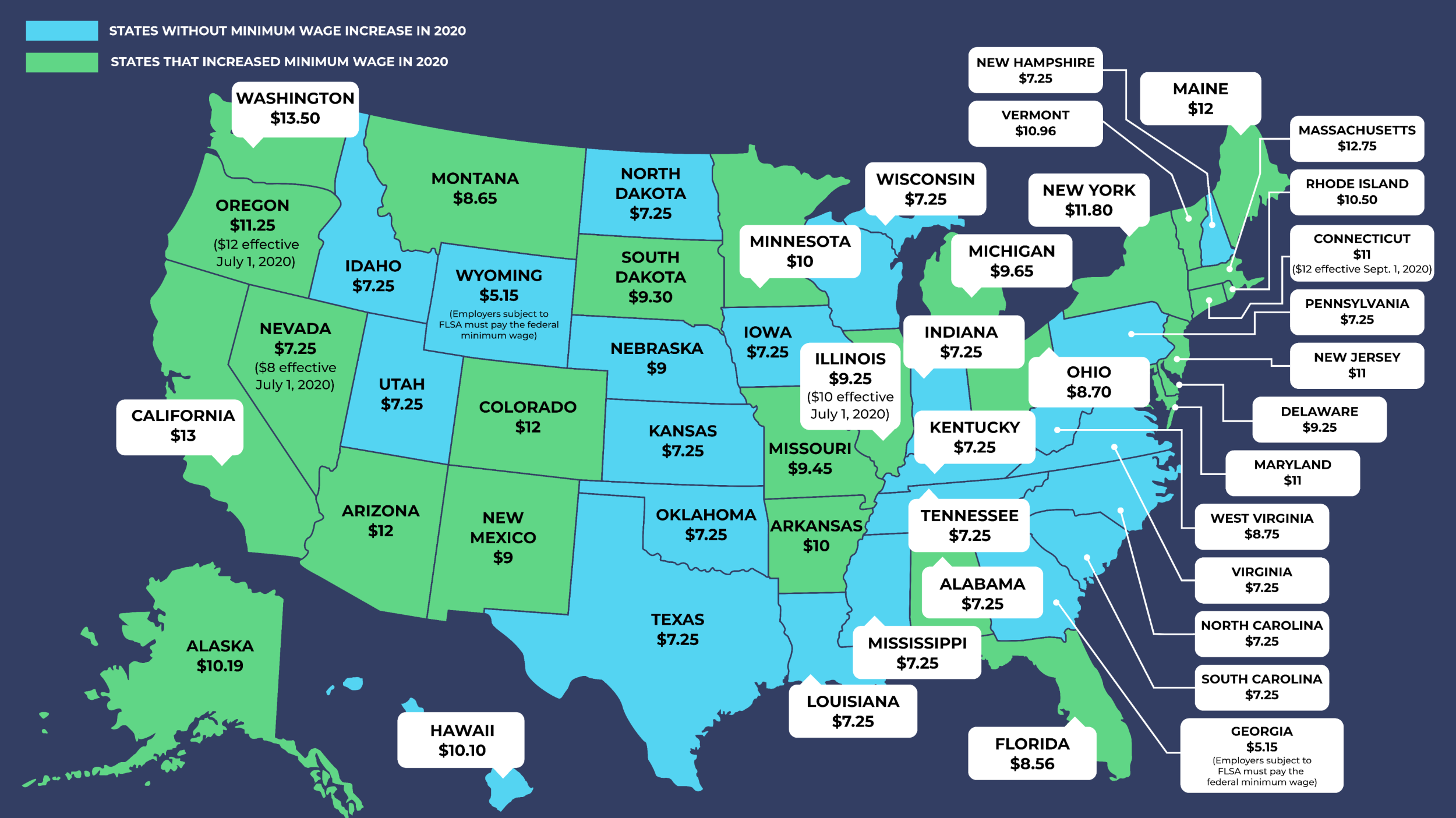

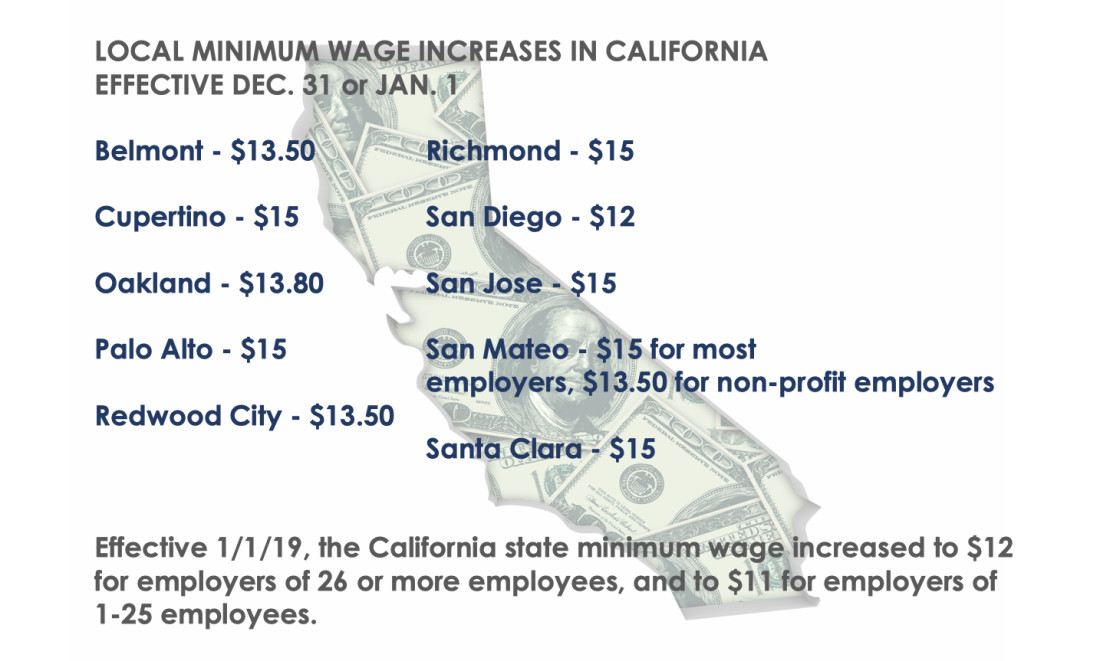

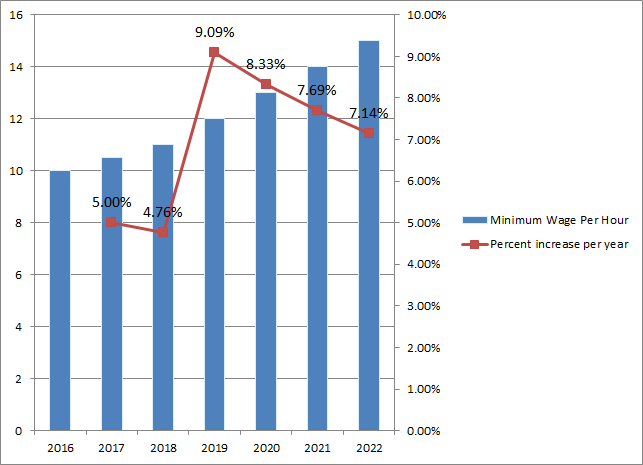

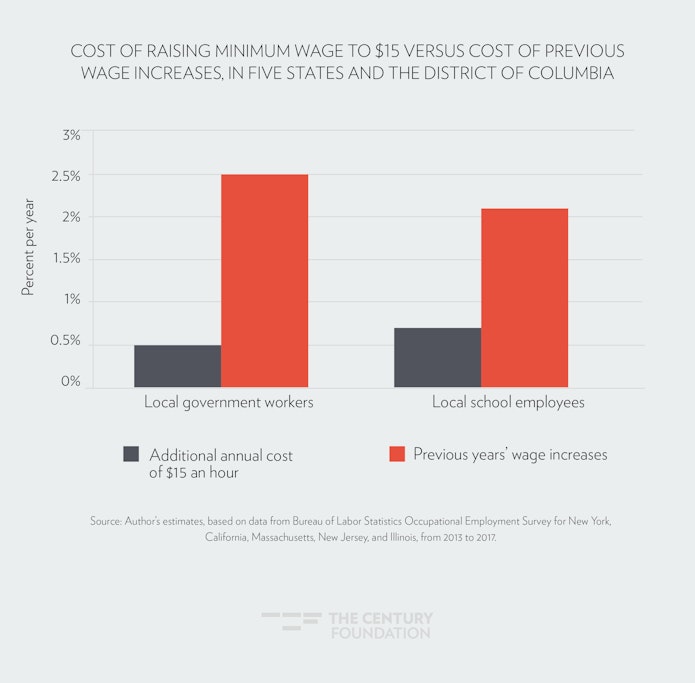

This latest increase will move california one step closer to its goal of a 15 per hour minimum wage. When state and federal law differ you must comply with the more restrictive requirement. In 2016 california enacted legislation setting forth gradual increases in the minimum wage until 2023. Numerous cities in california have enacted their own minimum wage legislation.

Effective january 1 2020 california s minimum wage is 13 per hour for employers with 26 or more employees and 12 per hour for employers with 25 or fewer employees. There are legal minimum wages set by the federal government and the state government of california. As of january 1 2020 the minimum annual salary to qualify for an exempt employee would be 54 080 double the state minimum wage 13 00 hour for employers with 26 or more employees is 26 00 hour x 40 hours week x 52 weeks 54 080. This calculation gives us a monthly salary that is equal to twice the state minimum wage for full time employment 17.

The minimum wage is the minimum hourly rate that nearly all california employees must be paid for their work by law. Use our calculator to discover the california minimum wage. Some jobs in california require workers to earn a minimum amount per month rather than a minimum hourly wage. You are entitled to be paid the higher state minimum wage.

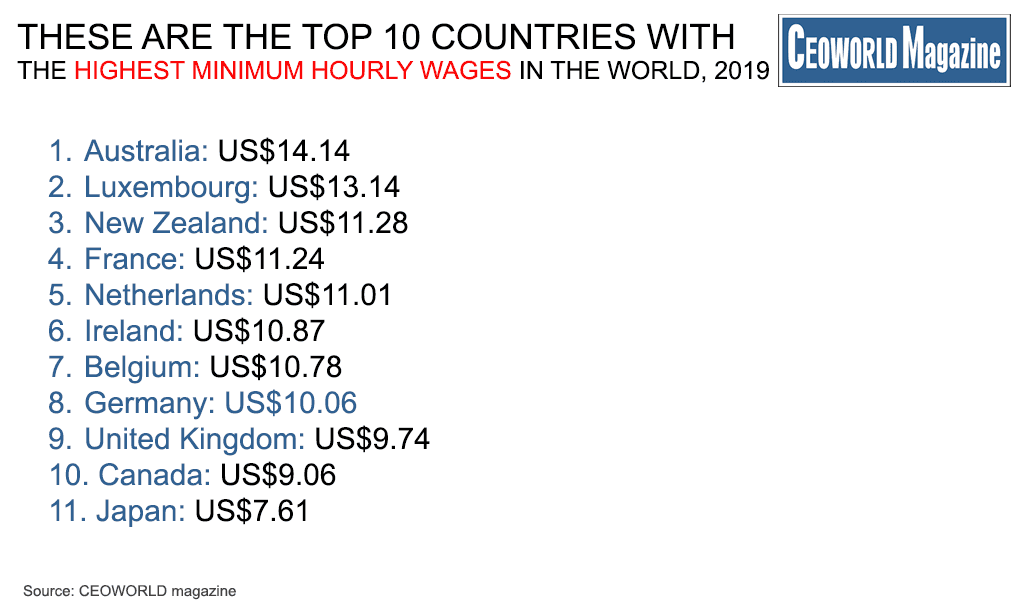

And this year is no different. The minimum wage in california will continue to rise each year on a statewide basis until it reaches 15 00 per hour. For employers with 25 or fewer employees the minimum annual salary would be 49 920. The federal minimum wage is 7 25 per hour and the california state minimum.

From january 1 2017 to january 1 2022 the minimum wage will increase for employers employing 26 or more employees. Importantly california s minimum wage is set to increase every year on january 1 st until 2023.