Income Tax Rate Quebec Calculator

Easy income tax calculator for an accurate quebec tax return estimate.

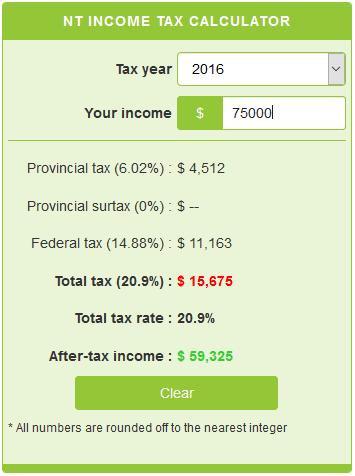

Income tax rate quebec calculator. Canada s federal taxes are calculated using the latest personal income tax rates and thresholds for quebec in 2020. 2020 income tax in quebec is calculated separately for federal tax commitments and quebec province tax commitments depending on where the. The information deisplayed in the quebec tax brackets for 2020 is used for the 2020 quebec tax calculator. In canada each province and territory has its own provincial income tax rates besides federal tax rates below there is simple income tax calculator for every canadian province and territory.

In 2020 quebec provincial income tax brackets and provincial base amount was increased by 1 9. In quebec the provincial sales tax is called the quebec sales tax qst and is set at 9 975. The period reference is from january 1st 2020 to december 31 2020. 2019 includes all rate changes announced up to june 15 2019.

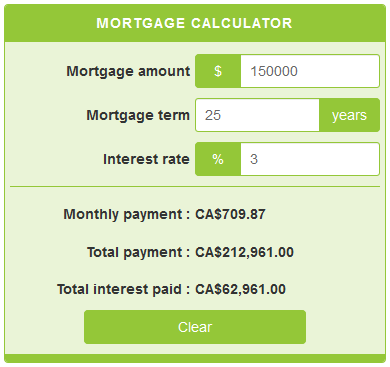

After tax income is your total income net of federal tax provincial tax and payroll tax. Enter your annual income taxes paid rrsp contribution into our calculator to estimate your return. Use appropriate free software from this list to file your tax return. If you make 52 000 a year living in the region of quebec canada you will be taxed 14 326 that means that your net pay will be 37 674 per year or 3 139 per month.

These calculations are approximate and include the following non refundable tax credits. The qst was consolidated in 1994 and was initially set at 6 5 growing over the years to the current amount of 9 975 set in 2013. Rates are up to date as of april 28 2020. Quebec provincial income tax rates 2020.

2020 includes all rate changes announced up to july 31 2020. Or you can choose tax calculator for particular province or territory depending on your residence. Your average tax rate is 27 55 and your marginal tax rate is 44 03 this marginal tax rate means that your immediate additional income will be taxed at this rate. Calculate the tax savings your rrsp contribution generates.

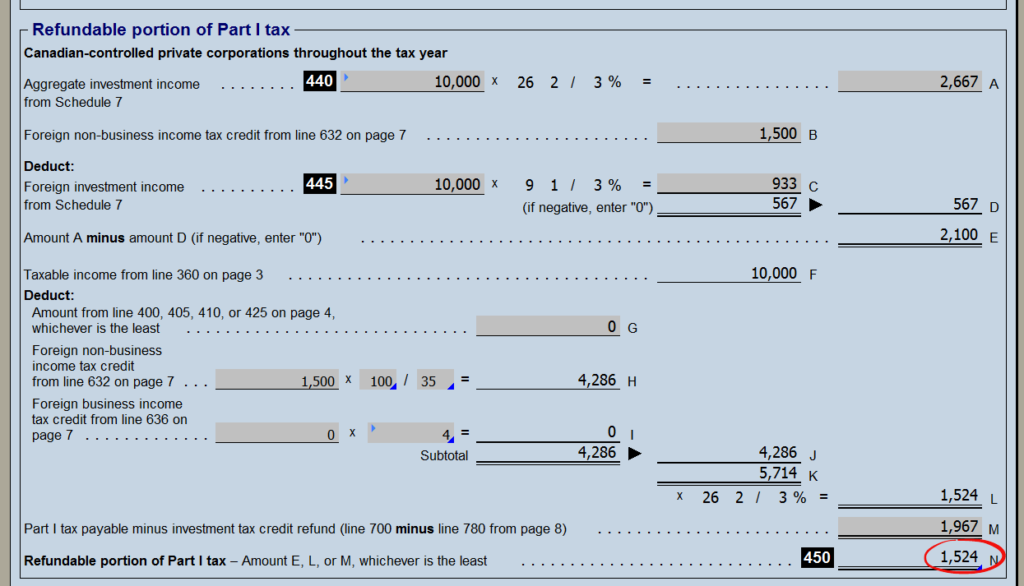

Quebec is one of the provinces in canada that charges separate provincial and federal sales taxes. Calculate the total income taxes of the quebec residents for 2020 including the net tax income after tax tax return and the percentage of tax. Income tax calculator takes into account the refundable federal tax abatement for québec residents and all federal tax rates are reduced by 16 5. Canadian provincial corporate tax rates for active business income.

Canadian corporate tax rates for active business income. Your 2019 quebec income tax refund could be even bigger this year.